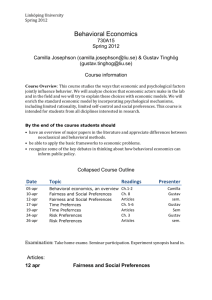

Feb 16, 2016: Introduction to Expected Utility

advertisement

Behavioral Finance

Economics 437

Behavioral Finance

Preferences Part I

Feb 16

Choices When Alternatives are

Uncertain

Lotteries

Choices Among Lotteries

Maximize Expected Value

Maximize Expected Utility

Allais Paradox

Behavioral Finance

Preferences Part I

Feb 16

What happens with uncertainty

Suppose you know all the relevant

probabilities

Which do you prefer?

50 % chance of $ 100 or 50 % chance of $

200

25 % chance of $ 800 or 75 % chance of zero

Behavioral Finance

Preferences Part I

Feb 16

Lotteries

A lottery has two things:

A set of (dollar) outcomes: X1, X2, X3,…..XN

A set of probabilities: p1, p2, p3,…..pN

Behavioral Finance

X1 with p1

X2 with p2

Etc.

p’s are all positive and sum to one (that’s required

for the p’s to be probabilities)

Preferences Part I

Feb 16

For any lottery

We can define “expected value”

p1X1 + p2X2 + p3X3 +……..pNXN

But “Bernoulli paradox” is a big, big weakness

of using expected value to order lotteries

So, how do we order lotteries?

Behavioral Finance

Preferences Part I

Feb 16

“Reasonableness”

Four “reasonable” axioms:

Completeness: for every A and B either A ≥ B or B ≥ A (≥ means “at

least as good as”

Transitivity: for every A, B,C with A ≥ B and

Independence: let t be a number between 0 and 1; if A ≥ B, then for

any C,:

t A + (1- t) C ≥ t B + (1- t) C

B ≥ C then A ≥ C

Continuity: for any A,B,C where A ≥ B ≥ C: there is some p between

0 and 1 such that:

B ≥ p A + (1 – p) C

Behavioral Finance

Preferences Part I

Feb 16

Conclusion

If those four axioms are satisfied, there is a

utility function that will order “lotteries”

Known as “Expected Utility”

Behavioral Finance

Preferences Part I

Feb 16

For any two lotteries, calculate

Expected Utility

p U(X) + (1 – p) U(Y)

q U(S) + (1 – q) U(T)

U(X) is the utility of X when X is known for

certain; similar with U(Y), U(S), U(T)

Behavioral Finance

Preferences Part I

Feb 16

Allais Paradox

Choice of lotteries

Lottery A: sure $ 1 million

Or, Lottery B:

89 % chance of $ 1 million

1 % chance of zero

10 % chance of $ 5 million

Which would you prefer? A or B

Behavioral Finance

Preferences Part I

Feb 16

Now, try this:

Choice of lotteries

Lottery C

Or, Lottery D:

89 % chance of zero

11 % chance of $ 1 million

90 % chance of zero

10 % chance of $ 5 million

Which would you prefer? C or D

Behavioral Finance

Preferences Part I

Feb 16

Back to A and B

Choice of lotteries

Lottery A: sure $ 1 million

Or, Lottery B:

89 % chance of $ 1 million

1 % chance of zero

10 % chance of $ 5 million

If you prefer B to A, then

Behavioral Finance

.89 (U ($ 1M)) + .10 (U($ 5M)) > U($ 1 M)

Or

.10 *U($ 5M) > .11*U($ 1 M)

Preferences Part I

Feb 16

And for C and D

Choice of lotteries

Lottery C

89 % chance of zero

11 % chance of $ 1 million

Or, Lottery D:

90 % chance of zero

10 % chance of $ 5 million

If you prefer C to D:

Then .10*U($ 5 M) < .11*U($ 1M)

Behavioral Finance

Preferences Part I

Feb 16

So, if you prefer

B to A and C to D

It must be the case that:

.10 *U($ 5M) > .11*U($ 1 M)

And

.10*U($ 5 M) < .11*U($ 1M)

Behavioral Finance

Preferences Part I

Feb 16

Oops

Choose Between:

A: A sure gain of $ 240

B: 25 % gain of $ 1,000 and 75 % chance to gain nothing

Choose Between:

C: A sure loss of $ 750

D: 75 % chance to lose $ 1,000 and 25 % chance to lose nothing

If you chose A & D:

25 % gain of $ 240 and 75 % chance to lose $ 760

{B & C} dominates {A & D}

25 % gain of $ 250 and 75 % chance to lose $ 760

Behavioral Finance

Preferences Part I

Feb 16

The End

Behavioral Finance

Preferences Part I

Feb 16