How Do Governmental and Not-For-Profit Organizations Differ From

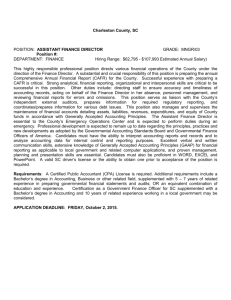

advertisement

1 Financial Reporting for Chapter Governmental and Not-for-Profit Entities What types of Governmental and Not-ForProfit Organizations do you think of? ? Approximately: o 87,500 local governments exist in US o One million not-for-profit organizations How do they get revenue? ? What do they spend money on? ? How Do Governmental and Not-For-Profit Organizations Differ From Business Organizations? o o o o Benefits are not proportional to resources provided Lack of a profit motive Absence of transferable ownership rights Services better society How Do Governmental Entities Differ From Not-For-Profit Organizations? Power ultimately rests in the hands of the people People vote and delegate that power to public officials Created by and accountable to a higher level government (states, county, township, city) Power to tax citizens for revenue Governed by budgets not markets Sources of GAAP and Financial Reporting Standards 1) FASB Business organizations Nongovernmental not-for-profits (YMCA) 2) GASB Governmental organizations Governmental not-for-profit (U of MI) 3) FASAB Federal Government and its agencies ***Hospitals can fall into either group 1 of 2 above Criteria for Determining Whether an NPO is Governmental Governmental organizations typically have one or more of the following characteristics: Popular election of officers, or appointment of a controlling majority of the governing body by officials of another government Potential dissolution by a government with net assets reverting to a government Power to enact and enforce a tax levy and impose charges States can issue tax-exempt debt Additional Governmental Characteristics Budgets not annual reports are the most significant financial document Budgets drive financial reporting Some can be legally binding Some must be balanced Governments can seize assets of other governments within their jurisdiction!!!!!! Additional Government Characteristics Revenue does not indicate demand for services (Benton Harbor) No direct link between revenues and expenses Many capital assets neither produce revenues or save costs (roads) so projects are evaluated differently Some resources are restricted (land, cash, art) Equity does not exist and ownership cannot be bought or sold Objectives of Financial Reporting “ACCOUNTABILITY is the cornerstone of all financial reporting in government “ REMEMBER ELECTED OFFICALS ARE OFTEN SHORT TERM FOCUSED !!!!!!!!! “Interperiod Equity the concept that constituents pay for the services that they receive and do not shift the burden to their children “ Objectives of Financial Reporting Q: What do we mean by accountability? A: Accountability arises from the citizens’ “right to know?” It imposes a duty on public officials to be accountable to citizens for raising public monies and how they are spent. Objectives of Financial Reporting Q: How does “interperiod equity” relate to accountability? A: Interperiod equity is a government’s obligation to disclose whether current-year revenues were sufficient to pay for currentyear benefits or did current citizens defer payments to future taxpayers (Doesn’t mean governments shouldn’t borrow) – For example – Interstate Highway System Users of Financial Reports Governing Boards Investors & Creditors Approx. $1.8 trillion bonds outstanding/bank loans Citizens/Taxpayers Donors/Grantors United Way and Ford Foundation Regulatory Employees and oversight agencies Objectives of Financial Reporting—State and Local Governments Financial reports are used primarily to: (CAFR’s) Compare actual financial results with legally adopted budget Assess financial condition and results of operations Assist in determining compliance with finance-related laws, rules, and regulations Assist in evaluating efficiency and effectiveness Comprehensive Annual Financial Report (CAFR) Introductory section Financial section Statistical section CAFR - Introductory Section Title page Contents page Letter of transmittal * General information on organization structure Other (as desired by management) *From CEO or CFO about state of affairs CAFR - Financial Section Auditor’s report MD&A Basic Financial Statements Required Supplementary Information (RSI) Combining and individual fund financial statements and schedules (if required) Management’s Discussion and Analysis (MD&A) Brief objective narrative providing management’s analysis of the government’s financial performance Basic Financial Statements Government-wide Financial Statements* Statement of Net Assets (page 42) Statement of Activities (page 43) Fund Financial Statements (see next slide) Notes to the Financial Statements *Sometimes called Governmental Activities Fund Financial Statements Balance Sheet (Page 44) Statement of Revenues, Expenditures, and Changes in Fund Balances - Governmental Funds with reconciliation (page 45-46) Statement of Net Assets - Proprietary Funds (Page 51) Statement of Revenues, Expenses, and Changes in Fund Net Assets - Proprietary Funds (Page 53) Fund Financial Statements (Cont’d) Statement of Cash Flows - Proprietary Funds Statement of Fiduciary Net Assets Statement of Changes in Fiduciary Net Assets CAFR - Statistical Section Tables and charts showing multiple-year trends in financial and socioeconomic information What information would be important?