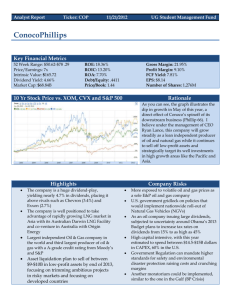

Exxon Mobil Valuation

Exxon Mobil and Chevron Corporation

-

-

Petroleum Industry structure:

5 sectors of operations (Upstream, downstream, marine, pipeline, and service/supply)

-

-

Extremely high barriers to entry allowing for sustainable profits in the long run

Supply of oil is controlled by a cartel regime (OPEC)

-

-

-

-

-

Economic market form is close to Oligopoly

Few large sellers dominate industry

High barriers to entry, competitors cannot enter to reduce profits of participating firms

Standardized product

Oil and Gas industry is described well by Cournot-Nash Models of competition ( Two equally positioned firms competing on quantity, not price)

-

-

Major Players (Integrated):

Exxon, Chevron, Royal Dutch Shell, British Petroleum

Operates as an Integrated Oil Company:

-Global exploration, extraction, refinement, transportation and marketing of petrol and chemical Products

Market Statistics:

-Market Cap (intraday) 5 :149.60B

-Market Value Debt: 10.54 B

-Enterprise Value (9-Mar-10) 3 :151.60B

-Trailing P/E (ttm, intraday):14.22

-Price/Sales (ttm):0.94

-Price/Book (mrq):1.63

WACC = [(D/V)*(YTM*(1-T))]+[(E/V)*(rf + β(Erm - rf)]

Cost of Debt = Weighted Avg. YTM (1-Marginal Tax Rate)

Equity = rf + β(Erm - rf)

Pre. Stock = Div/Price (Chevron does not have P.S.)

0.079299

0.045924

0.081512

DCF Analysis Results:

2014 FCF $140,499.52

Terminal Value $91,995

PV $2,076,684.74 Millions Per Share Price Approx $ 685 Current Share Price

($74.60)

Analysts Recommendations

Buys: 6

Buy/Hold: 8

Hold: 5

Hold/Sells: 0

Sells: 0

Operates as an Integrated Oil Company:

-Global exploration, extraction, refinement, transportation and marketing of petrol and chemical

Products

Market Statistics:

-Market Cap (intraday) 5 :316.23 B

-Market Value Debt: 10.54 B

-Enterprise Value (9-Mar-10) 3 :312.61B

-Trailing P/E (ttm, intraday):16.84

-Price/Sales (ttm):1.13

-Price/Book (mrq):2.84

WACC = [(D/V)*(YTM*(1-T))]+[(E/V)*(rf + β(Erm - rf)] 0.0615

Cost of Debt = Weighted Avg. YTM (1-Marginal Tax Rate) 0.0330

Equity = rf + β(Erm - rf)

Pre. Stock = Div/Price (Exxon Mobil does not have P.S.)

0.0900

DCF Analysis Results:

2014 FCF $130,273

Terminal Value $94,249

PV $3,997,414 Millions

Per Share Price Approx $ 845 Current Share Price ($67.00)

Analysts Recommendations

Buys: 5

Buy/Hold: 3

Hold: 10

Weak Hold: 1

Sells: 0

S&P: Fundamental outlook for the Integrated Oil & Gas subindustry for the next 12 months is positive, on expectations of improved global oil consumption amid an economic recovery. S&P projects that S&P 500 Energy sector operating

EPS will drop about 67% in 2009, but rebound about 89% in

2010.

Financial Data Change in 2009 Drop In Net Income

Exxon Mobil Net Income $19,280 for 2009 vs. $45,219 for

2008 (57% drop)

Chevron Net Income $10,483 for 2009 vs. $23,931 for 2008

(56% drop)

Buy Exxon Mobil current price $67

High price over past three years is $93 (April 2008) and it should head back to that level within the next 18 months with the economic recovery or

63.5% annual return

Buy Chevron current price $74.33

High price over the past three years $99 (June

2008) and it should head back to that level within the next 18 months or 53.7% annual return