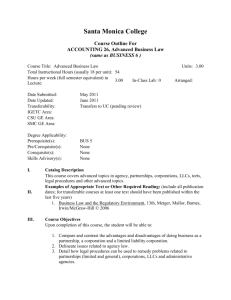

Business Organizations

advertisement

Chapter 8 Business Organizations Types of Organizations Business Organization – establishment formed to carry on commercial enterprise Three Types •Sole Proprietorship •Partnerships •Corporations Sole Proprietorships A business owned and managed by a single individual (most common type of business but only Produce 6% of sales in US) Advantages of Sole Proprietorships Easy to Start-Up •Very little paperwork and legal expense •Minimal requirements Authorization – must obtain a business license Site Permit – permission to use a building Pick a business name Advantages of Sole Proprietorships Relatively Few Regulations •Sole proprietorships are the least regulated businesses •Major regulation is the city zoning laws – city determines what areas will accommodate each kind of building Advantages of Sole Proprietorships Sole Receiver of Profit Full Control Easy to Discontinue It’s all mine! Disadvantages of Sole Proprietorships Unlimited I’ve lost Personal Liability everything! Limited Access to Resources Lack of Permanence Partnerships A business organization owned by two or more persons who agree on a specific division of responsibilities and profits (about 7% of all business are partnerships but they only produce about 5% of sales in US) Three Kinds of Partnership General Partnership – Equal share of responsibility and liability among partners •Examples include doctors, lawyers, accountants Three Kinds of Partnership Limited Partnership – one partner has unlimited personal liability, others contribute money Three Kinds of Partnership Limited Liability Partnership (LLP) – all partners are limited from personal liability •States must grant permission to be an LLP – usually for doctors, lawyers, and dentists Advantages of Partnerships Easy to Start •Articles of Partnership – legal agreement of how to share profits and losses Advantages of Partnerships Easy to Start •Without articles of partnership, the business falls under the Uniform Partnership Act Advantages of Partnerships Shared Decision Making and Specialization Large Pool of Capital Taxation – no special taxes on the business Disadvantages of Partnerships :-@! Unlimited Liability (except with an LLP) Potential for Conflict ;~[ Corporations, Mergers, Multinationals Large entity owned by individual stockholders who all share limited liability for the firm’s debts (20% of all business are corporations but they account for 90% of the sales in the US) •Stock – also called shares – a portion of ownership in a corporation Corporations Corporations are a separate legal entity from the stockholders who own it – so they’re taxed twice! Two Types of Corporations Closely-Held Corporations – majority of stock is passed down through the family (also called Privately held corporation) Two Types of Corporations Publicly Held Corporations – many shareholders buying stock on the open market Corporate Structure Stockholders Elect Board of Directors CEO COO Managers Other Employees Advantages of Incorporation Advantages to the investor: •Limited liability •Shares are transferable Advantages of Incorporation Advantages to the corporation •Higher potential for growth •Long lasting •Nearly unlimited capital Selling bonds Disadvantages of Incorporation Difficulty and Expense of Start-Up Double Taxation Loss of Control High Regulations Combining Corporations - Mergers Horizontal Mergers – join two or more firms competing in the same market + Combining Corporations - Mergers Vertical Mergers – join two or more firms involved in different stages of producing the same good + Combining Corporations Conglomerates Firms that buy other companies that produce totally unrelated goods GE GE Insurance NBC GE Plastics Multinationals Corporations that operate in more than one country at a time They must pay taxes and obey the laws of each country they operate in Many have bigger budgets than the country they are in Business Franchises Semiindependent business that pays fees to a parent company Business Franchises In return for the fees, the business gets exclusive rights to sell the parent company’s product in a certain area Advantages of Opening a Franchise Management Training Standardized Quality National Advertising Program I’m the same everywhere! Advantages of Opening a Franchise Financial Assistance Centralized Buying Power – the parent company buys in bulk to save everyone money Disadvantages of Opening a Franchise High Franchising Fees – parent company gets a share of the profit called a royalty Strict Operating Standards Disadvantages of Opening a Franchise Purchasing Restrictions Limited Product Line Cooperative Organizations A business organization owned and operated by a group of individuals for their shared benefit Three Kinds of Co-op’s Consumer Cooperatives – sell merchandise to members at reduced prices •Often require members to work or pay a membership fee Three Kinds of Co-op’s Service Cooperatives – same as consumer co-op, but it provides a service Producer Cooperatives – agricultural co-ops that help farmers sell their product Nonprofit Organizations Do not work for profit, but rather to help people Exempt from income taxes Nonprofit Organizations Professional Organizations – improve the image, working condition, and skill level of people in a profession Business Association – promote the business interests of a geographical area (like a city or a state) Nonprofit Organizations Trade Associations – promote the interest of an industry Labor Unions – organized group of workers that aim to improve conditions, hours, and wages