Macroeconomic Theories - Buncombe County Schools

advertisement

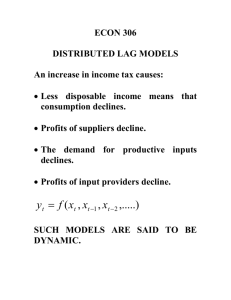

Macroeconomic Theories AP Macroeconomics Where did we come from? The “levers”: In the previous lesson we learned about the levers of economic growth, and how the government can stimulate these levers. Ways to stimulate these levers: http://www.extirpated.org/3.html 1) The supply of labor 2) The supply of capital 3) The supply of technology 1) Savings 2) Research 3) International Trade 4) Education/training Where are we going? In this lesson, we’ll discuss the current issues and sources of disagreement among economists. Most economists hold views that cannot be categorized into a particular school of thought. In this lesson… We will discuss the lags associated with policy-making. What is a lag? What are the lags in policy making? • Inside lag • Outside lag • Recognition lag • Decision (or response) lag • Transmission (or impact) lag Defining the “Inside Lag” The inside lag consists of the time it take for the following to occur: Data to be collected Policy makers to recognize that policy action is necessary Policy makers to make the decision about which policy should be taken, and the implementation of that policy Defining the “Outside Lag”… The outside lag is the time it takes the economy to respond to a new policy. Defining the “Recognition Lag”… The recognition lag is the time it takes for policy makers to see that there is a problem with the economy. In general, this is 3-6 months. Defining the “Decision (response) Lag”… The decision (or response) lag the times it takes for policy makers to decide and implement the policy response to the current economic problem. This is part of the inside lag! Defining the “Transmission (or impact) Lag”… The transmission (or impact) lag is the time it takes the change in policy to actually have an effect of the economy. This lag is very short for fiscal policy because of the media—by the time it is implemented, people are ready to adjust. This lag is long for monetary policy because the change in the MS affects interest rates, which affect interest-rate sensitive components of AD. Recognize Decide Transmit Where do these fit? Outside lag Inside lag Outside Lag Inside lag Recognize Decide Transmit Impact of government borrowing to finance increases in government expenditure, aka crowding out! Visual 5.3 Unit 5 Macroeconomics Why don’t prices & wages adjust quickly? First, take a guess… Next, let’s discuss… Menu Costs: it costs firms money to change their prices— for example, to issue new catalogs or change price tags. Labor contracts: multiyear contracts prohibit rapid changes in wages and may mandate cost-of-living adjustments (increases to match inflation). Firms worry about changes prices and getting into price wars with their competitors. Hence, firms might delay adjusting prices to changes in costs or demand. Let’s Review… • Initially the economy is at Y*, potential GDP and P. Aggregate demand increases from AD to AD1 and the economy moves to Y1 and P1. The final equilibrium is Y* and P2. •If the economy is already at full employment but policy makers think the unemployment rate is too high and carry out expansionary monetary policy, inflation will result. • This demonstrates the conflict between the fullemployment goal and the price stability goal. Visual 3.13 Unit 3 Macroeconomics And now… Some resources: Reffonomics: http://www.reffonomics.com/ Morton workbook: Activity 48 Krugman: Module 36 Works Cited Economics of Seinfeld. http://yadayadayadaecon.com/ Krugman, Paul, and Robin Wells. Krugman’s Economics for AP. New York: Worth Publishers. Morton, John S. and Rae Jean B. Goodman. Advanced Placement Economics: Teacher Resource Manual. 3rd ed. New York: National Council on Economic Education, 2003. Print. Reffonomics. www.reffonomics.com.