docx

advertisement

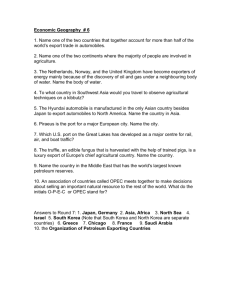

The Effects of Current Financial Crises on Trade Balances Seoul National University International Finance Seminar Team, Macroeconomics 1. The background and purpose of the study There was a sharp fall in the Dow-Jones on August 16th 2007. The Dow-Jones lost 390 points, to close at 12,845,78 point and this news was splashed in headlines across all the newspaper. This shock in the stock market was caused by the subprime mortgage loan policy that American government adopted. On early 2000's American government flooded the market with liquidity as a part of the economic stimulus policy. As the liquidity increased, a bubble economy was formed in the real estate markets. Consequently many financial agencies predicted that the prices of the real estates would keep increasing and expanded the lending, ignoring the borrowers' repayment ability and security value. One case was the subprime mortgage loan. The subprime mortgage loan is a program that the financial institutions lend it in ways which do not meet "prime" standards to an extent which puts the loans into the riskiest category of consumer loans typically sold in the secondary market. As the speculation in subprime mortgage loan increased, the liquidity increased and this caused inflation. As a result, American government raised the interest rate to prevent the prices of commodities from climbing and this policy caused the bubble economy in the real estate markets to burst. Finally the prices of real estates fell and this raised a problem that borrowers who got the loan couldn't refund the loaned money. This loss caused many American institutions to be bankrupt. On March 17th 2008, Bear Stearns Companies, Inc. was merged by JP Morgan one of the investment banks in America. One month later, Lehman Brothers Holings, Inc. was bankrupt and the Dow-Jones lost 504.48 points in that day. In succession, Merrill Lynch & Co, Inc. was merged and AIG requested a relief loan. Finally global financial institutions started to control the liquidity. This caused a global tightness of credit and stoke a blow in the object economy. The global financial crisis has started. The global financial crisis has changed many Asian countries' economy including Korea. Many Asian countries has suffered the crisis of course. However when we see the latest news, Korean trade balance is the largest ever. When we hear this news by chance, we can expect that the Korean economy is recovered. However if we research the real data about the amount of export year-on-year rate and trade balance, we can see that such recovery on trade balance is about the decrease in imports compared to exports. The global financial crisis raised the foreign exchange rate and this diminished the absolute quantity of international trade especially in imports. As a result, such surplus in trade balance is not an positive signal of economic recovery. We cannot expect this surplus to be continued. After all, if we make a decision with just formal information, we cannot analysis the trade balance correctly. In this paper, we research relationships between the global financial crisis and the Korean trade balance. In addition, we study trade conditions of other Asian countries. The reason that we expand our research for other Asian countries is that most Asian countries frame a policy which grow their economy with the expansion of exports. Consequently their net exports are given a great deal of weight on the entire economy. So because of the global financial crisis broke on 2007, we expect that their economy has been changed. Among the Asian countries we choose Korea, Japan and Taiwan because we can find some information we need. 2. Method of the study and research objects 2.1 Method of the study In this paper, we research documentary records, statistical data of each countries and analyse the date. In researching documentary records, we search thesis and papers, analysing the international trade conditions of Korea, Japan and Taiwan. In addition, we define the fundamental notions about facts which influence the trade balance such as the real GDP, real exchange rate, the terms of trade and the trade size. To find these factors we collect the statistic data from the Bank of Korea, the National Statistical office of Korea, the Bank of Japan. We find the monthly imports and exports of trade balance, the amount of semiconductor exports index, change in exchange rate, the unit cost of imports of crude oil and the amount of imports of crude oil. 3. Four factors which affect on trade balance. 3.1. Real GDP Real GDPis gross domestic product in constant dollars. Different from nominal GDP, this inflation-adjusted measure represents the price of the goods and services in a given year. And is expressed in base-year prices(Mankiw, 2009). 1 Because nominal GDP is in current dollars, real GDP can account for changes in the price level, and provide a more accurate figure.. suppose in year 1 a country produced a total of five widgets priced at $10 each, or $50 total. In year 2, it produced the same five widgets, but the price rose to $12, or $60 total. Assume year 1 1 Korea’s present based-year is 2000. is the base year used to calculate real GDP. In year 1, nominal GDP was $50 and real GDP was also $50. In year 2, nominal GDP was $60; but real GDP was only $50, because in constant (year one) dollars, only $50 in widgets were produced. By eliminating the effect of price changes, real GDP allows economists to make useful comparisons of a nation's output and services. Note that real GDP is also known as constant-price GDP and inflation-corrected GDP. Since real GDP includes not only domestic demand but net export as well, the figure is related to the trade balance 3.2. Real exchange rate Exchange rate stands for between two currencies specifies how much one currency is worth in terms of the other. It is the value of a foreign nation’s currency in terms of the home nation’s currency (In-June Kim, 2008)., If it is reflectied real purchasing power, real exchange rate. Under Marshall - Lerner condition, for a currency devaluation to have a positive impact in trade balance, the sum of price elasticity of exports and imports must be greater than 1. The principle is named after economists Alfred Marshall and Abba Lerner. As a devaluation of the exchange rate means a reduction on price of exports, quantity demanded for these will increase. At the same time, price of imports will rise and their quantity demanded will diminish.2 Rose(1991) proved that in five conutires of OECD, Marshall - Lerner condition was discrepant in short term in his study. However, Bahmani-Oskooee and Niroomand(1998) certified that most nations are corresponding with Marshall-Lerner condition through long-Run price elasticities and the Marshall-Lerner Condition Revision. 3.3. The terms of trade The terms of trade stands for the relative prices of a country's export to import. It also means the exchange rate between export and import of a nation. Normally, an improvement in a nation’s terms of trade is good for that country in the sense that is has to pay less for the products it imports. . The terms of trade fluctuate in line with changes in export and import prices. Clearly the exchange rate and the rate of inflation can both influence the direction of any change in the terms of trade. The terms of trade is normall7y a single number that represents the ratio of the relative prices. While, the income terms of trade is the ratio of the value of exports to the price of imports. 3.4. Trade size Trade size is calculated by the sum of the valuce of export and import. Meanwhile, trade balance is expressed by the valuce of export minus import. The bigger the trade size is, the more the conutry is dependant on trade. Therefore, trade size is one of the main factors. 4. Trade Structures of Korea, Japan and Taiwan 4.1. Trade structure of Korea (1) General situation Big growth of China is becoming a largest factor to cause a change to trade relation of threenation (KOREA, China, Japan). In accordance with industrialization of China, export contention of three-nation in world trade market has been deepened and interdependence relation on trade between three nations has been enlarged. From the viewpoint of trade structure of KOREA, trade relation of three-nation is most important conditions of economic growth in foreign side by reason of that China has been maximum export market to KOREA and that Japan has been maximum income nation to KOREA. KOREA is partly regaining trade deficit with Japan in trade surplus with China at present, but can encounter to the situation that a survival is threatened by according to changes related trade next so far. Therefore, according to transition comparative structural change of three-nation, KOREA's industrial structure may change the trend of other countries as appropriate for differentiation strategy and policy for industrial cooperation between three-nation. The most recent, opposite-sandwich theory is emerging and crisis is really great. The opposite-sandwich theory means that companies in Korea than in Japan has the advantage in price competitiveness, as China has significantly improved the quality advantage. (2) Export structure The prominent features in the trend of change of trade structure of the three-nation is a great syncronisation phenomenon. Enhanced China's industrial structure, China's export item structure is similar to South Korea and Japan. Electricity and electronics, machinery exports for 2005 based on the concentration to 41.9% in Korea. Of 2005, top of Korea's list of ten export items is the same that China’s first and second item as electricity and electronics and machinery. However, in less than third items, KOREA is a higher dependence on exports items which cars, the middle of materials and in case of China, does light industry goods. This shows that KOREA keep still up the differentiation in China at automobile, ship class, petrochemical, steel and capital-intensive industries. In addition, KOREA and Japan are similar to the configuration of the export items. However, differences still exist in the configuration items because of appreciable qualitative difference on the industrial structures of three-country. Classifying characteristics according to such structural differences, KOREA where industrial and large-device industry has comparative advantage than in China. In particular, enhanced export item structure in KOREA by cars, machinery, electrical and electronic, increased imports of core component and material with Japan. As a result, trade item structure has shown dependent on the vertical in trade with Japan. Korea's major export basket is durable consumer goods, exports of consumer-goods are fragile to the recession. (3) Recent changes in export structure The decreasing weight of light industry that is led export and the rising IT products (semiconductors, wireless communication devices, computer), automobile and ship as main items of KOREA’s exports on 2000, the proportion of heavy chemical products are gradually increasing. As the five main items in the percentage of KOREA's total exports in 2000, 41.4 percent in 2003, 42.9%, 44.1% in 2004 increased, situation that these items are deeply dependent on exports have shown. On 2005 and 2006 in a shrinking world economy, slowing slightly the exports of IT products and weight exports to 41.8%, respectively, 42% declined but still has a high percentage. These changes in the structure of exports are caused by what companies to expand investment in such industries and converting export industries into the heavy chemical industry and capital-intensive product since 1970. Also important thing is increasing the export dependence on China. KOREA's major trading partner the United States and Japan in the early 1990s was concentrated in. KOREA's exports weight to the United States for up to 30% of the total recorded in the early 1990s and in the late 1990s, continued growth of the IT sector in the country, accounting for more than 20% of exports were. However, since 2000, as China's economy greatly increased, KOREA’s exports weight with China began to increase. These situations are caused by that China's economy has been expanded by the opening and reform policy in 1990 because China's economy has been expanded, and as China's high economic growth increased, the demand for KOREA’s products increase. Since 2000, an upward tendency of the KOREA's exports weight with China rise more and faster and in 2003, China accounted for 18.1% of KOREA’s exports weight to the United States (17.7%) for the first time. As a result, China beating United States has emerged as the largest export market at KOREA. (4) Import Structure KOREA compared to Japan, relatively weak based on the production of parts, materials and the production-based of capital goods industries and does based on electric and electronic, machinery and materials. So, import weight of electricity, electronics, machinery and other things are very high. Specially, the electrical and electronic exports, higher imports of both countries but case of import, KOREA compared to Japan, has a relatively higher proportion of reported. This phenomenon is caused by what KOREA’s growth has been biased in certain areas such as memory chip, but Japan has been chosen the growth in the core parts and finished products. In items that except electrical and electronic products and machinery from KOREA, midterm product such as steel, organic chemicals, synthetic resins and high precision equipment for the increment of total imports weight in spite of growth in the mean time, we could think that the production structure in the field of high value-added products and core midterm product is insufficient. (5) Changes in the structure of trade KOREA imported machinery, necessary parts for export and core materials from Japan. On the other hand, KOREA exported consumer goods and material components from Japan. As a result, KOREA's trade balance with Japan in 2005 represents a deficit of 240 hundred million dollars. Surplus of 42 hundred dollars in consumer goods and representatively deficit of 87 hundred dollars, 195 hundred dollars in raw materials and capital goods are represented. According to the last few years, the trend of trade balance showed that after this cancellation of diversification of line of import, importing durable consumer goods from Japan gradually increase and surplus scale with Japan gradually decrease, but deficit scale of capital goods with Japan showed severe fluctuation depending on economy. KOREA’s trade balance with China is that KOREA supply China with midterm material required mainly the export industry and the transplant and supply capital goods, but showed a form of importing goods for import. As a result, KOREA’s trade balance with China in 2005 is a surplus of 230 hundred million dollars. This showed a surplus of 177 hundred million dollars, 89 hundred million dollars, respectively in raw materials and capital goods and showed a deficit of 36 hundred million dollars in consumer goods. 4.2. Trade structure of Japan (1) Recent situation Through multiple indicators of three-nation’s export competition showed that competition between Korea and Japan is the most severe, while the relatively weak relationship between China and Japan. However, during the period between 1998 and 2005, competition between China and Japan is much deeper than a competitive relationship between Korea and Japan. Korea is much higher than in Japan at exports to South Korea's dependency on China. And China is a relatively high dependence on exports at export dependency the Japanese market. Meanwhile, Japan's export dependence on China and South Korea market has a similar level. (2) Changes in export structure Based on Japan’s configuration of the 10 export items in 2005 showed the automobile, electronic, machinery, precision equipment, steel, organic chemicals, synthetic resin, ship, rubber products. Japan had the highest concentration of 40.6% in electrical and electronic machinery that are very high weight for three-nation’s export proportion. Japan's proportion of configuration of three export items was not changing around the 20-22% level. That showed that proportion of Japan’s export item’s configuration were very stable. Japan's trade relations with China was not enough relatively trade relations with Korea, because China’s industrial structure was not yet grown up. As a result, trade relationship with Japan didn’t show that vertical to be a dependent relationship. Based on Chinese trade statistics based on it. (3) Changes in import structure East Asian countries’ the import structure was arranged to reflect discrimination in the development of the structure of the world, but the trend since 2003, it consists of Japan's configuration of imported items showed significant change. Of 2005, Japan’s imported 10 items are petroleum, electricity and electronics, machinery, precision machinery, metals minerals, cars, fish, organic chemical products, textiles, clothing, wood. (4) Changes in the structure of trade Japan imported consumer goods, parts, materials and equipment from South Korea and exported general machinery, core parts for export to South Korea. As a result, Japan's trade surplus in 2005 reached 24 billion dollars. Japan exported capital goods and midterm material needed for industrialization, export industry to China and imported low-cost consumer goods from China. Of 2005 in Japan's trade with China represents a surplus of 16 billion dollars and showing a surplus of 21 billion dollars of capital goods and 11.7 billion dollars of raw materials, but showing a deficit of 16.7 billion dollars of consumer goods. Due to the characteristics of three-nation’s the export and import structure, Korea's trade deficit with Japan, Japan's trade deficit with China and China’s trade deficit with South Korea could be formed stable relationship when three-nation’s trade balance regard as the trade balance in the relationship. 4.3. Taiwan's trade structure (1) Export structure for several decade taiwan's foreign trade has been rapidly grown, and exports structure also has been changed. in 1950's taiwan's most notable exports are agricultural goods and processed agricultural goods. but later percentage of agricultural goods is more and more low and percentage of industrial products is more and more high. following data show change of taiwan's exports structure. agricultural goods 1952 1981 2001 22.1% 2.6% 0.2% 69.8% 4.6% 1.4% 8.1% 92% 98.4% processed agricultural goods industrial products and also we can know that taiwan's level of industrialization is very high. in the early days of taiwan's economic growth, taiwan's major exports are agricultural goods. in 1970's as labor intensive industries grew, textile products and footwear became taiwan's major exports. as economy grew, in 1980's taiwan experienced shortage of labor, in consequence cost of labor more and more high. finally cost of production became too high, taiwan lose comparative advantage of labor intensive industries. moreover other developing countries, like china and south-east asia countries, became strong competitors. instead taiwan's capitaltechnology intensive industries more and more grew, so percentage of the heavy chemical industry in export became higher. 1952 1981 2001 32.2% 52% 71.4% heavy chemical industry during this period computer, electronic equipment, plastic product and metalware became major exports. especially computer was the best. this changes are generated by taiwan government's efforts to make industrial structure more advanced and high-added value. so recently taiwan's major exports became semiconductor, computer and infocomindustry product. (2) export market structure because united states is the center of the world economy, almost all countries are related to united states as major trade partner and major export market. taiwan is not exception. but taiwan's dependence to united states is comparatively higher than many other countries. following is percentage of taiwan's export dependence to united states 1965 1985 2000's 21.3% 48.1% over 20% percentage of taiwan's export dependence to united states from 1985 to 1989, taiwan's annual trade surplus to united states over 10billion dollars. finally two countries experienced trade friction. taiwan government tried to solve the problem, but it had a limitation. the reason for this situation, united states market is the most large market in the world and this market had little trade barrier. and in the early days of taiwan's economic growth, taiwan gain GSP(Generalized System of Preference) from united states but not europe. because two countries had special political relationship. but taiwan has had huge deficit to japan. the reason for this is similar to that of south korea. taiwan is also import many industrial parts from japan. moreover japan's domestic distribution structure is very complicated and japan has had protective trade aspects. in the taiwan's foreign trade, other important issue is about china. because of political relationship, taiwan and china weren't direct trade but indirect trade via hongkong. but after 1990's, as relation between two country became friendly, mutual trade grew rapidly. and now china is taiwan's very important trade partner. and entry to WTO in 2002 was very crucial opportunity to taiwan's foreign trade and economy. 5. Effect on Trade balance of Korea by Global financial crisis (1) Decreased export owing to global recession The biggest factor on Korea's trade balance is global recession during global financial crisis. Global recession is very extreme so that many nations considered going back to protectionism. So, this phenomenon were reflected in decreasing of Korea's export instantly. As you can see from the graph, export of Korea decreased rapidly after September, 2008. Futhermore, at January, 2009 export quantity index recorded 98.5, it means that quantity of export in 2008 was less thant that in 2005. Korea export quantity index had been more volatile during financial crisis compared other nations, because of Korea trade structure which focuses on some advanced countries and volatility of semi conductor sales which occupies big part of Korea trade. According to a survey, Korea's export changes 3.6% as foreign GDP changes1%. This value is relatively high among OECD nations. And, the rate of dependence on exports of Korea(Exports/GDP) have increased from 28.2% in 2002 to 45.4% in 2008. These are relatively high compared with Japan(16.2%) and China(33.8%). High dependence on global economy brings about more difficulties than other nations when global recession outbreaks. (2) Jump of exchange rate In case of Korea, trade balance during global financial crisis seemed positive because there was a trade surplus in 2008. The biggest contributor was exchange rate. Yen was strong because of weakness of dollar but won is more weaker than dollar because of korea's particular financial market. And Yen and Yuan was upvalued than dollar by 15~20%, Korea exchange rate went more upward. In this situation, the inequality of Yen>Dollar>Won was established, Won-Dollar rate closed out at its highest level, average 1400\/$. High Won Dollar rate gave rise to positive effects on Korea exports market and negative effects on imports market, so in spite of global recession owing to global financial crisis, Korea trade balace can make a trade surplus. Exports and imports between Korea and Japan increasing Nation Month Exports increasing Imports rate balance rate Korea 10 37,111,140 7.8 36,098,774 10.3 1,012,365 11 28,841,617 -19.5 28,853,646 -15 -12,029 12 27,117,889 -17.9 26,575,580 -21.6 542,309 10 6,923,801,591 -7.8 6,990,933,836 7.4 -67,132,245 - 일본 11 5,325,361,947 -26.7 5,550,341,254 -14.4 224,979,307 - 12 4,831,923,835 -35 5,154,217,253 -21.5 322,293,418 (3) Decreasing of Oil price In addition to effect of exchange rate, oil prices had an effect on Korea trade balance. The weight of oil imports on total imports is about 20%. It is relatively high weight compared with other nations. Under this situation, decreased oil price during global crisis was so large, export price index of oil decresed by 100%. So, though there was no change in export quantity index of oil, a drop of oil price made imports of Korea small. In addition to a drop of oil price, there was a fall in prices of iron, copper and so on. So Korea which are highly dependent on price of resources can make more profit when price of resources goes down. 6. Conclusion 글 Global financial crisis made a huge effect on Korea's trade balance. First, global financial crisis caused the recession of object economy and this recession caused decreasing of Korea's exports. Second, high exchange rate had a positive effect on Korea's exports and negative one on imports. So, in spite of the recession of world economy, Korea's trade balance turned to surplus. Third, resource price like oil, iron, copper dropped during the crisis. This led Korea's imports price down and made Korea's trade balance positive. All this factors made a turning point of Korea's trade balance in various ways. But this change from deficit to surplus was not due to fundamental change of korea trade infrastructure. So this surplus will not be continued for a long time and it may be just phenomenon caused by global financial crisis. It can be proved if you check the terms of trade of Korea during that time. So, a trade surplus is not a sign of recovery of Korea economy.