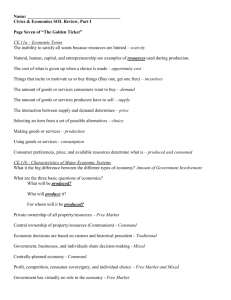

Unit #5 Notes Handout

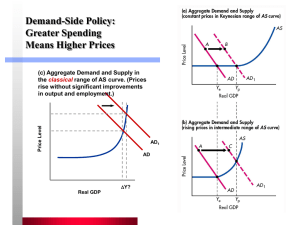

advertisement

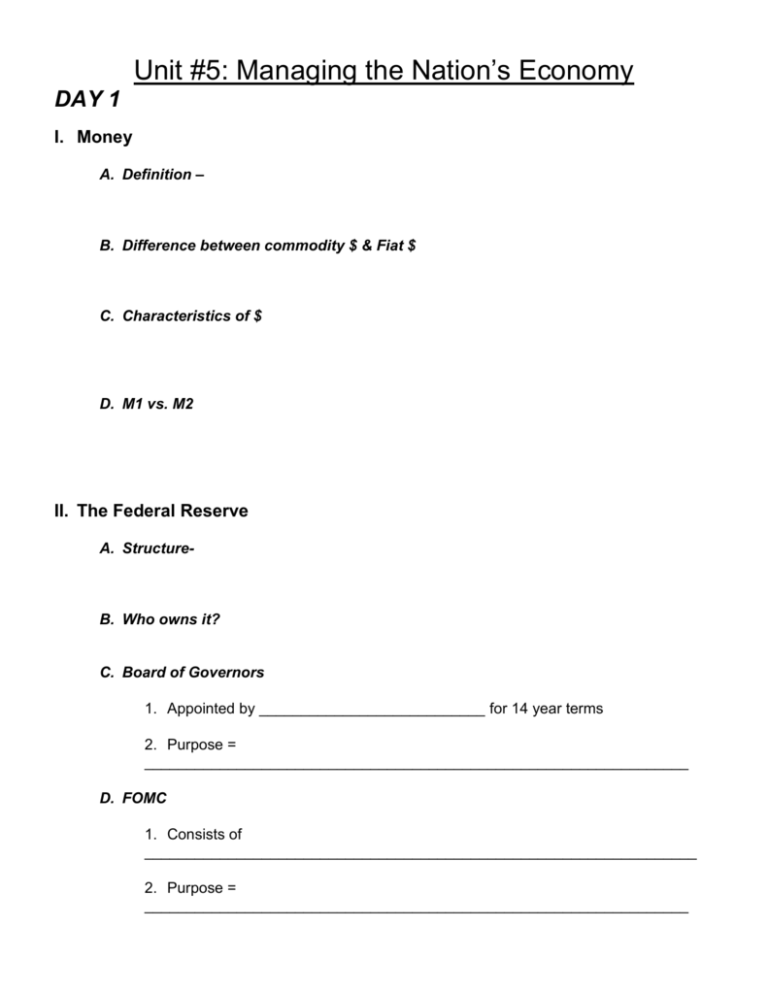

Unit #5: Managing the Nation’s Economy DAY 1 I. Money A. Definition – B. Difference between commodity $ & Fiat $ C. Characteristics of $ D. M1 vs. M2 II. The Federal Reserve A. Structure- B. Who owns it? C. Board of Governors 1. Appointed by ___________________________ for 14 year terms 2. Purpose = _________________________________________________________________ D. FOMC 1. Consists of __________________________________________________________________ 2. Purpose = _________________________________________________________________ III. U.S. Banks Operate under Fractional Bank Reserve System A. Definition- 1. Reserve Requirement 2. Legal Reserves IV. What’s the most important job of the Fed? = Influencing __________________ Policy!!! A. Definition = B. Tools 1. Reserve Requirements 2. Discount Rate 3. Open Market Operations C. Short run vs. Long run Impacts V. Two Schools of Thought on Fighting Inflation & Recession using Fiscal Policy (Group #1) A. Define fiscal policy – B. Demand-Side Policies (Keynesian Economics) C. Supply – Side economics V. The Cost of Economic Instability (Group #2) A. The Economic Costs B. The Social Costs VI. Macroeconomic Equilibrium (Group #3) A. Aggregate Supply B. Aggregate Demand C. Equilibrium VII. Taxes (Group #4) A. Two Principles of Taxation 1. Benefit Principle 2. Ability-to-Pay Principle B. Types of Taxes 1. Proportional 2. Progressive 3. Regressive VIII. Impact of Government Spending (Group #5) A. Two Kinds of Spending B. Impacts of Government Spending IX. Deficit Spending (Group #6) A. Definition of Deficit Spending B. Why would we ever do this? C. Effects