Financial Excellence Finance Department The mission of the

Financial Excellence

Finance Department

The mission of the Finance Department shall be to provide accurate and reliable information to the City Council, the City Manager and the citizens of Mustang and to assure compliance with financial policies.

The Finance Director is responsible for the disbursement of all monies and monitors expenditures to ensure the budget appropriations are not exceeded. The department is responsible for City business such as the collection and disbursement of accounting of all monies received in accordance with Generally Accepted Accounting Principles (GAAP); invests City funds to achieve maximum returns; development and administration of operating and capital improvement budgets; administration of utility billing and collections; development of various rates and fee studies; collection of tax revenues; issuance of new debt instruments and oversight of outstanding debt obligations. The department provides monthly and annual financial reports detailing expenditure budgetary compliance and the collection of revenues.

Along with internal auditing and reporting, the Management of the City provides a discussion and analysis of the City of Mustang’s financial performance as an overview of the City’s financial activities. The summary is a condensed view of the City’s assets and liabilities as obtained from the audited financial statements presented in the City’s Comprehensive Annual

Financial Report (CAFR). The statement distinguishes functions of the City that are principally supported by taxes and governmental activities from other functions that are intended to recover all or a significant portion of their costs through user fees or charges (business-type activities).

The governmental activities include administrative, culture and recreation, public safety, community development and streets. The business-type activities of the city include enterprise activities such as the water system; sewer system; sanitation and recycling.

The Finance Department is committed to safeguarding the fiscal integrity of the City of Mustang with an accounting and utility customer service team supervised by the Finance Director.

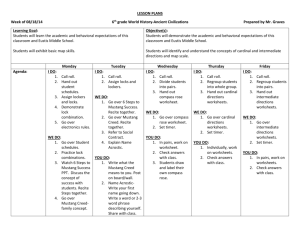

Operating Revenues

The General Fund operating revenues for fiscal year 2012 were $17.8 million. Sales tax in the amount of $7,876,617 represents 44% of total revenues. The current sales tax rate for the City of

Mustang is 8.85%. The tax rate structure is 4.5% State of Oklahoma; .35% Canadian County; and 4.0% City of Mustang. Of the City’s four cents sales tax, two cents is designated to the general operation; one cent is restricted for the repayment of the 2006 revenue bond; and the remaining one cent is pledged for the repayment of the 1998 revenue bonds. Sales tax can only be increased by the vote of the citizens of Mustang.

General Fund Revenues

Sales Tax

Transfers In

Charges for Services

Franchise Fees

Other Taxes

Fines

Licenses & Permits

Operating Expenses

The operating expenditures of all programs remained steady compared to the prior year. The majority of costs relate to transfers (46%), public safety (23%), culture and recreation (11%), general government (9%), administration (9%), and streets (2%).

General Fund Expenditures

Transfers Out

Public Safety

Culture & Recreation

General Government

Administration

Streets

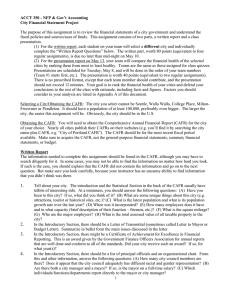

Debt Administration

At the close of fiscal year 2012, the City had $22,809,794 in outstanding notes, capital lease obligations, and bonds. Compensated absences liability accounted for $227,569. The total revenue bonds outstanding $19,070,000. A portion of that debt was backed with a full faith and credit of the City’s general obligation debt and payable with voter approved ad-valorem taxes.

The remaining debt is supported by pledged utility revenues and a voter approved sales tax.

Financial Highlights

Net assets are the difference between total assets and total liabilities and are an indicator of the current fiscal health of the City. For the year ending June 2012, the City’s combined net assets increased by $1,533,826 million or 3.7%.

Governmental activities net assets increased by $459,570 million or 1.5%.

Net assets of the business type activities increased by $1,074,256 million or 11.3%.

At the end of June 30, 2012, the City had $50.7 million invested in capital assets including police and fire equipment, buildings, park facilities, streets and drainage systems, water and sewer infrastructure.

Over the course of the fiscal year ending June 30, 2012, the General Fund budget was revised to supplement for grants, contributions, and donations. The revised budget was increased by $240,383.

Industry Acknowledgments

The Government Finance Officers Association of the United States and Canada (GFOA) has awarded the Certificate of Achievement for Excellence in Financial Reporting to the City of

Mustang for eighteen consecutive years. This prestigious honor is the highest form of recognition in the area of governmental accounting and financial reporting, and its attainment represents a significant accomplishment by a government and its management. The comprehensive annual financial report (CAFR) is judged by an impartial panel to meet the high standards of the program including demonstrating a constructive “spirit of full disclosure” to clearly communicate its financial story and motivate potential users and user groups to read the

CAFR. The report must satisfy both the generally accepted accounting principles (GAAP) and applicable legal requirements.

This information is designed to provide our citizens, taxpayers, and customers with a general overview of Mustang’s financial position. If you have any questions or need additional financial information, please contact Janet Watts, Finance Director, City of Mustang, 1501 N. Mustang

Road, Mustang, OK 73064, or by phone 405-376-4521.