OWNER_FINANCE - Searchable Sellers

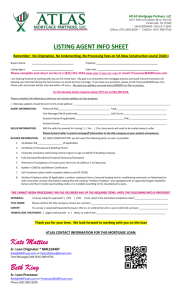

advertisement