401k Benefit Overview - Seemybenefitsonline.com

advertisement

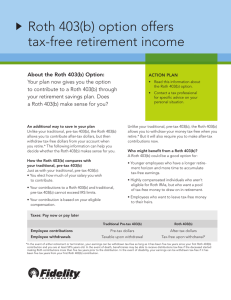

Co-op 401(k) Plan Enrollment for Farmer’s Cooperative Tuesday, July 9th, 2013 Why participate? Why participate? • Contributions are pre-tax – Amount deducted from paycheck has less effect on takehome pay – Can reduce the overall amount you pay in taxes on income earned today – Income not taxed until it is withdrawn 3 Why participate? • Payroll deductions are convenient – Automatically deducted from paycheck – Increase at any time via web or Benefit Service Center – Set up automatic increases on MillimanBenefits.com 4 Why participate? • Investing pre-tax saves you money 401(k) Retirement Plan (pretax) Gross income Minus taxes Amount available to invest Plus annual return Regular Investment (taxable) $1.00 -$0 $1.00 +10% Balance after one year $1.10 Are gains taxable? No Example taken from “The Power of Pretax Investing,” by David Bach. 5 $1.00 -30% $0.70 +10% $0.77 Yes Getting started Getting started • Am I eligible? – Understand your company’s eligibility requirements: • Age - (21 Years of Age) • Service - (1 year) • Entry date - (Monthly) 7 Getting started • Contribution limits – No more than 50% of salary – $17,500 (2013 IRS Limit) – Additional $5,500 if 50 or older (2013 IRS Limit) • Employer Contribution – 50% of 4% match. – Profit Sharing (1000hrs/last day requirement)(Optional) 8 Getting started • Can roll over money from: – Previous employer’s pension, profit sharing, or savings/thrift plan – Rollover IRA – Even if you are not yet eligible to contribute to the Plan 9 Roth 401(k) Roth 401(k) • The Roth 401(k) is a another retirement savings/contribution option • Hybrid of the Roth IRA and a 401(k) 11 11 Roth 401(k) Automatically deducted from paycheck When deducted? Regular/catch-up contribution limits (2013) Can employers match? Roth 401(k) Traditional 401(k) Yes Yes After-tax Pre-tax $17,500/$5,500* $17,500/$5,500* Yes, treated as pre-tax money and is taxed later Yes, treated as pretax money and is taxed later *Combined limit 12 12 Roth 401(k) Roth 401(k) Traditional 401(k) 59½ 59½ Age at which you must begin distributions After retirement or 70½ After retirement or 70½ Amount of time money must be in account 5 years No requirement Can money be rolled over into a Roth IRA?* Yes* No Age at which distributions allowed without penalty *Funds may not be able to be distributed until 5 years from date of rollover, unless transferred to pre-existing Roth IRA 13 13 Is the Roth 401(k) right for you? • Do you believe you will be in a higher tax bracket after you retire than you are now? • Will you be close to the income limits over which you are taxed for Social Security? • Can you afford it? 1414 Investing your money Investing your money • Your investor profile – What is your risk tolerance? – Where does your style fall in the range from conservative to aggressive? 16 Three Tiers of Investing Investing Preference: “I’ll do it myself” Core Funds LEAST VOLATILE RISKOMETER MOST VOLATILE InvestMap Professionally Managed Accounts 17 Professional Management Professional Management Agri-Invest – A Division of Rockbridge Investment Management – Professionally managed accounts • Agri-Invest specializes in working with people in agriculture • Accounts reviewed and adjusted periodically • Asset allocation based on personal demographics – Providing objective investment management: • Since 1999 • With $25 million managed assets in program • 1,000+ participants Craig A. Buckhout, CFA 19 Anthony R. Farella, CFP®, AIF® Patrick Rowe CRPC Professional Management • Objectives of the PMA – As a Registered Investment Advisor, Agri-Invest is duty bound to act in the best interest of each participant. The two most important services include: • Objective investment decisions based on the unique risk tolerance and goals of the participant. • Investment strategy with diversification at the lowest cost. 20 Core Funds Core Funds Asset class Fund Ticker Stable asset fund Galliard Stable Asset N/A Bond PIMCO Total Return Institutional PTTRX Inflation Protected Bond Vanguard Inflation-Protected Securities Fund VAIPX Balanced Vanguard Wellington Admiral VWENX Large-cap value Vanguard Windsor II Admiral VWNAX Index stock Vanguard Institutional Index VINIX Large-cap growth MainStay Large Cap Growth I MLAIX Mid-cap value JP Morgan Mid-Cap Value Select JMVSX Mid-cap growth T. Rowe Price Mid-Cap Growth RPMGX Small-cap value Allianz NFJ Small Cap Value Fund PSVIX Small-cap index Vanguard Small-Cap Index Signal VSISX Small-cap growth Vanguard Explorer Admiral VEXRX Intnat’l large-cap value Dodge & Cox International Stock DODFX Intnat’l large-cap blend Vanguard Internat’l Growth Admiral VWILX Intnat’l large-cap growth Artisan International Fund ARTIX 22 InvestMap InvestMap • What is InvestMap? – age-appropriate investment allocation approach • Uses the Plan’s underlying funds – Automatically becomes more conservative as you near retirement age. – Agri-Invest has constructed 5 different allocations to allow personalization in retirement strategy. 24 Keeping track of your account Keeping track of your account • Three ways to access account information and initiate transactions 1 26 www.millimanbenefits.com Keeping track of your account • Three ways to access account information and initiate transactions: 2 Benefits Service Center 888 7 0 8 27 6 9 8 8 Keeping track of your account • Three ways to access account information and initiate transactions: 3 28 Mobile App for iPhone and Android View account asset allocation and deferral only Keeping track of your account • Account statements • For each investment fund: – – – – – – Balance at beginning of quarter Contributions Investment earnings Distributions Balance at end of quarter Percent of total account balance – Personal rate of return 29 PlanAhead for Retirement Tools to assist participants www.millimanbenefits.com PlanAhead for RetirementTM 31 Withdrawing money Withdrawing your money • When you leave your company – If more than $1,000, can leave it in the account until age 70½ – Lump sum distribution – Roll money over into another retirement account – Partial distribution – Combination of distribution and rollover – Recurring payments – Taxes and penalties may apply 33 Withdrawing your money • Vesting – Your contributions always fully vested • Company Contribution – 6 year vesting on employer match – 6 year vesting on optional profit sharing 34 Thank you!