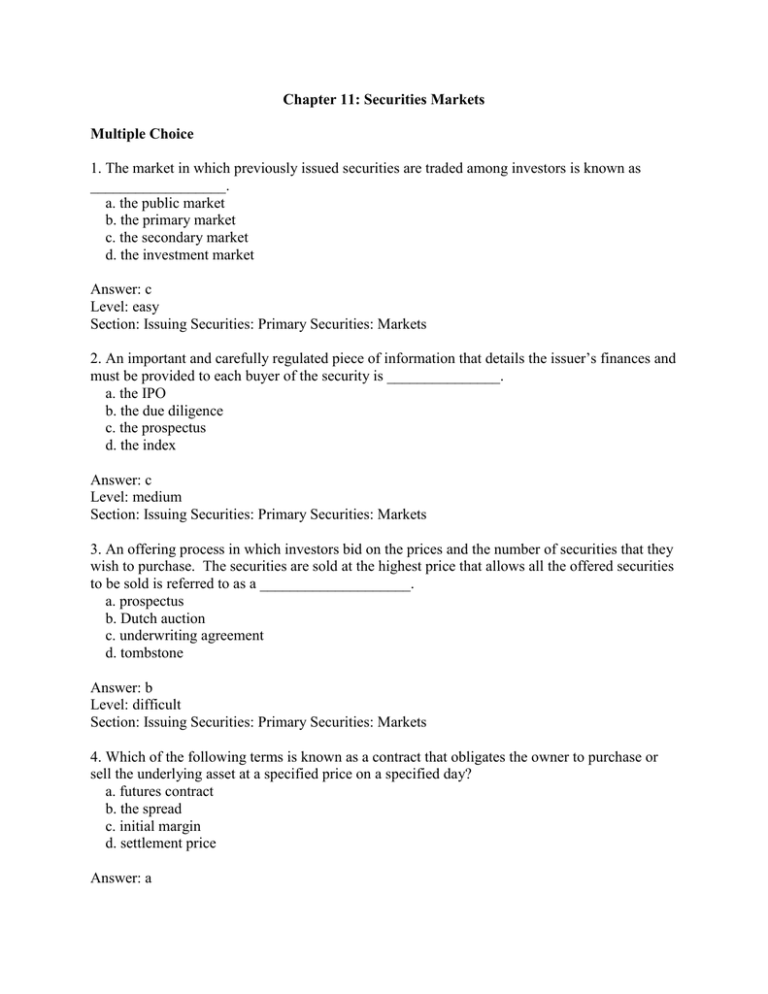

Chapter 11: Securities Markets Multiple Choice 1. The market in

advertisement

Chapter 11: Securities Markets Multiple Choice 1. The market in which previously issued securities are traded among investors is known as __________________. a. the public market b. the primary market c. the secondary market d. the investment market Answer: c Level: easy Section: Issuing Securities: Primary Securities: Markets 2. An important and carefully regulated piece of information that details the issuer’s finances and must be provided to each buyer of the security is _______________. a. the IPO b. the due diligence c. the prospectus d. the index Answer: c Level: medium Section: Issuing Securities: Primary Securities: Markets 3. An offering process in which investors bid on the prices and the number of securities that they wish to purchase. The securities are sold at the highest price that allows all the offered securities to be sold is referred to as a ____________________. a. prospectus b. Dutch auction c. underwriting agreement d. tombstone Answer: b Level: difficult Section: Issuing Securities: Primary Securities: Markets 4. Which of the following terms is known as a contract that obligates the owner to purchase or sell the underlying asset at a specified price on a specified day? a. futures contract b. the spread c. initial margin d. settlement price Answer: a Level: difficult Section: Futures Contracts 5. What expense is comprised of direct costs, the spread, and underpricing? a. inflation costs b. flotation costs c. the underwriting agreement d. the IPO Answer: b Level: easy Section: Cost of Going Public 6. Activities of investment bankers include all of these except ___________________. a. the management of pension and endowment funds for businesses b. providing financial counseling on a fee basis c. federal regulation of investment banking d. offering financial advice and participate in the financial planning of the firm Answer: c Level: medium Section: Other Functions of Investment Banking Firms 7. ________________ is a professional that assists in the trading process by buying or selling securities in the market for an investor. a. An investment banker b. A broker c. A dealer d. A trader Answer: b Level: medium Section: Other Functions of Investment Banking Firms 8. In which market are securities first issued, and the issuer sells the securities in an offering to investors? a. the primary market b. the securities market c. the secondary market d. a Dutch auction Answer: a Level: easy Section: Trading Securities: Secondary Securities Markets 9. Which group of investors on the New York Stock Exchange buys and sells stocks for their own account? a. registered traders b. independent brokers c. designated market makers d. supplemental liquidity providers Answer: a Level: medium Section: Structure of the NYSE 10. What is the term for the price offered by a potential buyer? a. bid b. ask c. spread d. market order Answer: a Level: easy Section: Security Transactions 11. The minimum margin to which an investment may fall before a margin call will be placed is called the __________________. a. short sale margin b. margin call c. initial margin d. maintenance margin Answer: d Level: medium Section: Security Transactions 12. All of the following statements are true about the OTC market with the exception of __________________________________. a. OTC dealers buy from and sell for their own account to the public, other dealers, and commission brokers. b. The OTC has DMMs. c. The OTC markets argue that theirs is a competitive system. d. The OTC is a telecommunications network linking brokers and dealers that trade OTC stocks. Answer: b Level: difficult Section: Over the Counter Market 13. Which company sold shares in 2012 in one of the biggest IPO deals ever? a. Google b. Facebook c. Netflix d. Linked In Answer: b Level: easy Section: Innovations Among Investment Banking Firms 14. An American depository receipt (ADR) is ________________________. a. restrictions of regulations of equity markets b. general economic expansion c. deregulation of exchange rates d. liberalization of regulations of equity markets Answer: d Level: easy Section: Foreign Securities 15. The growth in the market value of foreign securities has occurred because of all of these factors except _____________________________. a. restrictions of regulations of equity markets b. general economic expansion c. deregulation of exchange rates d. liberalization of regulations of equity markets Answer: a Level: medium Section: Foreign Securities