Saving

advertisement

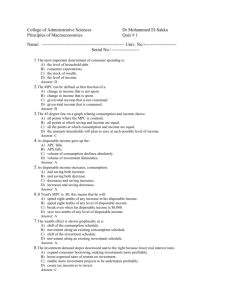

Basic Macroeconomic Basic Macroeconomic Relationships Relationships 27-2 CHAPTER OBJECTIVES Effect of changes in income on consumption (and saving) Other factors that affect consumption Effect of changes in real interest rates on investment Other factors that affect investment Changes in investment have a multiplier effect on real GDP BASIC RELATIONSHIPS 27-3 What are the two things we can do with our income? •Consume (spend) or Save Disposable income (DI) •After taxes 45°line for reference •C = DI on the Line •*****turn to pg. 615 S = DI - C INCOME CONSUMPTION AND SAVING LO1 CONSUMPTION AND SAVING The consumption schedule The saving schedule Break-even income When households spend their entire incomes Consumption APC = Income APS = Saving Income 27-5 Average propensity to consume (APC) Average propensity to save (APS) On average, what percentage of our incomes do we, as Americans, consume? FALLACY OF COMPOSITION The false assumption that what is true for a part will also be true for the whole. • Your experience is YOUR experience… • …Here, we are measuring the aggregate. 27-7 BE CAREFUL NOT TO GENERALIZE BASED ON YOUR OWN EXPERIENCE!! Marginal Propensity to Consume Marginal Propensity to Consume (MPC) •How much people consume rather than save when there is an change in income. •It is always expressed as a fraction (decimal). MPC= Change in Consumption Change in Income Copyright ACDC Leadership 2015 8 Examples: 1. If you received $100 and spent $50. 2. If you received $100 and spent $80. 3. If you received $100 and spent $100. Marginal Propensity to Save Marginal Propensity to Save (MPS) •How much people save rather than consume when there is an change in income. •It is also always expressed as a fraction (decimal) MPS= Change in Savings Change in Income Copyright ACDC Leadership 2015 9 Examples: 1. If you received $100 and save $50. 2. If you received $100 your MPC is .7 what is your MPS? MPC + MPS = 1 Why is this true? Because people can either save or consume Copyright ACDC Leadership 2015 CONSUMPTION AND SAVING SCHEDULES Consumption and Saving Schedules (in Billions) and Propensities to Consume and Save (1) Level of Output and Income GDP=DI (1) $370 (4) (6) (7) Marginal Propensity to Consume Marginal Propensity to Save (MPS), (3)/(1)* Average Propensity to Consume (APC), Average Propensity to Save (APS), (2)/(1) (3)/(1) (MPC), (2)/(1)* (5) (2) Consumption (C) (3) Saving (S), (1) – (2) $375 $-5 1.01 -.01 .75 .25 (2) 390 390 0 1.00 .00 .75 .25 (3) 410 405 5 .99 .01 .75 .25 (4) 430 420 10 .98 .02 .75 .25 (5) 450 435 15 .97 .03 .75 .25 (6) 470 450 20 .96 .04 .75 .25 (7) 490 465 25 .95 .05 .75 .25 (8) 510 480 30 .94 .06 .75 .25 (9) 530 495 35 .93 .07 .75 .25 (10) 550 510 40 .93 .07 .75 .25 Consumption (billions of dollars) CONSUMPTION AND SAVING 500 C 475 450 425 Saving $5 Billion Consumption Schedule 400 375 Dissaving $5 Billion 370 390 410 430 450 470 490 510 530 550 Disposable Income (billions of dollars) 50 Dissaving Saving Schedule S 25 $5 Billion Saving $5 Billion 0 370 390 410 430 450 470 490 510 530 550 27-12 Saving (billions of dollars) 45° NON-INCOME DETERMINANTS OF CONSUMPTION AND SAVING Wealth •When wealth suddenly increases, people consume more Borrowing Real interest rates 27-13 •Easy credit increases consumption, sometimes above disposable income…but debt needs repaid in the future Expectations WHAT DO YOU NOTICE ABOUT THE EARLY HOW ABOUT 2000’S? ‘09 ONWARD? LO1 INTEREST RATE AND INVESTMENT Expected rate of return on capital (r) The real interest rate (i) •Nominal rate less rate of inflation Meaning of r = i •Firms will invest as long as r ≥ i 27-15 Investment demand curve (r) and (i) 16% $0 14 5 12 10 10 15 8 20 6 25 4 30 2 35 0 LO3 Investment (billions of dollars) 40 Expected rate of return, r and real interest rate, i (percents) INVESTMENT DEMAND CURVE 16 14 Investment demand curve 12 10 8 6 4 2 ID 0 5 10 15 20 25 30 35 Investment (billions of dollars) 40 INVESTMENT DEMAND CURVE •Acquisition, maintenance, and operating costs •Business taxes •Technological change •Stock of capital goods on hand •Planned inventory changes •Expectations 27-17 Shifts of the curve SHIFTS OF INVESTMENT DEMAND Expected rate of return, r, and real interest rate, i (percents) Increase in investment demand Decrease in investment demand 0 LO4 ID2 ID0 ID1 Investment (billions of dollars) INVESTMENT DEMAND Instability of investment •Durability •Irregularity of innovation •Variability of profits •Variability of expectations 27-19 Consumption and Saving tend to be more stable than investment INSTABILITY OF INVESTMENT LO4 27-21 REVIEW PG. 633 #1, 2 THE MULTIPLIER EFFECT Why do cities want the Super Bowl in their stadium? An initial change in spending will set off a spending chain that is magnified in the economy. Example: • • • • Bobby spends $100 on Jason’s product Jason now has more income so he buys $100 of Nancy’s product Nancy now has more income so she buys $100 of Tiffany’s product. The result is an $300 increase in consumer spending The Multiplier Effect shows how spending is magnified in the economy. Copyright ACDC Leadership 2015 23 THE MULTIPLIER EFFECT • More spending results in higher GDP • Initial change in spending changes GDP by a multiple amount Multiplier = Change in Real GDP Initial Change in Spending 27-24 Change in GDP = Multiplier x Initial Change in Spending Causes of the initial change in spending • Most prevalent - Changes in investment • Become increases in wage, rent, interest, profit • Other changes: • C (confidence?) • G (stimulus?) • X (exchange rates?) Rationale • Dollars spent are received as income • Income received is spent (MPC) • Initial changes in spending cause a spending chain 27-25 THE MULTIPLIER EFFECT How is Spending “Multiplied”? Assume the MPC is .5 for everyone •Assume the Super Bowl comes to town and there is an increase of $100 in Ashley’s restaurant. •Ashley now has $100 more income. •She saves $50 and spends $50 at Karl’s Salon •Karl now has $50 more income •He saves $25 and spends $25 at Dan’s fruit stand •Dan now has $25 more income. This continues until every penny is spent or saved Copyright ACDC Leadership 2015 = Multiplier x Initial Change in Spending 26 Total change in GDP Calculating the Spending Multiplier If the MPC is .75 how much is the multiplier? Spending Multiplier OR •If the multiplier is 4, how much will an initial increase of $5 in Government spending increase the GDP? •How much will a decrease of $3 in spending decrease GDP? Total change = Multiplier Initial Change in GDP in Spending x Copyright ACDC Leadership 2015 27 The Multiplier Effect Let’s practice calculating the spending multiplier OR 1. If MPC is .9, what is multiplier? 2. If MPC is .8, what is multiplier? 3. If MPC is .5, and consumption increased $2M. How much will GDP increase? 4. If MPC is 0 and investment increases $2M. How much will GDP increase? Conclusion: As the Marginal Propensity to Consume falls, the Multiplier Effect is less Copyright ACDC Leadership 2015 28 Spending Multiplier THE MULTIPLIER AND THE MPC MPC Multiplier .9 10 .8 5 .75 4 .67 2 27-29 .5 3 HOMEWORK 27-30 Read pgs. 659-670 and complete AD/AS packet