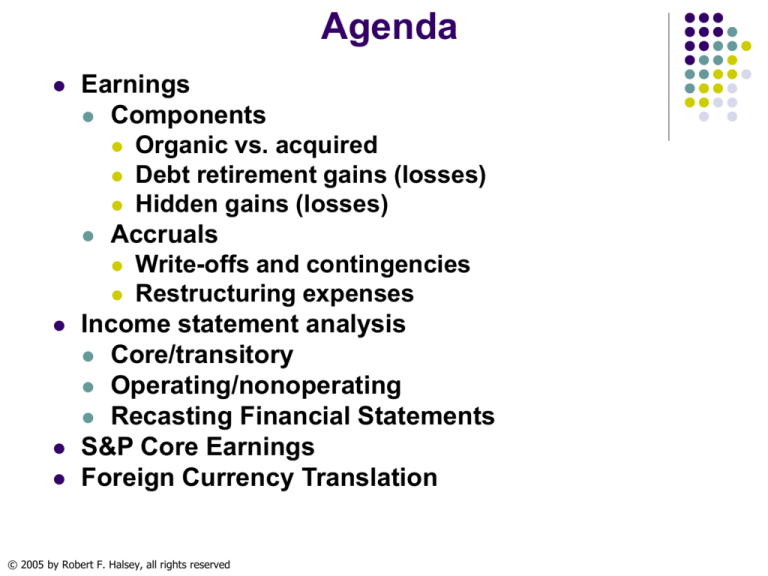

Agenda

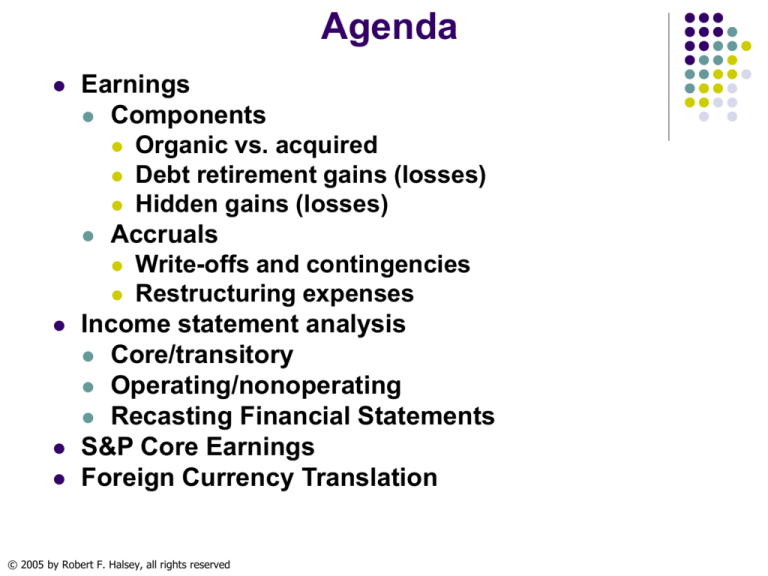

Earnings

Components

Organic vs. acquired

Debt retirement gains (losses)

Hidden gains (losses)

Accruals

Write-offs and contingencies

Restructuring expenses

Income statement analysis

Core/transitory

Operating/nonoperating

Recasting Financial Statements

S&P Core Earnings

Foreign Currency Translation

© 2005 by Robert F. Halsey, all rights reserved

Organic vs. acquired Earnings - Target

CAPEX =$2.2b

($3b x 74%) in

2003, or

approximately

$22 million

($2.2b/ 101 new

stores) per new

store. Projections

of continued

sales growth at

the 2003 level

will, therefore,

entail similar

expenditures

unless we expect

retail markets to

improve.

© 2005 by Robert F. Halsey, all rights reserved

Debt Retirement Gains (Losses)

Bond and note liabilities are carried on the balance sheet at

historical cost (original issue price plus or minus any

unamortized premium or discount).

When such debt is repurchased in the open market or

acquired via a call provision, the difference between the

purchase price and the book value of the debt is recorded

as a gain or loss in the income statement.

Classification of these gains and losses as ordinary or

extraordinary items depends on whether they meet the test

for extraordinary items of being unusual and infrequent.

Although such gains and losses on debt repurchases are

reported in income, no gain or loss occurs in an economic

sense. Thus, such gains and losses are irrelevant for

income analysis. As a result, we must adjust income to

eliminate the effect of these gains and losses as part of our

prospective analysis.

© 2005 by Robert F. Halsey, all rights reserved

Hidden Gains - IBM Mini-Case

Sale of the Global Network. In December 1998, the company announced that it

would sell its Global Network business to AT&T for $5 billion. The IBM Global

Network generated revenues of approximately $1.2 billion in 1998.

During the third quarter of 1999, the company completed the sales of its

Global Network business in 34 countries for approximately $727 million,

bringing the year-to-date total to 38 countries and $4,919 million. More than

5,100 IBM employees joined AT&T as a result of these sales.

The company recognized a pre-tax gain of $586 million on the third-quarter

sales ($366 million after tax, or $.19 per diluted common share). The net

gain reflects dispositions of Plant, rental machines and other property of

$62 million and contractual obligations of $79 million.

Selling, general and administrative expense for the third quarter and first

nine months of 1999 decreased 13.7 percent and 11.2 percent, respectively,

from the same periods in 1998. The decrease in the third quarter of 1999 was

primarily driven by the net pre-tax benefit…associated with the sale of the

Global Network…The decrease in the first nine months of 1999 reflects the net

pre-tax benefit of $2,066 million associated with the sale of the Global

Network…

© 2005 by Robert F. Halsey, all rights reserved

IBM mini-case

As reported

SG&A expense

Total revenue

3 months

ended

9/30/1999

3 months

ended

9/30/1998

9 months

ended

9/30/1999

9 months

ended

9/30/1998

3,501

4,057

10,284

11,588

21,144

20,095

63,366

56,536

SG&A-to-total revenue

16.6%

20.2%

16.2%

20.5%

Growth in total revenue

5.2%

-----

12.1%

-----

3 months

ended

9/30/1999

3 months

ended

9/30/1998

9 months

ended

9/30/1999

9 months

ended

9/30/1998

As adjusted

SG&A expense

Total revenue

SG&A-to-total revenue

© 2005 by Robert F. Halsey, all rights reserved

4,087

4,057

12,350

11,588

21,144

20,095

63,366

56,536

19.3%

20.2%

19.5%

20.5%

Write-offs and contingencies

Write-offs:

Compare undiscounted cash flows with book value of

asset

If less, write down to present value of cash flows

Loss on W/D of assets

Asset

xxx

xxx

(I/S)

(B/S)

Contingent liabilities:

Record if probable and can be estimated

Expense

Liability

xxx

Restructuring Expenses

© 2005 by Robert F. Halsey, all rights reserved

xxx

(I/S)

(B/S)

Kellogg mini-case

1.

2.

3.

4.

5.

6.

7.

How much expense did Kellogg Company report in each of the last 3

years relating to restructuring activities?

How much of this expense in each year was paid in cash?

What are the principle areas of cost encompassed under the general

term of restructuring expense?

Do you feel that the character of these expenses is the same? That

is, as a financial analyst, how do you interpret the different types of

restructuring expenses?

Should restructuring expenses be ignored in interpreting financial

results? That is, should analysts look at income before restructuring

expense?

What effect does the write-off of an asset have on current income?

On future income?

Assuming that you choose not to ignore them, does the character of

the restructuring cost suggest possible ways to treat them in your

analysis of the company’s profitability?

© 2005 by Robert F. Halsey, all rights reserved

Kellogg mini-case

© 2005 by Robert F. Halsey, all rights reserved

Kellogg

mini-case

© 2005 by Robert F. Halsey, all rights reserved

P&G Restructuring Charges

• But even as P&G excludes the restructuring charges from

what it calls its "core net earnings," it includes gains from

selling brands, sales that some analysts and investors believe

should be treated as one-time events.

• Depending on investors' views of the charges and gains, P&G

earnings are either rising or falling.

• If you back out the gain, as does Tim Drake, a senior equity

analyst at Banc One Investment Advisors, in Columbus, Ohio,

P&G's core earnings actually dropped 7%, to $1.16 billion.

"Their business isn't manufacturing brands and companies to

sell. Their business is manufacturing products to sell.“

• “You can chastise the company for the way it puts a [news]

release out, but it is still the analysts' job to put some thought

into this issue and decide what should or shouldn't be

included."

© 2005 by Robert F. Halsey, all rights reserved

Income Statement Analysis

© 2005 by Robert F. Halsey, all rights reserved

© 2005 by Robert F. Halsey, all rights reserved

Recasting – a preview

Income Statement Adjustments

1. Removing transitory items such as:

•

Gains and losses on sales of assets (long-term and investments)

•

Transitory items below income from continued operations (discontinued operations,

extraordinary items, and changes in accounting principles)

•

Restructuring expenses

•

Gains on stock issuances by subsidiaries

•

Losses on write-downs of assets (long-term and inventories)

•

Merger costs

•

LIFO liquidation gains

•

Gains and losses on debt retirement

•

Liability accruals deemed excessive

•

Gains from reductions of deferred tax valuation allowance

2. Separating operating and non-operating items

•

Treating pension service cost as operating

•

Treating pension interest costs and expected returns as non-operating

•

Treating debt retirement gains and losses as non-operating

•

Treating short-term fluctuations in tax expense as non-operating

•

Treating income from equity method investments as non-operating

•

Adding expenses not reflected in income

1. Employee stock option expense

2. Inadequate reserves for bad debts

3. Reductions of R&D, advertising, etc., to achieve short-term income targets

© 2005 by Robert F. Halsey, all rights reserved

Recasting – a preview

Balance Sheet Adjustments

•

Capitalization of operating leases

•

Consolidation of equity method investments

•

Consolidation of variable interest entities (VIEs)

•

Elimination of discontinued segments

•

Write-down of impaired goodwill

Statement of Cash Flows Adjustments

•

Recast cash inflows from asset securitization, from operating cash flows to financing

•

Eliminate operating cash flows that relate to tax benefits from exercise of employee stock

options

•

Eliminate operating cash flow gains from excessive increases in accounts payable

•

Recast operating cash flows from discontinued operations to non-operating section

© 2005 by Robert F. Halsey, all rights reserved

S&P’s Core Earnings Definition

(e.g., Operating, not Persistent)

© 2005 by Robert F. Halsey, all rights reserved

Foreign Currency Translation

Relates to translation of I/S and B/S into $US

Choice of Functional Currency dictates

translation method (Current or Temporal)

Translation method dictates whether FX

gains (losses) are run though I/S or in OCI.

© 2005 by Robert F. Halsey, all rights reserved

Translation methods

Current rate method

balance sheet items (except capital accounts) are translated

at current exchange rates.

Income statement accounts are translated at average

exchange rates. Net unrealized gains (losses) are

accumulated in other comprehensive income and do not

affect current profitability until the subsidiary is sold.

Temporal method

monetary assets (liabilities) are remeasured at current

exchange rates, non-monetary assets (liabilities) at

historical exchange rates.

Income statements are translated at average exchange

rates except for expenses relating to non-monetary assets

(COGS and depreciation, for example), which are

remeasured at historical exchange rates. Unrealized gains

(losses) affect current profitability under this method.

© 2005 by Robert F. Halsey, all rights reserved

Translation method

Current Rate*

Temporal

Cash & Investments

current

current

Accounts receivable

current

current

Inventory

current

historical

Prepaid expenses

current

historical

PP&E

current

historical

Intangibles

current

historical

Current Liabilities

current

current

Deferred income

current

historical

L-T Debt

current

current

historical

historical

derived

derived

Dividends

historical

historical

Revenues

average

average

Expenses

average

average

COGS

average

historical

Dep’n/Amortization

average

historical

Capital stock

Retained earnings

Translation adj.

Remeasurement

© 2005 by Robert F. Halsey, all rights reserved

Gain (loss) in

OCI

Gain (loss) in net income

Foreign Currency Translation Exercise

© 2005 by Robert F. Halsey, all rights reserved

© 2005 by Robert F. Halsey, all rights reserved

Current Rate Example

Assume that a company begins operations with an infusion of €1,350,000 in cash

and uses €1 million to purchase PP&E. The opening balance sheet is, therefore,

(in €)

Cash

350,000

L-T debt

550,000

PP&E

1,000,000

Equity

800,000

Total assets

1,350,000

Tot Liabs & Equity

1,350,000

At the end of the year, the company’s equity has increased to €1,300,000.

Assume that the exchange rates of the dollar and euro (€ ) are as follows:

January 1

€1.05 = $1.00

Average

€1.02 = $1.00

December 31

€0.95 = $1.00

The translation gain (loss) can be computed as follows:

Gain on beginning net assets

€800,000 x [(1/1.05 – 1/0.95)] =

80,200

Gain on increase in net assets

€500,000 x [1/1.02 – 1/0.95)] =

36,120

Total translation gain

116,320

© 2005 by Robert F. Halsey, all rights reserved

Reported in OCI,

not reported in

current income

Temporal Method Example

Assume that a company begins operations with an infusion of €1,350,000 in cash

and uses €1 million to purchase PP&E. The opening balance sheet is, therefore,

(in €)

Cash

350,000

L-T debt

550,000

PP&E

1,000,000

Equity

800,000

Total assets

1,350,000

Tot Liabs & Equity

1,350,000

The net monetary position at the beginning of the year is a net monetary liability of

€200,000 (cash of €350,000 less L-T debt of €550,000). Assume that the net

monetary position of the company at the end of the year is a net monetary liability

of €500,000 for an increase of €300,000. Assume that the exchange rates of the

dollar and euro are as follows:

January 1

€1.05 = $1.00

Average

€1.02 = $1.00

December 31

€0.95 = $1.00

The remeasurement gain (loss) can be computed as follows:

Loss on beginning net monetary liability

€200,000 x [(1/1.05 – 1/0.95)] =

$(20,050)

Reduces

Loss on increase in the liability

Current

€300,000 x [1/1.02 – 1/0.95)] =

$(21,672)

period profit

Total remeasurement loss

$(41,722)

© 2005 by Robert F. Halsey, all rights reserved