SBE03.01

B. OVERVIEW OF SMALL

BUSINESS

3.00 Can students explain the legal environment of small business?

3.01 What are the various forms of forms of business ownership?

(The logos used in this PowerPoint were copied directly from corporate websites.

They have not been altered in any way.)

Three basic forms of business ownership

•Sole proprietorship

•Partnership

•Corporation

Sole proprietorship

•A business owned and operated by one person.

•Approximately 76 percent of all businesses in the U.S. are sole proprietorships.

Partnership

A form of business ownership in which two or more people share the assets, liabilities, and profits.

Corporation

A business that is chartered by a state and legally operates apart from its owners.

B ECOME THE A DVISOR

1.

2.

3.

Research the one of the three basic forms of business ownership. Think of four questions you have about the business ownership.

Prepare a presentation that includes the following information about the type of business.

a)

Advantages versus Disadvantages of the ownership b) c) d) e) f)

Various types of the ownership if applicable

What is required to begin this type of business in NC?

What assistance is available to start the business?

What are the tax implications of this type of business

Give two examples of the business ownership type: one product, one service business.

Highlight any new terminology relevant to this business type.

Types of corporations

•C-corporation: The most common form corporation. It protects the entrepreneur from being personally sued for the actions and debts of the corporation.

•Subchapter S corporation: A corporation that taxed like a sole proprietorship or partnership.

Types of corporations

•Nonprofit corporation: Legal entities that make money for reasons other than the owner’s profit.

•Limited Liability Company (LLC): A new form of business ownership that provides limited liability and tax advantages.

Advantages of corporations

•Can raise money by issuing shares of stock.

•Offers owners limited liability. Limited

Owners are liable only up to the amount of their investments.

Advantages of corporations

•People can easily enter or leave the business by buying or selling their shares of stock.

•The business can hire experts to professionally manage each aspect of business.

Disadvantages of corporations

•Legal assistance is needed to start a corporation.

•Start-up is costly.

•Corporations are subject to more government regulations than partnerships or sole proprietorships.

Disadvantages of corporations

•A lot of paperwork is involved in running a corporation.

•Income is taxed twice.

Alternate approaches to starting a business

•Buy an existing business.

•Enter a family business.

•Own a franchise business.

Advantages of buying an existing business

•Existing businesses already customers, suppliers, and procedures.

•Seller of the business may be willing to train the new owner.

•There are existing financial records.

•Financial arrangements may be easier.

Disadvantages of buying an existing business

•Business may be for sale because it is not making a profit.

•Problems may be inherited with the purchase of an existing business.

•Many entrepreneurs may not have the capital needed to purchase an existing business.

Advantages to entering a family business

•There is a certain sense of pride and accomplishment that comes from being part of a family endeavor.

•A business can remain in the family for generations.

•Some people enjoy working with relatives.

•The efforts of running a family business give one the benefit of knowing that their efforts are helping those whom they care about.

Disadvantages to entering a family business

•Senior management positions are often held by family members who may not be the best qualified.

•It may be difficult to retain qualified employees who are not members of the family.

Disadvantages to entering a family business

•Family politics may affect decisions regarding the business.

•It is often difficult to separate business life and private life in family-run businesses.

•It is often difficult to set policies and procedures and to make decisions.

Own a franchise business

• Franchise: A legal agreement that gives an individual the right to market a company’s products or services in a particular area.

• Franchisee: A person who purchases a franchise agreement.

• Franchisor: The person or company who sells a franchise.

• Initial franchise fee: The fee the franchise owner pays in return for the right to run the business.

Advantages of purchasing a franchise business

An established product or service is being provided.

Franchisors often offer management, technical, and other assistance.

Equipment and supplies may be less expensive.

A guarantee of consistency attracts customers.

Disadvantages of purchasing a franchise business

The cost of franchises may be high, which reduce profits.

Franchise owners are limited in the decisions they can make regarding the business.

The performance of other franchises impact on the franchisee.

The franchise agreement may be terminated by the franchisor.

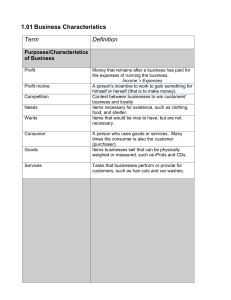

CHARACTERISTICS OF

THE LEGAL FORMS OF

BUSINESS

FEATURE

Simple to start

Decisions made by one person

Low initial cost

Limited liability

Limited government regulation

Ability to raise capital

Double taxation of profits

S LIDE 28 C

HAPTER

4

Think

Critically on pages:

Pg. 84; 1-2

Pg. 91; 1-3

Pg. 97; 1-3

Pg. 100;

27-30

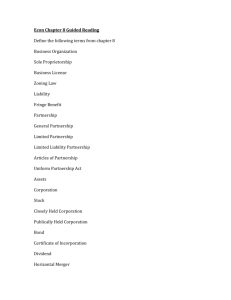

A SSIGNMENT : C HAPTER 4

1. Outline Chapter 4, be sure to define the key terms below

2. Complete each “Think Critically” Assessment

C-corporation

Corporation

Franchise

Franchisee

Franchisor

General partnership

Initial franchise fee

Joint venture

Limited liability

Limited Liability Company

(LLC)

Limited partnership

Nonprofit corporation

Partnership

Public goods

Sole proprietorship

Strategic alliance

Subchapter S corporation

Unlimited liability

B. OVERVIEW OF SMALL

BUSINESS

3.00 Explain the legal environment of small business.

3.02 What are the available sources of assistance for entrepreneurs?

(The logos used in this PowerPoint were copied directly from corporate websites.

They have not been altered in any way.)

The importance of seeking assistance

•Most entrepreneurs do not possess ALL skills and knowledge necessary to run a successful business.

•Many forms of support and assistance are available to entrepreneurs from government agencies and private professionals.

Federal Resources

•Small Business Administration (SBA)

•Service Corps of Retired

Executives (SCORE)

•Small Business Institute (SBI)

Federal Resources

•U.S. Department of Commerce

•Federal Trade

Commission (FTC)

•Internal Revenue Service (IRS)

Federal/State Resource

•Small Business Development Center

(SBDC)

State Resources

•Department of Development (DOD)

•Workers’

Compensation Board

•The State Department of Labor

State Resources

•The State Department of

Agriculture and Consumer

Protection Division

•The Office of the

Secretary of State

State Resources

•The State Department of Agriculture and Consumer Protection Division

•The State Sales and Use Tax Division

Local/community Resources

•Chambers of Commerce

Local/community Resources

•Colleges, universities, and technical schools

•Licensing and Permit Offices

•County Health Departments

•County Extension Services

Professional Services

•Attorneys

•Accountants

•Insurance agents

![SBE03[1].01](http://s2.studylib.net/store/data/009907829_1-78ccdc09e75adf2351c2ff6cd9f4e040-300x300.png)