Chevron, Exxon Cut Spending on Oil Price Slide

advertisement

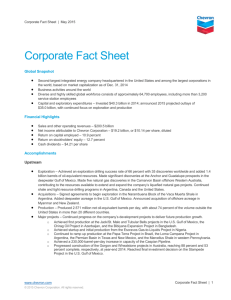

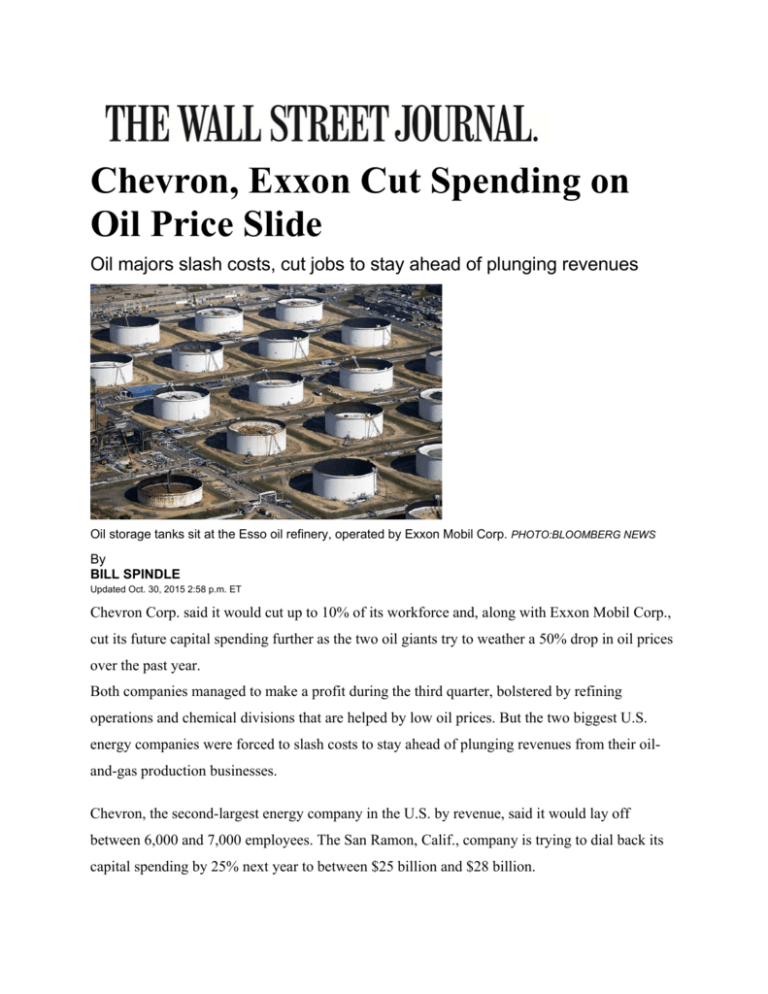

Chevron, Exxon Cut Spending on Oil Price Slide Oil majors slash costs, cut jobs to stay ahead of plunging revenues Oil storage tanks sit at the Esso oil refinery, operated by Exxon Mobil Corp. PHOTO:BLOOMBERG NEWS By BILL SPINDLE Updated Oct. 30, 2015 2:58 p.m. ET Chevron Corp. said it would cut up to 10% of its workforce and, along with Exxon Mobil Corp., cut its future capital spending further as the two oil giants try to weather a 50% drop in oil prices over the past year. Both companies managed to make a profit during the third quarter, bolstered by refining operations and chemical divisions that are helped by low oil prices. But the two biggest U.S. energy companies were forced to slash costs to stay ahead of plunging revenues from their oiland-gas production businesses. Chevron, the second-largest energy company in the U.S. by revenue, said it would lay off between 6,000 and 7,000 employees. The San Ramon, Calif., company is trying to dial back its capital spending by 25% next year to between $25 billion and $28 billion. John Watson, Chevron’s chief executive, told analysts that job reductions would be concentrated in Australia as the company completes construction of two giant, liquefied natural-gas projects. Some cuts also will come from West Africa as Chevron reorganizes operations in Angola. Chevron also predicted further spending cuts in 2017 and 2018 that would bring its capital expenditures down to as low as $20 billion. That is a dramatic shift from a year ago, when Chevron was booking the most profit per barrel among the world’s top publicly-traded oil firms, with its sights set on generating more cash than larger rivals Exxon and Royal Dutch Shell PLC. Still, results for the quarter fell less than Wall Street had expected. Chevron reported earnings of $2.04 billion, or $1.09 a share, down 64% from $5.6 billion a year earlier. Revenue for the period dropped 37% to $34.32 billion. “The grim reality is that when you have prices in the mid-$40s as we did in the third quarter, it’s tough sledding,” Mr. Watson said. “It’s a challenge, but we’re taking it on.” Guy Baber, an analyst with energy investment bank Simmons & Company International, said Chevron is not alone. So far this year the 14 major oil companies he follows are collectively spending more on dividends and capital expenditures than their cash flow generation by $90 billion, or 11 percent, he said. “They’ll be outspending significantly next year as well in a $50 per barrel oil price world,” he said. “That is forcing them to make difficult decisions, and significant cuts to capital spending. And it will have an impact on production,” he said. Chevron, for example, revised its oil production target for 2017 down by between 100,000 and 200,000 barrels a day, Mr. Watson told analysts. The company said it still plans to be able to meet its dividend payment with cash flow for 2017. Meanwhile, Exxon confirmed it had cut third-quarter capital spending by 22% from the prior year to $7.67 billion. As costs to drill and pump oil and gas continue to fall in the low-price oil environment, the biggest U.S. oil company said it expects to shave another $1 billion off its capital expenses and $7 billion from its operating expenditures. “We’re always working to reduce the structural cost on our business,” Jeff Woodbury, the company’s head of investor relations, told analysts. The Irving, Texas, company reported a profit of $4.24 billion, or $1.01 a share, down 48% from $8.07 billion a year prior. Revenue fell 27% to $67.34 billion. Exxon’s profit in the exploration and production division fell 79% to $1.36 billion in the latest quarter, and its U.S. division became unprofitable, booking a loss of $422 million. Still, with fatter profits from its fuel refineries that doubled to $2.03 billion, Exxon managed to beat Wall Street expectations. Chevron’s stock, down 20% this year, gained 1% to $90.88 while Exxon was up less than 1% to $82.74, both in 4 p.m. trading on Friday. Chevron and Exxon Mobil said they would cut capital spending further as declining crude oil prices and fewer big new projects have reduced demand for and costs to drill and pump oil and gas. PHOTO: AGENCE FRANCE-PRESSE/GETTY IMAGES Other large global oil companies also reported sharply lower earnings earlier this week as they gave up on some ventures that no longer make sense when crude-oil prices are under $50 a barrel. Royal Dutch Shell posted a $6.1 billion loss in the third quarter after its decision to walk away from exploring the Arctic for oil and exploiting Canada’s oil sands resulted in $7.9 billion in charges. ConocoPhillips, the biggest U.S. shale driller, reported a loss of $1.1 billion and announced new plans to trim spending. Smaller companies continue to shed jobs, too. Calgary-based Husky Energy Inc., which operates oil sand mines and runs refineries in the U.S. and Canada, told investors on Friday that it cut 1,400 workers and will extend a companywide salary freeze. Forecasts for oil prices vary, but many banks and analysts predict that prices will stay lower for longer through next year. Goldman Sachs Group has said oil prices may need to drop as low as $20 a barrel before the supply glut that is putting pressure on the market is cleared. The investment bank expects Brent crude, which is considering the global oil benchmark price, to trade under $50 a barrel next year.