ACCT 350 - NFP & Gov*t Accounting

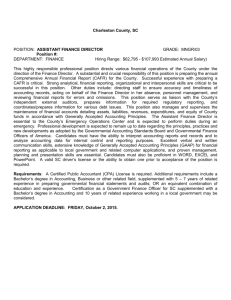

advertisement

ACCT 350 - NFP & Gov’t Accounting City Financial Statement Project The purpose of this assignment is to review the financial statements of a city government and understand the fiscal policies and sources/uses of funds. This assignment consists of two parts, a written report and a class presentation. (1) For the written report, each student on your team will select a different city and individually complete the “Written Report Questions” below. The written part, worth 80 points (equivalent to four regular assignments), is due no later than mid-night on May 10. (2) For the presentation report on May 13, your team will compare the financial health of the selected cities by ranking them from most to least healthy. Teams are the same as those assigned for class quizzes. Presentations are scheduled for Tuesday, May 8, and will be done in the order of your team numbers (Team #1 starts first, etc.). The presentation is worth 40 points (equivalent to two regular assignments). There is no prescribed format, except that each team member should contribute, and the presentation should not exceed 12 minutes. Your goal is to rank the financial health of your cities and defend your conclusions to the rest of the class with rationale, including facts and figures. Factors you should consider in your analysis are listed in Appendix A of this document. Selecting a City/Obtaining the CAFR: The city you select cannot be Seattle, Walla Walla, College Place, MiltonFreewater or Pendleton. It should have a population of at least 100,000, preferably even bigger. The larger the city, the easier this assignment will be. Obviously, the city should be in the U.S. Obtaining the CAFR: You will need to obtain the Comprehensive Annual Financial Report (CAFR) for the city of your choice. Nearly all cities publish their CAFRs on their websites (e.g. you’ll find it by searching the city name plus CAFR, e.g. “City of Portland CAFR”). The CAFR should be for the most recent fiscal period available. Make sure to acquire the CAFR, not the general-purpose financial statements, summary financial statements, or budget. Written Report The information needed to complete this assignment should be found in the CAFR, although you may have to search diligently for it. In some cases, you may not be able to find the information no matter how hard you look. If such is the case, you should explain that the CAFR did not contain the information and go on to the next question. But make sure you look carefully, because your instructor has an uncanny ability to find information that you didn’t think was there. 1. 2. 3. 4. Tell about your city. The introduction and the Statistical Section in the back of the CAFR usually have tidbits of interesting info. At a minimum, you should answer the following questions: (A) Have you been to this city? If so, what did you think of it? (B) What are some unique things about this city (e.g. attractions, tourist or historical sites, etc.)? (C) What is the latest population and what is its population growth rate over the last year? (D) When was it incorporated? (E) How many employees does it have and in what capacity (brief description of their function – firemen, etc.)? (F) What is the square mileage? (G) Who are the major employers? (H) What is the total assessed value of all taxable property in the city? In the Introductory Section, there should be a Letter of Transmittal (sometimes called Letter to Mayor or Budget Letter). Summarize in bullet form the main issues discussed in the letter. In the Introductory Section, there might be a Certificate of Achievement for Excellence in Financial Reporting. This is an award given by the Government Finance Officers Association for annual reports that are well done and conform to all of the standards. Did your city receive such an award? If so, for what year(s)? In the Introductory Section, there should be a list of principal officials and an organizational chart. From this and other information, answer the following questions: (A) How many city council members are there? Does it appear that the city council adequately has different racial and gender representation? (B) Are there both a city manager and a mayor? If so, is the mayor on a full-time salary? (C) Which individuals/functions/departments report directly to the mayor or city manager? 1 5. 6. 7. In the Financial Section, locate the auditor’s report. (A) Who were the city’s auditors? Were they CPAs? (B) Did the auditors feel that the financial statements were fairly stated? (C) When was the audit report dated? (D) How long after fiscal year-end did it take them to finish the audit? In the Financial Section, find the Management Discussion and Analysis. In bullet form, summarize the major points addressed. How does management see the current financial position and future prospects of the city? In the Financial Section, find the Gov’t-Wide Financial Statements. Use the tables, charting and graphing tools of a spreadsheet to complete the following steps. A. Prepare a summary dollar and common-size balance sheet (items are shown as percent of total assets), similar to the following. Note that you might have to use your judgment in order to divide current from non-current assets and liabilities. Comment on how the composition of the Governmental Activities compares to Business-Type Activities. Governmental Activities $ Percent Current Assets Non-Current Assets Total Assets Current Liabilities Non-Current Liabilities Total Liabilities Net Assets Total Liab. & Net Assets Business-Type Activities $ Percent Total $ Percent 100% 100% 100% 100% 100% 100% B. For Governmental Activities, prepare a table/graph/chart comparing total expenses (direct & indirect) with total program revenues, program by program (e.g. double bar graph for general government, another one for judicial, public safety, etc.) Discuss which programs appear to be self-supporting and which rely mostly on general tax revenues. Here’s an example: C. For Business-Type Activities, prepare a table/graph/chart comparing total expenses (direct & indirect) with total program revenues, program by program (e.g. double bar graph for electricity, water, 2 wastewater, parking, etc.) Discuss which programs appear to be operating most profitably and least profitably. D. Prepare a table/graph/chart that shows how total revenues are broken down for Governmental Activities. Revenues would include both program revenues and general revenues. Categories might include charges for services, operating grants & contributions, capital grants & contributions, property taxes, sales taxes, etc. Here’s an example: 8. 9. 10. E. Prepare a table/graph/chart that shows how total revenues are broken down for Business-Type Activities. Revenues would include both program revenues and general revenues. Categories might include charges for services, operating grants & contributions, capital grants & contributions, investment earnings, etc. F. Compare D & E above. Do Business-Type Activities usually depend more or less on tax monies than Governmental Activities? If someone implemented a user-fee approach to government finance, how would this impact the information D & E? Refer to the Fund Financial Statement section. What are the largest three reconciling items (dollars) included on the reconciliation between the net change in fund balances of governmental funds (modified accrual basis) and the change in net assets of governmental activities (full accrual)? Prepare a narrative/chart/graph/table that summarizes the most significant budget variances for the governmental funds for the most recent fiscal year. In other words, how would you briefly describe to somebody how actual results differed from the budget for the governmental activities of the city? Note that not all government funds prepare a budget --sometimes only the general fund has a budget. The budget information is often located in the Required Supplementary Information section. (A) What is the property tax mill levy for your city? (B) How much property tax did the city levy against a home assessed at $100,000? Is this more or less than the City of College Place in 2014? [Note: we are referring to the city’s portion of property taxes only, not the county’s, state’s, school district’s, etc. For College Place, you can find the exact number in Assignment 3c.] (C) Have property tax rates been increasing or decreasing in the city over the last few years? 3 The next few questions have answers that can usually be found in the notes to the financial statements 11. Describe the budget process/calendar of the city. (i.e. When is the executive branch supposed to submit the budget to the legislative branch? When should the legislative branch approve it? Etc.) Where in this process is the city at this moment? 12. (A) What accounting basis and measurement focus does the city use? (B) When does the city record its revenues? (C) Expenditures? 13. (A) What, if any, component units are included with the primary gov’t? (B) What is the rationale for them to be included with the primary gov’t? (C) Are they blended or discrete? 14. (A) Does the city use encumbrances? (B) Do the encumbrances lapse at year-end? (C) What is the balance of total outstanding encumbrances at year-end? 15. (A) Describe the types of investments the city holds. (B) Judging from the investment policy and the types of investments held, is the city a risk-taker or is it risk-adverse? Explain. (C) Does the city have any repos, reverse-repos, or security lending arrangements? If so, describe. (D) Does the city use any internal or external investment pools? If so, describe. 16. (A) Describe the composition of any receivables from external parties (types and amounts). (B) Describe the types and amounts of any interfund receivables/transfers. 17. (A) What is the amount of inventories, if any? (B) Does the city use the purchase or consumption method in the governmental funds? 18. (A) What is the policy of the city towards capitalization of infrastructure assets? Is the modified approach used? (B) What is the city’s capitalization cut-off policy? (C) What depreciation methods are used? (D) Prepare tables/charts/graphs showing the types of capital assets and the total (land, buildings, equipment, etc.). Do a separate table/chart/graph for Governmental and another for Business-type Activities. 19. Describe the type and amount of current liabilities listed. 20. (A) Describe any bond or note issues outstanding. (B) Do most of the bonds appear to be serial or term bonds? General obligation or revenue bonds? (C) Did any bond refundings, TANs, BANS, or RANs exist at year-end. Is so, describe. 21. What is the funded status of any defined benefit pension plans? 22. Give an example of claims, judgments, lawsuits, or contingencies disclosed. For the next 6 questions, refer to the Required Supplementary Information. Measure size by total assets. 23. List the five largest special revenue funds (major & non-major) and explain their purpose. 24. List the five largest debt service funds (major & non-major) and explain their purpose. 25. List the five largest capital projects funds (major & non-major) and explain their purpose. 26. List the five largest internal service funds (major & non-major) and explain their purpose. 27. (A) List the five largest major enterprise funds (major & non-major) and explain their purposes. (B) What criteria does the city use to distinguish between major and non-major funds? 28. Give a specific example at your city of each of the following, if applicable: (A) pension trust fund, (B) permanent fund, (C) private-purpose fund, (D) agency fund. 29. How well do the parts of CAFR compare to the outline in Ch. 5 of your text? Explain. 30. Would you rate your city’s overall financial position and results of operations as strong, medium, or weak? Why? 31. What particular financial challenges or opportunities do you see your city facing in the near future? 4 Appendix A – Suggested City Financial Health Indicators for Presentation Report As mentioned, the goal of your presentation is to rank the financial health of your cities and support your ranking with analysis. Charts would be very helpful (line, column, bar, pie charts, etc.). You may find the comparison somewhat nuanced, since certain parts of one city (e.g. business-type activities) might be more healthy than other parts of the same city (e.g. governmental activities). Your comparison would most likely include trend (horizontal) analysis; common-size (vertical) analysis; and a few standard ratios that measure liquidity, solvency, and profitability. Here are some specific suggestions: A. Look at demographic factors, such as population trends, age of population, property value trends, poverty rate, and unemployment rate. Obviously, a healthy city will be growing city in terms of people and wealth. If your city does not disclose sufficient demographic data on its website or in its CAFR, the Census Bureau might be helpful -- see http://factfinder2.census.gov/faces/nav/jsf/pages/index.xhtml . B. Show the trends in general fund unreserved (or unassigned) fund balance. Do the same for unrestricted net assets of business-type funds (enterprise) funds. For purposes of comparing cities, it would be helpful to calculate the fund balance/or net assets on a per capita basis. A positive balance in unreserved fund balance or unrestricted net assets provides a cushion for revenue shortfalls or expenditure overruns. Continuous reductions in fund balance may indicate poorly structured budgets that could lead to future budgetary problems, even if the current fund balance is positive. Even more significant is a fund balance that is negative, or what is known as a deficit fund balance. This situation could seriously affect the ability to continue to provide services at current levels. Deficits in major funds in excess of 1.5 percent of fund expenditures or $50,000 (whichever is greater) are generally causes for concern. C. Show the trends in general fund operating surpluses or deficits. For purposes of comparing cities, it would also be helpful to show the general fund operating surplus or deficit as a percent of gross expenditures. The annual operating surplus or deficit is the difference between the revenues and expenditures for a fiscal year. If expenditures exceed revenues, the local government or school district has an operating deficit; if revenues exceed expenditures, the local government or school district has an operating surplus. One way to measure this is to subtract gross expenditures from gross revenues and divide the result by gross expenditures. This ratio depicts how large or small the surplus or deficit is in relation to each fund’s operations for the year. Over time, operating deficits in individual years may offset operating surpluses from other years. Since several successive years of operating deficits could cause financial hardship for a local government, reviewers should consider the results over several years of operation. The fund balance is the total accumulation of all operating surpluses and deficits since the beginning of a local government’s existence. Each year’s operating surplus or deficit is added to or subtracted from the prior fund balance. A local government that relies on surplus fund balance to finance current operations may eventually experience fiscal problems. D. Show the tax capacity by comparing property tax mill levy rates. Those cities with lower rates have the capacity to raise property taxes if needed. Note that mill levy rates just for the city portion may not be shown in the CAFR but would likely be reported on the city’s website somewhere. E. Show the trend in the current ratio (current assets divided by current liabilities). If current assets are not classified separately, you may need to guess which assets are current. These assets usually include cash/equivalents, short-term investments, short-term receivables/due froms, deposits, and inventories. This ratio measures the availability of current resources to pay off current obligations. A downward trend (percentages are decreasing) indicates difficulty raising the cash needed to meet current expenditures. Real property taxes, a significant revenue source in most local governments, are generally collected at the beginning of the fiscal year and spent down as the year progresses. To create a conservative ratio, use year-end figures, when cash balances are usually at their lowest. F. Show the trend in total liabilities as a percent of total assets. Clearly, too much debt threatens the viability and long-term solvency of the government. G. If the city is large enough, it may even have a separate bond rating disclosed in its CAFR or on the city’s website. Because the bond rating agency studies the finances of the city carefully, a comparison of bond ratings can be a meaningful way to judge the future health of a city. 5 H. Consider the unfunded status of any defined benefit pension plans, which will impact cash flows for years to come. In the past, cities have pacified their employee unions by promising better pension benefits, as opposed to raising current wages. Consequently, pensions often present the single biggest financial threat to a city’s continued existence (e.g. consider Detroit, MI). 6