Lower Olefins Breakeven cracker margins vs reported

advertisement

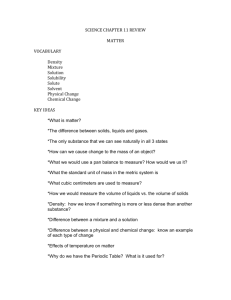

Is Liquids Cracking the Future of Gulf Coast Petrochemicals? Fran Keeth Executive Vice President Shell Chemicals Limited Petrochemical feedstock: oil and gas Gas Cracking Raw Natural Gas Separation of natural gas and natural gas liquids (NGLs) power, heat Ethane, Propane, Butane ‘Gas’ Cracker Ethylene USGC Ethylene Production • 70% from Gas • 30% from Liquids Liquids Cracking Crude Oil Refinery distillation Naphtha, Gas Oil Liquids Cracker Ethylene Co-products (Propylene, transportation fuels, heat, power C4s, Gasoline, Aromatics) 2 Ethylene manufacture 45 40 35 From Liquids Fixed Cost 40 Energy 35 30 25 20 15 10 5 0 45 Feedstock • Liquids Co-Product Credits: • Propylene • C4s • Gasoline • Aromatics From Gas (NGL) 30 25 20 15 Energy Net Ethylene Cost Co-Product Credits Fixed Cost 10 5 Feedstock • Gas (NGL) Net Ethylene Cost 0 3 Natural Gas to Crude Oil Ratio Natural gas / crude oil 1.20 1.00 1990 – 1997 Average = 0.60 0.80 0.60 1998 – 2004 Average = 0.88 0.40 0.20 @ 6 MMBtu/bbl 0.00 1990 1992 1994 1996 1998 2000 2002 2004 4 Historical ethane vs. naphtha cracking margins for generic USGC crackers Source: CMAI 5 Global ethylene production costs •Middle East lowest cash cost •Ethane availability enables Middle East supply growth •Middle East 9% of world ethylene today 14% by 2010 Source: CMAI 6 Shifting trade flows in polyethylene 1996 Source: historical data - Parpinelli TECNON; Shell forecasts 2001 2010 -1.0 -1.0 -8.3 -1.3 -1.1 -0.9 1.8 -1.1 -2.0 -1.0 1.0 2.5 -0.9 -0.4 1.9 1.8 0.3 9.9 Net trade in polyethylene 1996 – 2010 (mln t/a ) export import 7 Co-Product Price Composite Index USGC Generic Naphtha Cracker Percent 140 Basket of naphtha cracker co-product values, normalized by crude price and indexed to longterm average, includes propylene, C4s, pyrolysis gasoline components 120 Increasing in 2004 100 80 1985 – 2003 Average = 100% 19 85 19 86 19 87 19 88 19 89 19 90 19 91 19 92 19 93 19 94 19 95 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 60 8 Higher Values for “non-C2” On-Purpose Propylene Growth Source: CMAI 9 US Ethylene Market Expected demand growth met by capacity creep/de-bottlenecks Source: CMAI 10 USGC Refining Picture - Current • No new grass roots US refineries in last 30 years • US fuels demand greater than domestic supply • Global demand and limited supply growth => favorable margins in recent years • Clean fuels regulations - less sulfur - less aromatics (Bz) - lower vapor pressure & MTBE • Invested/investing in hydrotreating & coking 11 Western Hemisphere Crude Shifts Heavy/Sour Discounts Growing Maya Discount from WTI ($/bbl) 25 20 15 10 5 0 Jan-99 Source: Simmons & Co., Platts Jan-00 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 12 USGC Refining Picture – Future? • Refinery additions - chemicals feed? - Gasoline future: FCC, coking, benzene extraction - Distillate future: Hydrocracking & coking - Steam cracking as ‘conversion capacity’ - Only integrated refining/chemical companies likely to play 13 Relative Competitiveness of USGC Cracking – Gas vs. Liquids High Liquids >> Gas Future? Natural Gas/ Oil Ratio Past X X Liquids << Gas Low Co-product Values Weak Strong 14 Conclusions • Liquids cracking competitiveness improves • Demand does not warrant new crackers (liquid or gas) • New liquids feedstock opportunities may be created • Revitalization of USGC petrochemicals based on liquids feeds unlikely We need to make the most of what we have 15 16