Merger Report

advertisement

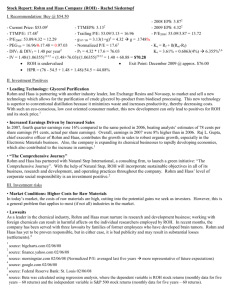

Issued to Professors DeMong and Harris DOW AND ROHM & HAAS MERGER ANALYSIS W WA AR RD DSS V VAAALLLUUUAAATTTIIIOOONNN •• W M A N O U WAAANNNGGG •• A ALLLBBBEEERRROOO •• R REEENNNDDDIIINNNAAA •• D DAAAVVVIIISSS •• SSOOOUUUM MA AN NO OU U •• February 2009 Table of Contents Section 1 Executive Summary 2 Proposed Merger Introduction 3 Industry Overview, Business Histories and Performance 4 Strategic Acquisition Analysis 5 Updated Valuation Section 1 Executive Summary After a thorough review of the initial assumptions and reasoning behind Dow’s $18.8 billion bid for Rohm & Haas, we conclude that the economics and strategy behind the acquisition are no longer sound. In light of the considerable costs of litigation, evaporation of liquidity in the credit markets, and Dow’s imminent insolvency if forced to complete the acquisition, we recommend a renegotiation to account for recent changes. We recommend Rohm & Haas implement a Pac-Man defense and leverage its superior market capitalization and inflated stock price to overtake Dow in a stock-for-stock transaction. In this analysis we discuss: 1. 2. 3. 4. The macroeconomic context of the proposed merger. A brief history of the parties, including financial performance and industry position. Strategic analyses of each firm and an updated synergy outlook for new proposal. Financial assumptions and conclusions of several financial valuation methods. Sizeable Premium No Longer Economically Viable Dow initially claimed the deal was “game-changing” and was willing to pay a 74% premium for the scarcity value of Rohm & Haas. In the time since the announcement, however, Rohm & Haas’s market capitalization has grown to exceed that of Dow’s, and the initial transaction size now exceeds the capitalizations of some of the investment banks involved in the bridge loan. While a combined Dow and Rohm & Haas would stabilize earnings, it is not viable for Dow to take all the risk of the deal through an all-cash acquisition and court-ordered completion would force Dow into bankruptcy and significantly harm both firms. Strategic Logic Is Sound, But Rohm & Haas is the Stronger Player Rohm & Haas’s performance and specialty products would offset Dow’s cyclical earnings and reliance on commodity products. The two firms have complementary geographic strengths and would gain significant economies of scale upon combining R&D, manufacturing, and distribution. Recent revelations about the quality of Dow’s governance and the capacity for innovation make Rohm & Haas a stronger candidate for successfully leading the combined firm in the future. Stock-for-Stock Transaction Accounts for Synergies and Economic Conditions The combined company’s synergies will create over $9 billion in value. This value can best be realized through a stock-for stock transaction in which Rohm & Haas offers one share of its stock for approximately every five shares of Dow. In this way no new debt need be issued, the transaction is accretive to Rohm & Haas, which will now possess a controlling stake in the combined company, and no taxes are imposed on the transaction. Section 2 Proposed Merger Introduction Dow Chemical’s intended acquisition of Rohm & Haas represented a turning point in each company’s history. The combination of specialty chemical and advanced material businesses promised to reduce cyclicality, cut costs by combining technologies, and give the combined company an ever greater global scale and scope with strong earnings growth potential. In the seven months since the announced acquisition however, company-specific and macroeconomic factors have changed dramatically. Rohm & Haas’s market capitalization now exceeds that of Dow, whereas at the time of announcement, Dow’s cap was three times higher than that of Rohm & Haas. In the meantime the market cap of the banks said to be involved in the financing has been halved and the cost of borrowing has increased as banks grow more cautious. In addition, the fallout from Dow’s failed joint venture with a Kuwaiti petrochemical company further reduced Dow’s access to funds. Dow executives claim the acquisition would lead to immediate insolvency and a bankruptcy filing. Rohm & Haas executives dismiss such claims and are suing for execution on the contracted acquisition. Despite ongoing battles, the strategic logic is sound and now, more than ever, earnings growth and reduction of cyclicality is key. We see an opportunity to solve issues of corporate governance and financing while capitalizing on both firms’ depressed P/E ratios in order to complete the acquisition. A 100% stock-for-stock transaction giving Rohm & Haas controlling ownership of the combined company is the ideal strategic and financial solution to recent economic and business developments. Rather than a Dow acquisition, the deal entails a Pac-Man defensive move by Rohm & Haas. Section 3 Industry Overview, Business Histories and Performance Rohm & Haas, a global specialty materials company with 2008 sales of $9.6 billion incorporated in Delaware in 1917. Thirty years later the Dow Chemical Company, focused on chemicals, plastics, agricultural and other products, incorporated and in 2008 reported sales of $57.5 billion. The turbulent economic climate, declining market demand, the impact of environmental shocks, and litigation expenses are hurting both companies’ bottom lines, however. At the time of announcement, Dow was set to be flush with cash from the contribution of half its basic plastics business in a joint venture. Shares were trading at $34 with a 10x P/E ratio and its $42 billion enterprise value was six times EBITDA. Rohm & Haas traded at $45 and 7.3x P/E with an enterprise value twelve times EBITDA. Each firm was profitable in different, complementary geographic and business segments (see Exhibit 1 for a detailed financial and market history). Each firm is highly ranked within the material industry for its corporate governance. Neither stresses strategic development as a Board goal, rather each Board performs a reactionary watchdog role overseeing company management. Dow ownership is primarily in the hands of large institutional investors, including AllianceBernstein and Dodge and Cox. Members of the Haas family on the other hand, control one third of Rohm & Haas shares outstanding. Another influential shareholder, Paulson & Co., is pressuring Dow to cut dividends, issue stock, and sell bonds to shore up cash for the deal. To finance the merger, Dow issued convertible preferred stock to Warren Buffett’s Berkshire Hathaway; a fixed dividend approach some analysts say puts Mr. Buffett’s interests out of line of common shareholders’. Finally, Dow intended to add two Board seats for Rohm & Haas directors after the acquisition, another choice analysts question considering the all-cash transaction in which Dow assumes all risk for the going concern. Each firm has historically made strategic acquisitions and divestitures and entered into joint ventures to enhance competitive advantage and maximize profits in the competitive chemical sector (see Exhibit 2). To increase its position in plastics and chemicals, Dow formed joint ventures with National Oil Corporation in Libya and Chevron Phillips Chemical to pool North and South American assets to build stronger regional presences, reduce costs, enhance innovation and deliver a superior service to our customers. Rohm & Haas represented an opportunity to acquire a unique industry competitor, to counteract the cyclical nature of Dow’s current business, and to better ensure income growth in the future. Dow confidently entered into a joint venture with Kuwait’s Petrochemicals Industries Company to finance the acquisition, but the Kuwait Supreme Petroleum Council put an end to the K-Dow joint venture due to economic downturn and dropping oil prices. Dow is now suing due to nonperformance on the deal, just as Rohm & Haas is suing Dow for the same reasons. Rohm & Haas is also active in acquisitions and divestitures to maintain a competitive edge. In 1998, the company sold its Plexiglas acrylic manufacturing division due to commoditization of the product and subsequently acquired Morton salt. In 2006, Rohm & Haas Electronic Materials invested in Nanophase Technology Corp. to create a global partnership for the use of new nanomaterials in chemical applications, a key source of Rohm & Haas’s current success. The success of the merger depends on several critical aspects of integration. Dow promised the acquisition would create an advanced materials firm with a rich heritage and global reach, particularly in emerging markets. Analysts worry about the integration of Rohm & Haas’s innovative culture and the implications of workforce reduction on each player, undercutting Dow’s claim of significant revenue and cost synergies. Proper integration of business units and cultures will be a critical success factor for the combined company. Section 4 Strategic Acquisition Analysis As Dow and Rohm & Haas began this journey, both companies foresaw great potential for growth, profits, and worldwide industry leadership. The CEOs of both companies stated their excitement for the synergies to be realized in the years after the acquisition. Dow CEO Andrew Liveris claimed the acquisition would help it realize its “vision of becoming the largest, most profitable and most respected chemical company in the world.” The economic reality facing the two companies today, however, contrasts starkly with the rosy picture management painted in July. The failure of the K-Dow joint venture and evaporation of liquidity in the credit market make fulfillment of the deal under the current terms a step backwards in both firms’ growth strategies. The only real value in the deal would accrue to Rohm & Haas shareholders who assume no risk in the all-cash deal and to Mr. Buffett, happily clipping 8½ % coupons on the $1 billion in convertible preferred shares issued to Berkshire Hathaway to finance the deal. At the time of announcement, analysts hailed the strategic motivations of the merger yet expressed concerns about whether the synergies could outweigh the immense premium. The risk that all revenue and cost synergies could not be achieved was a significant one, especially considering that Dow assumed all of the risk. There were anti-competitive murmurs due to the fact that the combined company would control more than 60% of the U.S. and one-third of the global acrylates capacity. The FTC approved the deal in January, though, and the regulatory hurdle was overcome. Delving further into the $800 million in annual cost synergies, Dow disclosed that it sources propylene, the top raw material expense for Rohm & Haas, far more efficiently. This purchasing leverage will be a reliable and significant source of cost synergies. Revenue synergies also looked promising, considering each firm’s different expertise and geographic focus. Opportunities for cross-selling, stabilizing revenue streams, and entering new markets more efficiently gave weight to the $2 to $2.6 billion predicted revenue synergies. Dow’s businesses include performance plastics and chemicals, agricultural sciences, basic plastics and chemicals, and hydrocarbons and energy. Rohm & Haas also boasts a diversified portfolio of industries including building and construction, electronics and devices, food, household goods, packaging and paper, pharmaceutical and healthcare, transportation, and water. Despite each business’s advantages, worldwide declines in demand yielded dismal fourth quarter results for both firms. As salt and Dow’s commodity businesses perform marginally better than the specialized electronics and agricultural businesses, the viability of transforming earnings streams from commodities to performance sectors in the near future appears unlikely. Prior to the merger announcement, the economy was just beginning to slow and the global financial meltdown was certainly not in sight. Dow management clearly lacked a crystal ball, selecting Merrill Lynch and Citi as two of three lead lenders of the bridge financing. At the time of the announcement, the deal looked lucrative to Dow. Prices for propylene were up six cents in June with massive price increases set for July. Despite rising costs, the Institute for Supply Management’s June report showed an increase in export orders. If Dow could take advantage of its purchasing power in propylene and at the same time increase production and exports, the timing of the acquisition in a softening industry appeared very attractive. Seven months later, the global economy is in its worst position since the Great Depression and every industry is impacted. In December, core durable consumer goods orders fell 2.8% from November levels, representing a contraction in the market for such important downstream goods for chemical manufacturers as computers and appliances. In addition, industrial production fell 2% and indicates further GDP and production contraction in the coming months. December railcar loadings, which represent one quarter of total chemical shipping tonnage, declined 19% from the previous year, further demonstrating declines in the sector. Regardless of economic circumstance, however, Rohm & Haas remains a “rare jewel” and a high-value piece of “beachfront property.” Upon an economic upswing, synergies should be substantial. In the meantime, Rohm & Haas’s salt business is a rare bright spot in an economic black hole and will contribute to the success of the combined company until that economic upswing occurs. While Dow’s decision-making logic in this deal seemed sound at the time, the firm’s historic motivations in strategic growth aim for competitive parity rather than competitive advantage. Cyclical sales create unpredictable revenue streams and Rohm & Haas represented an opportunity to normalize income. Dow’s historic effort to keep up with competitors and its recent downward financial spiral make it a newly attractive target for acquisition. Upon announcement, several analysts expressed concern about the emotional integration of the two firms’ cultures. Dow prides itself on a culture of execution and standardization. The reactive culture is focused on developing products and services to meet customer needs, assessing customer feedback, and taking action on that feedback to improve customer service. Rohm & Haas has a strong history of innovation and forward-looking decision-making as seen by the invention of Plexiglas and subsequent divestiture when the company correctly predicted commoditization of the product. Prompt response to market opportunities, customer needs, and changes in competition are key to this proactive culture. Integrating the two companies’ back-office operations, R&D efforts, and customer relations will harm each firm’s culture and employee morale if not executed properly. Dow’s strengths include its global presence, diversified product portfolio, and strong R&D capacity. Dow has 150 manufacturing sites in 35 countries and sells its products in over 160 countries. In these geographically diverse markets, Dow offers over 3,100 products to diverse market segments. To continue to offer the most targeted products and services to these customers, Dow employs 6,100 employees in R&D. Rohm & Haas has a strong R&D capability as well, employing over 2,000 technologists throughout the world to develop new specialty chemical products and improve existing ones. The firm’s commitment to innovation and progression has historically yielded strong revenue growth in its diversified operations and markets. Rohm & Haas’s strong revenue growth would offset a Dow weakness: declining profit margins. Declining revenues and margins in recent years have undercut investor confidence, resulting in a severely depressed stock price. Adding to this weakness, Rohm & Haas’s lawsuit against Dow, Dow’s suit following K-Dow, and other lawsuits sap company resources and distract from operational efficiency. Rohm & Haas has its weaknesses, as well. The firm lacks the scale to compete with the industry’s largest players. Additionally, Rohm & Haas is overly dependent on the North American market. The firm has diversified revenue streams and customer segments, but North American revenues account for half of total sales and could impact future stability. Alliances are a low-risk means of value-creation, and both Dow and Rohm & Haas have each entered into joint ventures when appropriate. In this case, however, an acquisition was the best strategy. The knowledge sharing in R&D and materials expertise represent reciprocal synergies best realized through an acquisition. The resources to be shared are primarily hard, including manufacturing facilities, distribution channels, and geographic networks. Such resources are best combined through acquisition and redundant resources can be best eliminated after an acquisition than in the case of an alliance. Dow’s expertise in the industry and the companies’ relatedness leaves little market uncertainty and the high competition in the chemical industry makes acquisition of the Rohm & Haas “beachfront property” the ideal growth strategy. In the months since the acquisition announcement, though, Dow lost funding from the K-Dow joint venture, its market capitalization is now smaller than the target’s, and the transaction value exceeds the total capitalization of several of the banks involved. The deal, set to close in late January, is now delayed and costs Dow $3.3 million each day. Dow’s alternatives for financing include selling assets, finding a new partner for a joint venture, or renegotiating loans. The evaporation of liquidity and economic slowdown make these options impossible to exercise in a timely fashion. Dow’s best alternative to the negotiated agreement, therefore, is to walk away and pay the $750 million termination fee, eliminating the need to shore up billions in costly new debt. Dow’s non-performance imposes a serious cost for Rohm & Haas as well. If a Delaware court forces Dow to complete the acquisition, both firms face ruin as Dow teeters on the brink of insolvency. Rohm & Haas’s greater market capitalization, higher forecasted growth rate, and stronger management reputation make a Pac-Man defense in which the firm acquires Dow in the best alternative, the financing for which is detailed in the following section. Not only will a Rohm & Haas Pac-Man defense improve the combined firm’s valuation, but it will also put the company under stronger strategic guidance. While Dow’s Corporate Governance Quotient is higher than Rohm & Haas’s, recent events put those claims of strong governance to the test. Dow’s non-performance on the agreed-upon acquisition and CEO Liveris’s alleged attempts to stall FTC approval and his refusal to include each side’s financial and legal advisors in meetings point to disappointing governance. A Dow stockholder recently sued the Board of Directors for failure “to bring rational judgment to bear” in the acquisition. Rohm & Haas recently issued a press release scolding Dow’s directors for approving a $400 million dividend and urging them to take control of the situation. Dow’s recent questionable financial, strategic, and ethical decisions show Rohm & Haas to have stronger governance and better judgment for the future. Section 5 Updated Valuation As outlined in the strategic analysis, this is no longer a case of Dow acquiring Rohm & Haas. As such, we updated the valuation of Rohm & Haas as a stand-alone entity, then valued the combined company without adjusting for synergies, and finally accounted for synergies in an updated valuation of the ideal combined company. The updated valuation of Rohm & Haas accounts for the firm’s increased stock price and therefore greater weight of equity. Analyst consensus for the 5-year growth of Rohm & Haas is 10.3% according to Yahoo! Finance. We used this value to grow revenues for a five-year period of competitive advantage. Expenses, capital expenditures, and change in net working capital were derived using the percent of sales method based on percentage of sales for these line items over the past two years (see Exhibit 3). Cost of capital of 7.84% was derived from Bloomberg data, using slightly backdated information as not to give excessive weight to the company’s vastly increased market capitalization. Free cash flows were calculated assuming a 35% tax rate and using the previously described forecast values. We calculated the terminal value using the Gordon Growth Model and assuming a perpetual growth rate of 3% due to the slightly higher-than-GDP anticipated growth in the chemical sector. The sum of the terminal value and free cash flows, discounted at the 7.84% cost of capital yielded an enterprise value of $13.47 billion. The value of net debt was found using Yahoo! Finance, and the subtraction of debt from the forecasted enterprise value yielded a $10.24 billion equity value, or $52 per share for 195.2 million shares outstanding. A sensitivity analysis, varying discount rate and perpetual growth produced a range of valuations from $9.77 to $21.63 billion of enterprise value and a range of share prices from $33.48 to $94.26 (see Exhibit 4). Due to our firm belief that Dow is a viable acquisition target in light of recent macroeconomic and company-specific developments, we deemed it necessary to value Dow as a stand-alone entity as well. This valuation also aided in the calculations of the combined company’s value and the value of synergies. Analyst consensus for Dow’s 5-year revenue growth was 7%. After growing revenues at this rate, we assessed expenses, capital expenditures, and change in net working capital based on percentages of revenue specific to Dow. These assumptions yielded the earnings before interest and taxes values shown in Dow’s discounted cash flow model (see Exhibit 5). In order to discount Dow’s free cash flows, we determined the cost of debt based on the BBB bond yield of 9.39%. Due to Dow’s high 1.22 beta, we calculated cost of equity using an equity risk premium of 3.02% based on the relatively low risk and high liquidity value of the chemical firm. In this manner, we calculated the cost of capital as 8.56% considering the 39% weight of equity, the 61% weight of debt, and the 35% tax rate. Using the same perpetual growth assumptions for terminal value as we used for Rohm & Haas, we calculated an enterprise value of $20.59 billion, yielding a $9.44 target price for the 924.4 million shares outstanding after subtracting $11.86 billion in net debt. Our sensitivity analysis offered a range of enterprise values from $15.56 to $29.78 billion and target prices of $4.01 to $19.39. In order to assess each firm’s stand-alone value in relation to industry competitors, we compiled a list of companies for each firm that operate in the same business lines and have similar structures. Using February 19 data from Yahoo! Finance, we used a ranged of EV/EBITDA multiples to create a range of valuations for Dow and Rohm & Haas. These calculations produced enterprise valuations for Rohm & Haas ranging from $7.54 to $11.63 billion and yielding share prices of $22.10 to $43.02. For Dow, enterprise values ranged from $20.61 to $28.18 billion with share prices from $9.47 to $17.65 (see Exhibit 6). In order to estimate company values in a transaction with synergies at play, we looked at several recent strategic acquisitions in the chemical industry. Using a transaction value/ EBITDA forward multiple, we triangulated a range of transaction values considering both companies as potential targets for acquisition. By multiplying either firm’s EBITDA by a range of multiple, we found transaction values, then netted out debt and divided by shares outstanding to find an implied price per share for each transaction value. These calculations indicate the value of synergies in the average strategic chemical acquisition. For Rohm & Haas, valuations ranged from $27.80 to $63.42 per share and for Dow the valuations ranged from $15.02 to $37.39 per share (see Exhibit 7). We next used discounted cash flows to value the combined company first as a sum of parts and second as a synergized whole. In our valuation of the combined firm without synergies, income statement values are simply the sum of the forecasted values for each individual firm. To discount the free cash flows of the combined firm, we calculated the cost of capital using weighted costs of debt and equity for each firm. For example, Dow’s total debt compared to the combined debt of Dow and Rohm & Haas, multiplied by Dow’s cost of debt plus Rohm &Haas’s debt compared to the total debt, multiplied Rohm & Haas’s cost of debt, derived from Bloomberg. We used the same approach to calculate the combined cost of equity. Multiplying each combined cost by the weight of total equity or after-tax debt to total enterprise value produced a blended cost of capital of 8.03%. With the same perpetual growth assumptions, the combined company’s enterprise value before synergies was $35.92 billion. Assuming a 5-for-1 stock transaction, we calculated the new shares outstanding to be $380 million. After subtracting total debt from enterprise value, this new share count generated a target price for the combined company of $58.84 (see Exhibit 8). In order to reassess the value of the transaction, we then added the value of synergies to our combined company forecast. Analysts generally accepted the validity of the synergy claims, and we therefore accepted management claims, choosing the value the revenue synergies at $2.4 billion and keeping the estimate of $800 million in annual cost synergies. We assumed that 1/3 of all synergies would be realized the first year, and 2/3 of the synergies would be realized the second year, and the full value of the synergies would be realized thereafter. Discounted back at the blended cost of capital, we value the enterprise at $45.23 billion including synergies. This represents a $9.31 billion increase in value (see Exhibit 9). In order to determine the maximum price per share any acquirer should pay for either firm, we added this synergy value to each firm’s standalone equity value and divided by shares outstanding. This calculation produced a maximum price of $100.17 for Rohm & Haas and of $19.51 for Dow. These maximum price valuations perfectly match our strategic plan for a 5-for-1 stock exchange. Such an exchange would give Rohm & Haas a controlling stake in the combined firm, eliminating issues of governance, creating a tax-free transaction, eliminating the need for new debt, and creating an accretive effect on earnings. Strategically and financially, under current industryspecific and macroeconomic conditions, a 5-for-1 stock-for-stock transaction giving Rohm & Haas control of the combined enterprise is the ideal outcome. Rohm & Haas Price Ranges 100 90 80 70 60 50 40 30 20 10 0 Dow Price Ranges 40 35 30 25 20 15 10 5 0 Discounted Cash Flow Comparable Companies Precedent Transactions Discounted Cash Flow Comparable Companies Precedent Transactions