Enough? Euro and Yen Short positions

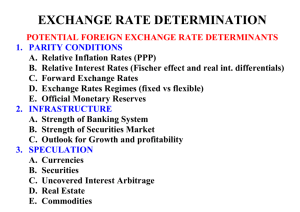

advertisement

Dan’s Inner Circle Euro Short getting Risky? by speculators in the euro as of last Tuesday was 288,376 contracts. That is equivalent to a $45 billion short position. The net short position (total shorts minus total longs) was 187,211, which is about a $35 billion short position. Still very impressive. The yen is showing similar concentration. Total short positions by speculators in yen futures on the CME approached a notional value of nearly $26 billion, while the net short position came to around $20 billion. • 288,376 Contracts • $45 billion short position • Usual Government Currency intervention is Less Than $1 billion • Yen at $26 billion short position • Potential Short Squeeze Pure TV Hype • Persistent shortfall of economic growth and inflation in the euro area could lead to a further appreciation of the dollar and have adverse effects on the US external sector. • At the same time, a couple of participants pointed out that the appreciation of the dollar might also tend to slow the gradual increase in inflation toward the FOMC's 2 percent goal. Cross currents. Conflicting signals Stock market divergence followed by KEY REVERSAL Cumulative Net Points Cumulative Net Volume S&P 500 This is a medium term divergence. Could reverse itself now. This is what you should watch for… As of this morning See new lows next… Divergence A new character starting March 2014. Ratio SPX:COMPQX. Nasdaq Strong then reverses Beginning of tough market? Hat tip to Helene Meisler of TheStreet.com for this chart./ The more profitable the more it fell out of favor. Fast profit growth doesn’t matter Short term Bottom ? Key reversal Key reversal Alternate is DTO it will end with the price being driven below the marginal cost of production as revenue-maximizing state firms try to cover their fixed costs, with high-cost secondary recovery techniques such as oil sands being rendered uneconomic and with the inevitable growth in global petroleum demand soaking up excess production capacity. Once this process is underway, pricing control will shift back to producers as it always has and always will. Then the cycle will repeat. What Drives the Stock Market? What Drives Oil Prices? Yellen in Jackson Hole mentioned a 19-component index developed by Fed economists, as well as an even broader 24-component Labor Market Conditions Index (LMCI) developed by the Kansas City Fed. -98.3% correlation Future interest rate expectations suggest easing, while everyone expects tightening. More confusion. Zero Allowance for Inflation: another deal with no risk premium. Investors opt for more yield now! Fed would normally be easing here Small business lending: benefit from socialist regulation Benefit from the business cycle instead of being stuck in it.