IInd_sessional_paper_oc_cost_MGT_A

advertisement

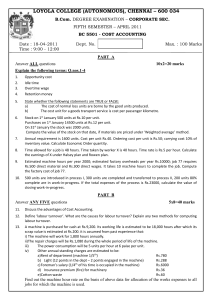

Nagar Yuvak Shikshan Sanstha’s DATTA MEGHE INSTITUTE OF MANAGEMENT STUDIES MBA-I SEM-II SESSIONAL EXAM (2013) SUBJECT NAME Time: 3 Hrs. Marks: 70 Instructions: (a) Each short answer question carries 2 marks. (b) Attempt any 5 questions from Q2. to Q11. Each Question carries 10 marks. Q1. Write short answer (Thirty Words). Attempt any 10. a) Write in brief meaning and scope of Cost Accountancy. b) Write in brief the various contents of cost sheet? c) What are the various reasons for differences in the results shown by Cost Accounts and Financial Accounts? d) What is work certified in contract costing and how it is computed? e) What are the various types of Profitability Ratios? f) What is Marginal Cost Equation? g) From the following compute cost of materials consumed: Prime Cost Rs. 4,77,000, Direct Labour Cost Rs. 2,90,000, Direct Expenses Rs. 7,000. h) Contract Price Rs. 8,00,000, Current Cost incurred to date Rs. 4,00,000, Cash Received 80%. Calculate the amount of profit to be credited to Profit & Loss A/C by considering the given inromatin: Value of Work Certified Rs. 2,00,000, Cost of work uncertified Rs. 2,60,000. i) X Ltd. has a current ratio of 3:1. Its net working capital is Rs. 2,00,000 and its inventory is Rs. 2,20,000. Calculate liquid assets. j) Selling price per unit Rs.10, Variable Cost per unit Rs. 6, Fixed Costs Rs. 2,000, Actual Sales Rs. 20,000. Fixed Costs include Depreciation Rs. 300. Deferred Revenue Expenditure w/o Rs. 100. Calculate B.E.P (in units), B.E.P. (in value). k) X Ltd. provides you the following information: Particulars Budgeted Expenses March (Rs). 30,000 April (Rs). 50,000 May (Rs). 70,000 June (Rs). 90,000 Budgeted Expenses include depreciation amounting to Rs. 10,000. Calculate the amount of expenses paid in the month o f April, May & June if the time lag in payment is 1/3 month. l) Calculate the value of work certified in the following case: Cash received Rs. 4,80,000 being 80% of Work Certified. m) Calculate the Debtors Turnover Ratio and Average Debt Collection Period for the year 2011-2012 from the following information Sundry Debtors Bills Receivables Provision for Doubtful Debts 1.4.2011 Rs. 15,000 Rs. 5,000 Rs. 1,500 Total Sales Rs. 2,10,000, Sales Returns Rs. 10,000. Cash Sales Rs. 40,000. 31.3.2012 Rs. 45,000 Rs. 15,000 Rs. 4,500 n) Calculate sales in the following cases: Cost of sales Rs. 1,20,000, Profit = 20% on sales. o) Selling price per unit Rs. 10, Variable cost per unit Rs. 4, Fixed Cost Rs. 35,000. Calculate B.P.E if Variable cost is decreased by 25%. Q2. The following is the Trading & Profit & Loss A/c of Vikas Electronics for the year ended on 31st Dec 2015. Dr. Particulars To Material To Wages To Work Expenses To Administrative Expenses To Goodwill w/o To Discount on Debentures w/o To Net profit Cr. Rs. 12,000 4,000 12,000 12,000 4,000 3,000 28,000 75,000 Particulars By Sales (350 Units) By Finished stock (50 units) By Interest received Rs. 70,000 3,500 1,500 75,000 The company’s cost records show that: i) Works overhead have been recovered at 100% on prime cost ii) Administrative overheads have been recovered at 25% of factory cost Prepare: i) A statement of cost indicating net profit; and ii) A statement reconciling the profit as disclosed by cost accounts and that shown in financial accounts. Q3. . From the following information, prepare a statement showing the cost and profit; a. b. c. d. e. f. g. h. Cost of material @ Rs. 13 per unit. Labour cost @ Rs. 7.50 per unit. Factory overheads are absorbed @ 60% of labour cost. Administration overheads are absorbed @ 20% of factory cost. Selling Overheads are charged @ Rs. 2.50 per unit sold. Opening stock of finished goods- 500 units @ 19.75 Closing stock of finished goods -250 units Sales-10250 units at profit of 20% on sales. Q4. Mr. X. Undertook a Contract No. 501 for Rs. 5,00,000 on 1st July 2011. On 31st March 2012 when the accounts were closed, the following information was available. Materials issued to site Rs. 55,000 Direct expenses paid Rs. 6,000 Site office Cost Rs. 10,000 Plant Rs. 2,00,000 Direct Expenses Prepaid at the end Rs.1,000 Cost of Work Uncertified Rs 20,000 Wages Paid Rs. 18,000 General overheads 25% of Wages Cost of Sub-contracts Rs. 15,000 Wages accrued at the end Rs. 2,000 Materials at site at the end Rs. 5,000 Cash received Rs. 2,00,000 being 80% of work certified. The plant was installed on the respective date of the contract and depreciation to be provided at 10% p.a. Prepare Contract Account, Contractee’s A/c and show the relevant items relating to contract in the Contractor’s Balance Sheet. Q5. 1. Prepare Cash Budget of X Ltd. for April to June 2012 from the following information. a. Estimated Sales, Purchases & Expenses are as follows: Particulars Jan Rs. Feb Rs. Mar Rs. Apr Rs. May Rs. June Rs. Sales 2,00,000 4,00,000 6,00,000 8,00,000 10,00,000 12,00,000 Purchases 1,52,000 3,06,000 4,60,000 6,08,000 7,56,000 9,04,000 Wages 24,000 30,000 36,000 48,000 60,000 72,000 Adm. Exp 30,000 40,000 50,000 60,000 70,000 80,000 Selling & 30,000 50,000 70,000 90,000 1,10,000 1,00,000 Dist Exp b. Cash Sales are 20% of total sales. c. 50% of credit sales are collected within one month and the balance in two months. d. Cash purchases are 25% of total purchases. e. 50% of credit purchases are paid within one month and the balance in two months. f. No stock remains at the end of a month. g. Commission on sales 10%. h. The time lag in the payment of wages is one third of the month and that of Adm. Expenses one month. i. Administrative expenses for each month include depreciation amounting to Rs. 10,000. j. 12% Rs. 2,00,000 Debentures of Rs. 100 each were issued on 1st Jan ( Half yearly interest due on 30th June and 31st Dec). k. Cash balance at the end of March Rs. 4,00,000. l. 36,000 Equity Shares of Rs. 10 each were issued on 1st May at 5% premium. Q6. From the following information prepare the Balance sheet: • Net profit after Interest, Tax & Preference Dividend Rs. 2,22,000 • Tax Rate: 50%, • 18% Preference Share Capital? • 15% Debentures?, • Return on Capital Employed 50% • Return on Shareholder’s Funds 60% • Return on Equity Shareholder’s fund 74% • Current Ratio 2:1 • Net Fixed Assets Rs. 9,00,000. Q7. Calculate Margin of Safety in each of the following alternative cases: a. Profit Rs. 2,400 Contribution per unit Rs. 6 B. Break even sales 1600 units, Actual sales 2000 units C. Profit Rs. 2,400, P/V Ratio 60% D. Break-Even Sales 30%, Actual Sales Rs. 20,000 E. Profit Rs. 4,800, Total Contribution Rs. 19,200 Q8. What do you mean by the term budgetary control? What are the various objectives of budgetary control system. Q9. Write in detail the advantages and limitations of Cost Accountancy. Q10. What do you mean by the term cost? Explain the various types of costs. Q11. What do you mean by Operating Costing? Explain in brief about transport costing, hotel costing, canteen costing and hospital costing.