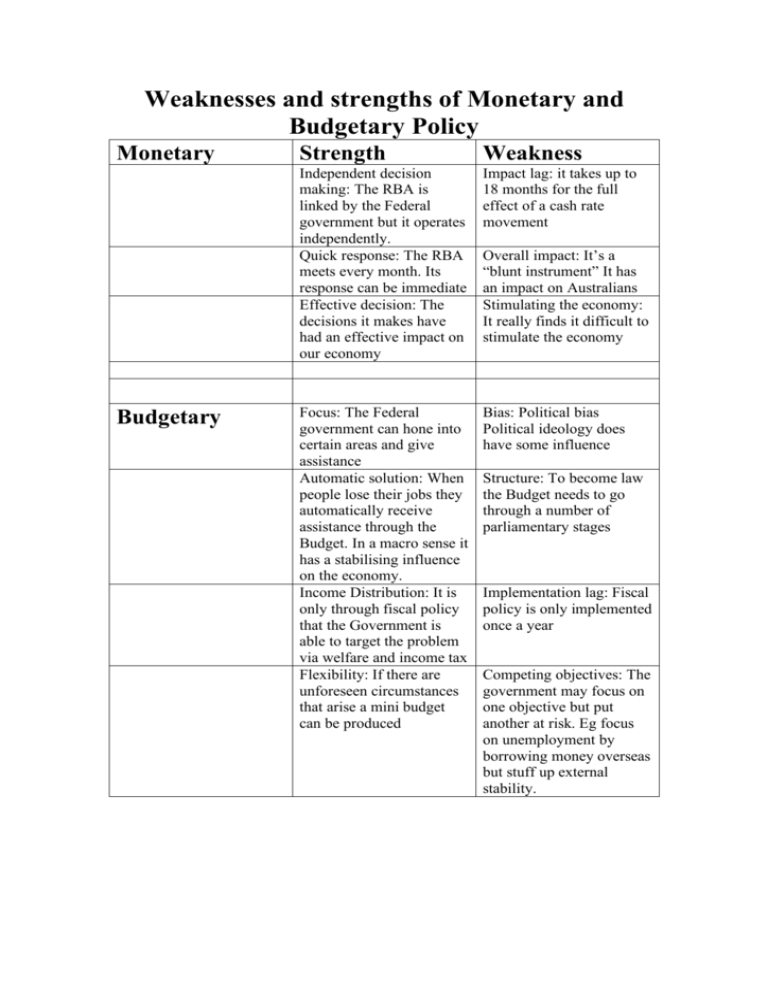

Weaknesses and strengths of Monetary and Budgetary Policy

advertisement

Weaknesses and strengths of Monetary and Budgetary Policy Monetary Budgetary Strength Weakness Independent decision making: The RBA is linked by the Federal government but it operates independently. Quick response: The RBA meets every month. Its response can be immediate Effective decision: The decisions it makes have had an effective impact on our economy Impact lag: it takes up to 18 months for the full effect of a cash rate movement Focus: The Federal government can hone into certain areas and give assistance Automatic solution: When people lose their jobs they automatically receive assistance through the Budget. In a macro sense it has a stabilising influence on the economy. Income Distribution: It is only through fiscal policy that the Government is able to target the problem via welfare and income tax Flexibility: If there are unforeseen circumstances that arise a mini budget can be produced Bias: Political bias Political ideology does have some influence Overall impact: It’s a “blunt instrument” It has an impact on Australians Stimulating the economy: It really finds it difficult to stimulate the economy Structure: To become law the Budget needs to go through a number of parliamentary stages Implementation lag: Fiscal policy is only implemented once a year Competing objectives: The government may focus on one objective but put another at risk. Eg focus on unemployment by borrowing money overseas but stuff up external stability.