PowerPoint

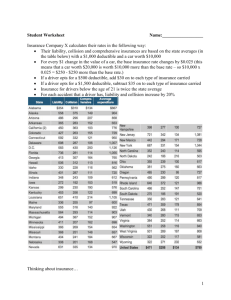

advertisement

Chapter 12: Transportation Buying a car…New or Used? What are the pros and cons of each option? Draw a line down the center of your paper. On one side write “new car” and the other write “used car”. Write at least 2 pros and 2 cons of each option. New Car Pros Reliable Low Mileage Newer Technologies Reduced Maintenance Warranty Cons More expensive Lose its value the most in the first 3 years Edmunds Used Cars Cons Pros Can be more affordable Many options to choose from Warranty can carry over from previous owner In some cases, they can be more expensive since you usually can only finance used cars for up to 4 years May break down- you don’t know ALL previous problems the car may have had May have a lot of miles Can you pay for a car? A car loan should be NO MORE than 15% of your gross pay or 20% of your net pay. Example: Salary of $50,000 Take home: $2,430/ month Car Loan: $ 486 or LESS! Can you afford a car? You must keep in mind other expenses you have! Rent/Mortgage Cell Phone Bill Groceries Utilities Car Insurance Student Loans Maintenance for car If all of this adds up to more than 80% of your take-home pay...then you may have a problem! What car is right for you? There are many different sizes, styles, features and options of cars. How do you decide what car is right for you? What factors should you consider? Features Characteristics of a particular car model that offer benefits to the owner. Remote keyless entry Side airbags Telescoping steering wheel/adjustable pedals Anti-lock brakes Some features are standard and come with the car, others are optional and cost more money. Options Features that you can choose to include or not include on the car. Sunroof Leather Seats MP3 Player GPS Navigation System OnStar System Buy or Lease a Car? Financing More than 80% of people who buy new cars in the US use credit to finance their purchase. Leasing Renting an automobile for a specific period of time. You still make monthly car payment, but they are usually lower than if you took out a loan and financed your car. How Leasing Works... When you lease, you are paying for using the car for the amount of time your lease is for...renting a car. At the end of the lease you can either decide to: 1. Turn in the car to the dealership 2. Buy the car Who should consider leasing? Someone who likes a new car often Someone who drives very few miles Someone who takes care of their car and drives safely! At the end of a lease term, a leased car will be examined. Additional scratches or wear done to the car will be taken into consideration and you may incur additional charges. The Car Buying Process Invoice Price The amount the dealer paid to buy the car from the manufacturer. Using this information you can calculate a fair price and know what you should be paying for a car. Useful Resources Consumer Reports Edmunds Kelley Blue Book MSN Autos Cars.com Sticker Price (MSRP) • The Manufacturers Suggested Retail Price (MSRP). “Sticker” Price (MSRP) This price is almost always higher then the dealer expects consumers to pay for the car. 9-11 % higher than invoice price. Public Transportation for the City Life Style Cost- compared to owning a car, public transportation can be inexpensive Convenience- Goes to most popular destinations. Speed- can be faster than cars to get to your destination. Subways and ferries don’t compete with cars on freeway. Some cities even have bus lanes. Parking- You don’t have to worry about finding a spot/lot. Shopping for A Car Open your Life-Smart Project to page 7 Use your pay amount from the career section This helps to determine how much you can afford. Search 2 used and 1 new car - Find loan payment information - Complete the Shopping for a Car worksheet and the Car Search Reflection sheet Start browsing for cars! Bell Ringer What is the purpose of auto insurance? Why do you think it is against the law to not have car insurance? CAR INSURANCE Chapter 14.2 What is Auto Insurance? Automobile Insurance Arrangement between an individual (consumer) and an insurer (insurance company) Protects individuals against risk from automobile accidents Why Car Insurance? Used to protect you and your car. State law says you cannot legally drive without car insurance. Full Coverage Bodily Injury liability Property damage liability Medical payment Uninsured/underinsured motorist Comprehensive Collision Activity Read each statement and identify which auto coverage you believe is being described. Try your best to choose which option you believe describes the scenario most accurately! Discuss with your neighbor. Bodily injury liability coverage When you are legally responsible for injuring other people in an automobile accident. Coverage is described by 2 numbers. (Example: $250,000/$500,000) 1st number ($250,000)is for 1st person injured, 2nd number ($500,000) is for all people injured in accident. Insurance will cover that amount, you must pay remainder if total of accident is more. Property Damage Liability Coverage Pays for damage you caused to another person’s property. It DOES NOT cover damage to your car. Medical Payments Coverage Pays medical and funeral expenses for you, your family members, and other passengers in your car …due to injuries sustained in an accident- no matter who caused the accident. Un-insured/Underinsured Motorist Coverage Pays medical and damage expense for you and your passengers cause by a driver without insurance or with too little insurance to cover the loss. It does not cover the other driver. Comprehensive Coverage Pays for damage to your car caused by something other than collision. Examples: earthquake, fire, wind, hail, and floods. If your car is vandalized or stolen, you car is also covered under this type of insurance. Collision Coverage Pays for damage to your car caused by colliding with another car or object, such as a tree or fire hydrant. Next to liability, this is likely to be the most expensive portion of an automobile policy. Deductible Comprehensive and Collision coverages carry a deductible. When you are at fault, you may need to pay the deductible before your insurance company will pay the rest. Deductible An amount you pay before the insurance company pays anything. Example: Suppose you are in a car accident. Your car has $1,200 in damage and your deductible is $500. You would have to pay the first $500 and your insurance company will pay the remaining $700. Sample Insurance Policy Full Coverage When you are covered in all areas of insurance. Requirements Liability Property Damage Bodily Injury Highly in IL: Suggested Comprehensive Collision Medical Underinsured Motorist 5 Factors Affecting Auto Insurance Premiums 1. Driver Classification: - Based on Age, Gender, and Marital Status - Statistics show males under the age of 21 have more accidents, therefore if you are a male under 21 your premiums will be higher. 2. Rating Territory -Driving in the city vs. a rural area 3. Driving Record - Includes accidents and traffic violations 4. Type of Car - Cost to repair car in the case of an accident is considered - Statistics show certain cars are stolen more than others - this is also taken into consideration. 5. Claims history Auto Insurance Open your Life-Smart Project to page 9 Go to www.ratekick.com to get an estimate for car insurance Choose age 22 to get a more accurate quote Enter your gender and marital status (single)