Types of Businesses PPT

advertisement

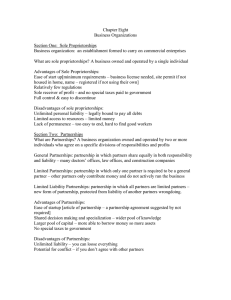

Types of Businesses Good vs. Service • What is the difference between a good and a service? Types of Business Ownership • There are three main types of businesses: – Sole proprietorships – Partnerships – Corporations *entrepreneurs must decide which type best fits their situation* *during the life of a business, its form can change* • These changes often occur when a business is growing – Sole proprietorships – Partnerships – Corporations – Franchise – Non-Profit Sole Proprietorships • A Sole Proprietorship is a business owned by one person • About 75% of all businesses in the U.S. are sole proprietorships Sole Proprietorships • Advantages – It is easy to do • Might need only a license or a permit to start – They are in charge of their own business • They can make all the decisions and run the companies as they see fit – They can keep all of the profits – Their income taxes are lower than a corporation’s • Corporations pay taxes on the income they receive • Then a corporation’s stockholders pay taxes on the income they receive as dividends on stocks • A sole proprietor is only taxed on their personal tax rate, which is often lower than the corporate tax rate Sole Proprietorships – Unlimited Liability • Disadvantages – Unlimited Liability, which means the owner is responsible for the company’s debts • If the owner has more debt than income received, the owner has to make up the difference – Limited access to credit • If the owner doesn’t have much experience or money saved, lenders will be reluctant to offer credit • Many sole proprietorships fail because they run out of money – The person in charge may not have all of the skills needed to run the business • The owner may know everything about the skills needed for the service, but nothing about record keeping – The company ends when the owner dies Partnerships • A Partnership is a business owned by two or more people who share its risks and rewards • To start a partnership, you need a Partnership Agreement, which is a contract that outlines the rights and responsibilities of each partner Partnerships • Advantages – It is easy to do • Might need only a license or a permit to start – It is easier for partnerships to obtain capital – Each partner usually contributes money to start the business – Banks are often more willing to lend money to partnerships than to sole proprietorships – Not dependent on a sole person – The income of a partnership is taxed only once – Each partner brings difference skills and talents to the business Partnerships • Disadvantages – All of the partners share the business risks – Problems occur when partners do not get along or one of them decides to leave • The other owners must end the partnership and reorganize the business since the original partnership no longer exists – Partners share unlimited legal and financial liability • If one partner makes a bad decision, all partners are responsible Corporations • A Corporation is a company that is registered by a state and operates apart from its owners • To form a corporation, the owners must get a corporate charter from the state where their main office will be located – A corporate charter is a license to run a corporation • To raise money, the owners can sell stock, or shares in the company • The company must have a boards of directors, who will govern the corporation Corporations • Advantages – Limited Liability, which holds a firm’s owners responsible for no more than the capital that they have invested in it – The ability to raise money when people buy stock – The corporation does not end if an owner dies • The deceased owner’s shares are sold, and the business continues Corporations • Disadvantages – Corporations pay taxes on their income, and stockholders pay taxes on profits issued to them, which is called Double Taxation – The government regulates corporations more than other types of businesses – Corporations are difficult and costly to start NIKE? S Corporations • S Corporations are special corporations that do not have double taxation – They do have other restrictions Other Ways to Organize a Business • Cooperative • Nonprofit Organization • Franchise Cooperative • A Cooperative is an organization owned and operated by its members – Groups of businesses, such as small farms, pool their resources and form a cooperative – The purpose is to save money on the purchase of certain goods and services – A cooperative can make marketing of goods and services more efficient and profitable • Juice maker Ocean Spray is a cooperative of cranberry growers Nonprofit Organization • A Nonprofit Organization, or nonprofit, is a type of organization that focuses on providing a service, but not to make a “profit” • Nonprofits must also register with the government • Because they do not make a “profit”, they do not pay taxes Franchise • A Franchise is a contractual agreement to use the name and sell the products or services of a company in a designated geographic area – Two common franchises are Taco Bell and Merry Maids – To run a franchise, you have to invest money and pay franchise fees or a share of the profits – In return, the franchiser offers a well-known name and business plan Churches? Review With a partner: • Identify TEN businesses and determine which type of business structure they fall into. • Create a PowerPoint Presentation showing the ten businesses your chose and the type of business they are.