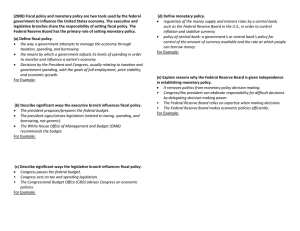

Angel Kyle Delos Angeles BSA 2-A CODE: (3007) Monetary policy is a set of tools used by a nation's central bank to control the overall money supply and promote economic growth and employ strategies such as revising interest rates and changing bank reserve requirements. The contribution that monetary policy makes to sustainable growth is the maintenance of price stability. Since sustained increase in price levels is adjudged substantially to be a monetary phenomenon, monetary policy uses its tools to effectively check money supply with a view to maintaining price stability in the medium to long term. Theory and empirical evidence in the literature suggest that sustainable long-term growth is associated with lower price levels. In other words, high inflation is damaging to long-run economic performance and welfare. Monetary policy has far reaching impact on financing conditions in the economy, not just the costs, but also the availability of credit, banks’ willingness to assume specific risks, etc. It also influences expectations about the future direction of economic activity and inflation, thus affecting the prices of goods, asset prices, exchange rates as well as consumption and investment. A monetary policy decision that cuts interest rate, for example, lowers the cost of borrowing, resulting in higher investment activity and the purchase of consumer durables. The expectation that economic activity will strengthen may also prompt banks to ease lending policy, which in turn enables business and households to boost spending. In a low interest-rate regime, stocks become more attractive to buy, raising households’ financial assets. This may also contribute to higher consumer spending, and makes companies’ investment projects more attractive. Low interest rates also tend to cause currency to depreciate because the demand for domestic goods rises when imported goods become more expensive. The combination of these factors raises output and employment as well as investment and consumer spending then therefore contributing to the economic growth and development. https://www.cbn.gov.ng/out/eduseries/series11.pdf https://www.investopedia.com/terms/m/monetarypolicy.asp Fiscal policy refers to the use of government spending and tax policies to influence economic conditions, especially macroeconomic conditions. Central banks influence the money supply indirectly through adjusting interest rates, bank reserve requirements, and the acquisition and sale of government securities and foreign exchange. Governments have an impact on the economy by altering the level and composition of taxes, the extent and composition of spending, and the degree and form of borrowing. By adjusting its level of spending and tax revenue, the government affect the economy by either increasing or decreasing economic activity in the short term. The most immediate impact of fiscal policy is on aggregate demand for goods and services. A fiscal expansion, for example, increases aggregate demand in one of two ways. First, if the government increases its purchases while keeping taxes constant, it directly stimulates demand. Second, if the government lowers taxes or raises transfer payments, households' disposable income grows, and they spend more. This increase in consumption will raise aggregate demand. Fiscal policy affects the composition of aggregate demand as well. When the government runs a deficit, it uses BONDS to cover some of its expenses. In doing so, it competes with private borrowers for savings loans. Holding all else equal, a fiscal expansion will boost INTEREST RATES and "crowd out" some private INVESTMENT, lowering the proportion of production made up of private investment. Fiscal policy influences the exchange rate and the trade balance in an open economy. The rise in interest rates caused by government borrowing draws foreign money during a fiscal expansion. Foreigners bid up the price of the dollar in order to obtain more dollars to invest, generating an exchange-rate rise in the near run. This appreciation makes imported items cheaper in the US and exports more expensive abroad, causing the merchandise trade balance to fall. https://www.investopedia.com/terms/f/fiscalpolicy.asp https://crsreports.congress.gov/product/pdf/R/R45723/1#:~:text=Fiscal%20policy%20is%20the%20me ans,activity%20in%20the%20short%20term. https://www.econlib.org/library/Enc/FiscalPolicy.html