Confidential - Helsinki Capital Partners

advertisement

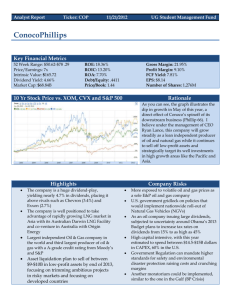

Confidential BP a contrarian and controversial value bet? Ernst Grönblom 01.07.2010 Premises • We operate under the assumption that the market usually over-reacts both on the upside (booms and manias) and the downside (busts and panics). • We currently live in the aftermath of the most severe financial crises since the Great Depression. • After the massive government bank-bailouts, public outrage against (actual or perceived) corporate wrongdoings is at historical highs. BP – key data • 2009 sales: 239 Bn$ (global rank: 4) • 2009 profits: 17 Bn$ (global rank: 4) • 2009 (june) market cap: 147 Bn$ (global rank: 10) • 2009 total net tangible assets: 81 Bn$ The Deepwater Horizon –spill is probably the most widely covered environmental accident to date Costs to BP • Cost can be divided into three main parts: (1) Direct costs (stopping the leak, environmental cleanup). Estimates: best case ~ 8 Bn $, worst case ~ 16 Bn $ (source: UBS) (2) Penalty fines under the US Federal Water Pollution Control Amendments of 1972 (a.k.a. “Clean Water Act”). Estimates: 10 – 20 Bn $. (3) Damages under the US Oil Pollution Act of 1990. Maximum damages under the act capped to 75 M $, but BP has committed to ignore the cap and “honour all legitimate claims”. Estimates: 5 – 10 Bn $. • Summary: worst-case scenario ~ 40 Bn $, best-case scenario ~ 10 Bn $ (Nomura estimate: 12 Bn $ ). Costs to BP (Bn $) 183 102 92 40 10 Market cap ( before accident 19.04.2010) Net book assets (31.12.2009) Market cap (current 02.07.2010) Spill related costs (worst-case scenario) Spill related costs (best-case scenario) BP vs Shell vs Chevron vs Exxon vs S&P 500 (January 2002 – July 1, 2010) BP vs Shell vs Chevron vs Exxon vs S&P 500 (April 1, 2010 – July 1, 2010) BP vs Shell vs Chevron vs Exxon relative valuations (02.07.2010) P/E Price / Book Exxon 13,1 Exxon Chevron 10,4 Chevron Shell 10,4 Shell BP 4,6 BP 2,39 1,44 1,09 0,88 Balance sheet analysis Assets vs Liabilities (Bn $) Asset breakdown (Bn $) 236 Cash 8 Receivables 30 134 Invetories 23 Other noncurrent assets 10 Total assets Total liabilities Property, plant & equipment 108 Investments 30 Intangible assets 12 Goodwill 9 Conclusions and investement thesis summary • • • • • • • Fact: since the accident, BP has lost approximately 90 Bn $ of market capitalization. Fact: most experts estimate the worst-case scenario cost to BP to be approximately 40 Bn $. Fact: considering the financial strength of BP, a bancruptcy can be considered very unlikely. Fact: the response to the accident of both the public, the media and the political establishment has been very aggressive. Demands have been made of, e.g. retroactive legislation (with unlimited liability) and seizure of the company. Politicians – eager to win public points by appearing tough – have made demands that clearly lack legal grounds. The public – and most investors – seem to have failed to distinguish between political rethoric and economic and legal facts. Hypotheses: current investor sentiment (as reflected in market capitalization) grossly over-estimates the probable final economic consequences of the accident to BP. Investment thesis: at current valuations, BP probably represents a deepvalue play with a potential short-term upside of 50 – 90 %.