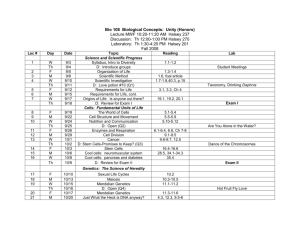

Week 2 class slides

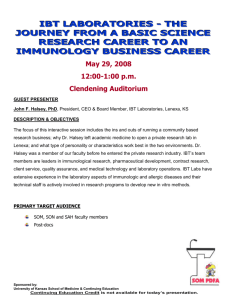

advertisement

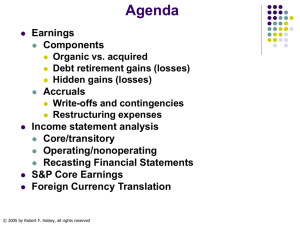

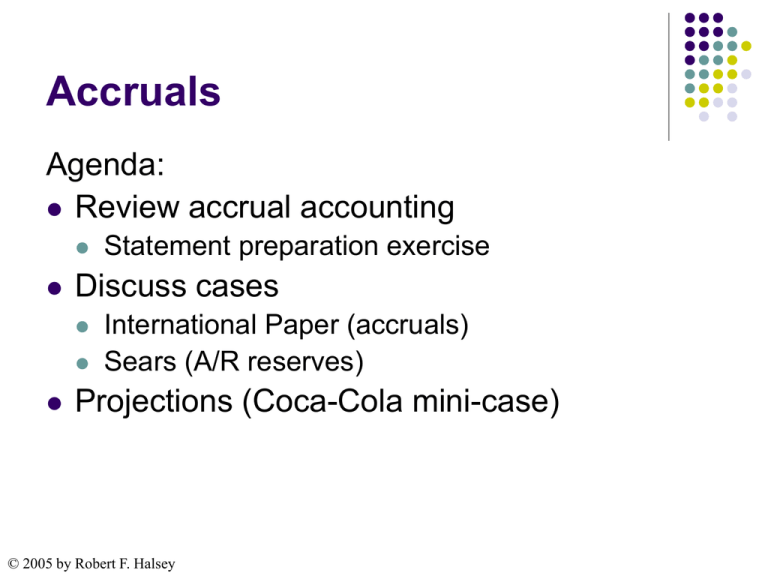

Accruals Agenda: Review accrual accounting Discuss cases Statement preparation exercise International Paper (accruals) Sears (A/R reserves) Projections (Coca-Cola mini-case) © 2005 by Robert F. Halsey Accrual Accounting Revenue recognition principle: record revenues when “realized or realizable” and “earned” “realized or realizable” means received in cash or have another asset that will generate cash (e.g., A/R) “Earned” means the transaction is complete No rights of return or other contingencies No involvement in resale © 2005 by Robert F. Halsey Accrual Accounting Matching principle: once the revenues have been recognized, match against those revenues the expenses incurred in order to generate them. Record expenses when “incurred” (not necessarily when cash is paid) Expenses should not precede nor lag revenues (why?) © 2005 by Robert F. Halsey Accrual Accounting Examples: Capitalize and depreciate fixed assets Record expenses in advance of payment (e.g., wages, severance accruals, contingent liabilities) Defer revenues until earned even though cash paid in advance (e.g., magazine subscriptions) Accrual exercises (Hennessey F/S) International Paper mini-case © 2005 by Robert F. Halsey Accrual Exercise Accrual Sales Revenue COGS Payment on Mdse Salaries Expense Utilities Exp Interest exp Net income © 2005 by Robert F. Halsey Cash Accrual Exercise ASSETS Amount LIABILITIES Cash Accounts Receivable Inventories Accounts payable Note payable Interest payable Salaries payable Utilities payable Total Liabilities Furn, Fix & Equip Accumulated Depreciation Furn, Fix & Equip (net) EQUITY Total Assets Total Liabilities and Equity © 2005 by Robert F. Halsey Contributed Capital Earned Capital amount International Paper mini-case – Q1 © 2005 by Robert F. Halsey International Paper mini-case – Q2 Components of $969 million charge © 2005 by Robert F. Halsey International Paper mini-case – Q3 Components of $824 million charge © 2005 by Robert F. Halsey International Paper mini-case – Q4 Components of $125 million charge © 2005 by Robert F. Halsey International Paper mini-case – Q5 Components of $541 million charge © 2005 by Robert F. Halsey International Paper mini-case – Q6 Components of $34 million reversal © 2005 by Robert F. Halsey International Paper mini-case – Q7 In sum, do you think these accruals provide investors with relevant information? How might a company use accruals to misrepresent its financial condition? What might you look as an analyst to analyze the appropriateness of accruals? © 2005 by Robert F. Halsey A/R Allowance for Uncollectible Accounts A/Rs are reported net of uncollectible accounts (UA) Estimate bad debts and make the following journal entry: Bad debt expense Allowance for UA xxx xxx Expense is recorded when incurred (bad debts estimated), no expense when A/R is written off Sears mini-case © 2005 by Robert F. Halsey Sears Mini-Case Describe the actions Sears took with respect to its allowance for uncollectible accounts in 1993? How did this affect earnings? What other actions occurred in that year? Why does the analyst think that Sears’ reported earnings are overstating its “true” earnings” What is the response of Sears’ CFO to these allegations? Do you believe him? How can a company use the allowance for uncollectible accounts to shift earnings from one period into another? As an outsider, what might you look at to give you a clue that the company might be managing earnings via the allowance account? © 2005 by Robert F. Halsey Accruals and Future Stock Performance “Most investors claim to pay attention to earnings quality, but recent academic research suggests otherwise. Investors often ignore valuable publicly disclosed information regarding the reliability of reported earnings and their potential improvement or deterioration, creating an opportunity to exploit the likely impact on stock performance.” Our own research has confirmed the academic findings and enhanced a stock-selection tool the academics suggested, making it more timely and broadly applicable. Just as important, our research sheds insight on the fundamentals the tool captures, making it a very useful addition to our researchreview process. The tool appears to be capturing information that our existing tool set doesn’t, and thus could be additive to the returns of our US value portfolios. (US Value Equities) © 2005 by Robert F. Halsey While some of its underlying drivers seem to have a value flavor, our research shows the tool to be style-agnostic. In a large-cap universe sorted on the basis of price to book, it is effective for both value and growth stocks (Display 2). In fact, it was somewhat more effective for stock selection within growth. (US Value Equities) © 2005 by Robert F. Halsey Essentially, we believe that balancesheet accruals speak to the persistency of reported earnings. It implies that investors take earnings reports literally and treat all sources of reported earnings as equal, although the accrual component of reported earnings is less reliable than the cash component. US Value Equities © 2005 by Robert F. Halsey Accruals and Reversion of ROA Source: Richard G. Sloan, The Accounting Review, July 1996 © 2005 by Robert F. Halsey Figure 2 Average Cumulative Excess Returns Average Cumulative Excess Return 0.1 0.05 0 -0.05 -0.1 -0.15 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 Months After Test Year Cycle Peaks Cycle Troughs Halsey, R.F. 2001. "Stationary Components of Earnings and Stock Prices," Advances in Quantitative Analysis of Finance and Accounting, vol. 9, pp 81-110. © 2005 by Robert F. Halsey CFRA Comments on Accruals Source: CFRA 2004 © 2005 by Robert F. Halsey Coca-Cola mini-case (projections) © 2005 by Robert F. Halsey