Three Types of Business Organization

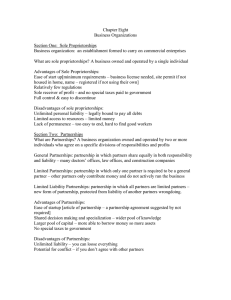

advertisement

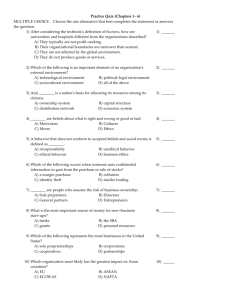

Introduction to Sweet Opportunities Sole Proprietorship—a business owned exclusively by _____ ____________. This one person is in control of all business aspects. The government exercises very little control over sole proprietorships. Partnership—a business owned by ____________ _______________. The partners share in decision-making, responsibilities, profits, and losses. Partnerships face very little government regulation. Corporation—treated _________________ of its owners. The corporation, not the owners, pays taxes, enters into contracts, and held liable for negligence. Ownership is in shares of stock. Liability ______________Options Tax Implications __________of the Business Can be an issue with sole proprietorships and partnerships. ______________when a business experiences financial difficulties or fails If a business is not fully insured, there is also the possibility of loss due to disaster (e.g., fire, flood) or lawsuits ___________________means that the owner’s personal assets can be used to pay for any debts of the business For sole proprietorships and partnerships, the only source of money is often ____________________. Corporations have more options when they need to obtain additional financing. Corporations typically find it easier to borrow money – through loans from the financial markets (commercial banks, __________________, insurance companies). Tax law permits corporations to deduct the full cost of employee _______________, such as medical insurance, thus reducing corporate tax liabilities. Sole proprietorships and partnerships are not permitted to deduct these costs directly from their business income (the costs may be partially deductible as an adjustment to income) Sole proprietors and partners pay ______________________ on their companies’ earnings. A corporation is taxed as a separate entity that pays tax on its income. The stockholders also pay personal income tax on any dividends they receive. The effect is referred to as “double taxation” and in this case, it is the corporate owners that have a tax disadvantage. Sometimes _______________ can arise which result in partnership and sole proprietorships being dissolved. For example: death or illness of a key person within a sole proprietorship or partnership. Form groups of 4. Sit with your group and then wait for additional information about the sweet opportunities activity. Using these notes and your Chapter 4 notes, make recommendations as to what form of business organization you think is best for EACH client. State the reasons for your position Identify at least one negative and suggest how you might minimize it