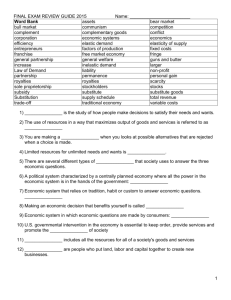

SBE03[1].01

advertisement

![SBE03[1].01](http://s2.studylib.net/store/data/009907829_1-78ccdc09e75adf2351c2ff6cd9f4e040-768x994.png)

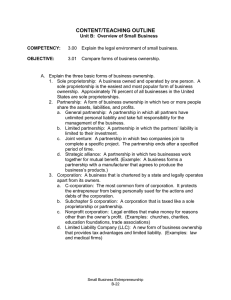

B. OVERVIEW OF SMALL BUSINESS 3.00 Explain the legal environment of small business. 3.01 Compare forms of business ownership. (The logos used in this PowerPoint were copied directly from corporate websites. They have not been altered in any way.) Three basic forms of business ownership •Sole proprietorship •Partnership •Corporation Sole proprietorship •A business owned and operated by one person. •Approximately 76 percent of all businesses in the U.S. are sole proprietorships. Advantages of sole proprietorships •Easy and inexpensive to create. •Owner makes all business decisions. •Owner receives all profits. •Least regulated form of business ownership. •Business itself pays no taxes. Disadvantages of sole proprietorships •Owner has unlimited liability for all debts and actions of the business. Unlimited liability: The debts of the business may be paid from the personal assets of the owner. •Difficult to raise capital. •Sole proprietorship is limited by his/her skills and abilities. •The death of the owner automatically dissolves the business. Partnership A form of business ownership in which two or more people share the assets, liabilities, and profits. Types of Partnerships •General partnership: A partnership in which all partners have unlimited personal liability and take full responsibility for the management of the business. •Limited partnership: A partnership in which the partners’ liability is limited to their investment. •Joint venture: A partnership in which two companies join to complete a specific project. The partnership ends after a specified period of time. •Strategic alliance: A partnership in which two businesses work together for mutual benefit. Advantages of partnerships •Shared decision making and management responsibilities. •Easier to raise capital than in a sole proprietorship. •Few government regulations. •Business losses are shared by all partners. Disadvantages of partnerships •Partnerships may lead to disagreements. •Some entrepreneurs are not willing to share responsibilities and profits. •Some entrepreneurs fear being held legally liable for the error of their partners. •Each owner has unlimited liability. Corporation A business that is chartered by a state and legally operates apart from its owners. Types of corporations •C-corporation: The most common form of corporation. It protects the entrepreneur from being personally sued for the actions and debts of the corporation. •Subchapter S corporation: A corporation that is taxed like a sole proprietorship or partnership. •Nonprofit corporation: Legal entities that make money for reasons other than the owner’s profit. •Limited Liability Company (LLC): A new form of business ownership that provides limited liability and tax advantages. Advantages of corporations •Can raise money by issuing shares of stock. •Offers owners limited liability. Limited liability: Owners are liable only up to the amount of their investments. •People can easily enter or leave the business by buying or selling their shares of stock. •The business can hire experts to professionally manage each aspect of the Disadvantages of corporations •Legal assistance is needed to start a corporation. •Start-up is costly. •Corporations are subject to more government regulations than partnerships or sole proprietorships. •A lot of paperwork is involved in running a corporation. •Income is taxed twice. Alternate approaches to starting a business •Buy an existing business. •Enter a family business. •Own a franchise business. Advantages of buying an existing business •Existing businesses already have customers, suppliers, and procedures. •Seller of the business may be willing to train the new owner. •There are existing financial records. •Financial arrangements may be easier. Disadvantages of buying an existing business •Business may be for sale because it is not making a profit. •Problems may be inherited with the purchase of an existing business. •Many entrepreneurs may not have the capital needed to purchase an existing business. Advantages to entering a family business •There is a certain sense of pride and accomplishment that comes from being part of a family endeavor. •A business can remain in the family for generations. •Some people enjoy working with relatives. •The efforts of running a family business give one the benefit of knowing that their efforts are helping those whom they care about. Disadvantages to entering a family business •Senior management positions are often held by family members who may not be the best qualified. •It may be difficult to retain qualified employees who are not members of the family. •Family politics may affect decisions regarding the business. •It is often difficult to separate business life and private life in family-run businesses. •It is often difficult to set policies and procedures and to make decisions. Own a franchise business Franchise: A legal agreement that gives an individual the right to market a company’s products or services in a particular area. Franchisee: A person who purchases a franchise agreement. Franchisor: The person or company who sells a franchise. Initial franchise fee: The fee the franchise owner pays in return for the right to run the business. Advantages of purchasing a franchise business An established product or service is being provided. Franchisors often offer management, technical, and other assistance. Equipment and supplies may be less expensive. A guarantee of consistency attracts customers. Disadvantages of purchasing a franchise business The cost of franchises may be high, which can reduce profits. Franchise owners are limited in the decisions they can make regarding the business. The performance of other franchises impact on the franchisee. The franchise agreement may be terminated by the franchisor.