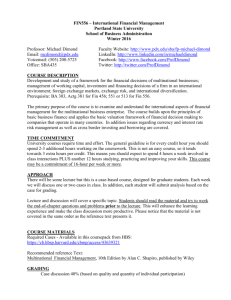

Chapter Concepts

advertisement

International Business Oded Shenkar and Yadong Luo Chapter 14 Financial Management for Global Operations Chapter 14: Financial Management for Global Operations Do You Know? • The ways that sound financial management contributes to Multinational Enterprise global success? • The major financial issues that are especially important to global operations? • How payment methods differ between domestic and international transactions? Chapter 14: Financial Management for Global Operations Do You Know? • How global payments are commonly conducted? • The major sources of financing in global business and export? • The major steps involved in listing stocks on the international exchanges? Chapter 14: Financial Management for Global Operations Do You Know • How to reduce risk from foreign exchange fluctuation? • The differences between foreign exchange risk and foreign exchange exposure? Chapter 14: Financial Management for Global Operations Minimizing Exposure in RTZ • How does a company manage international risk? It isn’t easy. When RTZ realized that foreign exchange fluctuation, risk, and exposure influenced net profits and could reduce shareholder wealth, they reorganized F(x) into the executive suite. …/… Chapter 14: Financial Management for Global Operations Minimizing Exposure in RTZ • The strategy they created had RTZ borrowing and conducting revenue operations with dollars, yen, and pounds. • In operational locations presenting foreign exchange risk, they hold large reserves in domestic currency to preserve purchasing power and maintain ability to meet obligations in the foreign location. Chapter 14: Financial Management for Global Operations Why Learn Financial Management? • Financial Management should be required knowledge for all international business managers. • Financial management is, however, much more complex than the domestic equivalent because management must deal with differing financial markets, environments, institutions, and systems. Chapter 14: Financial Management for Global Operations Why Learn Financial Management? • Many times, financial management in an Multinational Enterprise global operations occurs in an environment characterized by volatile foreign exchange rates, restrictions on capital flows, varying country and political risk, differing tax systems, and a wide spectrum of institutional settings. Chapter 14: Financial Management for Global Operations Why Learn Financial Management? Knowledge of financial management helps the firm in two ways: • It helps the financial manager decide what steps should be taken to exploit opportunities and protect the firm from financial threats • It helps the manager anticipate events and make profitable decisions before events occur Chapter 14: Financial Management for Global Operations Why Learn Financial Management? Financial management for global operations deals with the following major issues: • International Trade Finance • Financing Global Operations • Managing Foreign Exchange Risk and Exposure • Working Capital Management Chapter 14: Financial Management for Global Operations International Trade Finance Options for International Trade Payment are: • Cash in Advance • Letter of Credit • Documentary Collection • The Open Account Chapter 14: Financial Management for Global Operations International Trade Finance • Cash In Advance affords the exporter the greatest protections because payment is received before shipment, or when goods arrive. • This is mainly used in countries where there is political instability, or where the buyer’s credit is shaky. • Political crises and/or foreign exchange controls often necessitate the Cash in Advance Deal. Chapter 14: Financial Management for Global Operations International Trade Finance • Letters of Credit (l/c) are the means by which the majority of international transactions occur. • This is a letter written to the seller, signed by the buyer’s bank. • It promises to honor drafts drawn on the bank, if the seller follows the rules set in the letter, which are usually the same as in the purchasing contract. If they are different, both conditions apply. Chapter 14: Financial Management for Global Operations Advantages of L/Cs • They eliminate Credit Risk, if the bank is in good standing • They reduce uncertainty for payment, because the seller knows all the rules for obtaining payment • They stabilize production by assuring payment before a production run begins • They facilitate financing because they assure a ready foreign buyer Chapter 14: Financial Management for Global Operations International Trade Finance L/C Terminology • Documentary Requirement – L/C is required for most import/export transactions • Clean L/C – presented without other documents, it is useful for overseas bank guarantees, escrow arrangements, and security purchases • Irrevocable L/C – cannot be revoked without the specific permission of all parties involved, including the exporter • Confirmed L/C – is issued by on bank and confirmed by another, obligating both banks to honor drafts drawn in compliance …/… Chapter 14: Financial Management for Global Operations International Trade Finance • Unconfirmed L/C – is the obligation of only the issuing bank. Most would prefer the “confirmed, irrevocable L/C.” • The Transferable L/C – is where a beneficiary has the right to instruct the paying bank to make credit available to one or more secondary beneficiaries • The Back to Bank L/C – exists where the exporter, as beneficiary, offers its credit as security in order to finance the opening of a second credit • The Revolving L/C – exists where the tenor or amount of the L/C is automatically renewed pursuant to terms and conditions. These can be cumulative or non-cumulative …/… Chapter 14: Financial Management for Global Operations International Trade Finance Exhibit 14-1: Process of using letter of credit (L/C) Chapter 14: Financial Management for Global Operations International Trade Finance • The Documentary Collection is a payment mechanism that allows exporters to retain ownership of goods until they receive payment or are reasonable certain they will receive it. These documents are generally titles to the goods. • The Open Account involves shipping goods, and then billing the importer later. The credit terms are arranged between the importer and the exporter. These are usually afforded to longstanding partners, or to foreign affiliates where payment is reasonably assumed. Chapter 14: Financial Management for Global Operations International Trade Finance Exhibit 14-2: Documents against payment (D/P) flow Chapter 14: Financial Management for Global Operations International Trade Finance Exhibit 14-3: Documents against acceptance (D/A) flow Chapter 14: Financial Management for Global Operations International Trade Finance • Means of Payment are traditionally done through the Airmail Payment, the Telex, the Society for Worldwide Information and Funds Transfer (SWIFT), the bank draft, the money order, and the inter-bank email system. Chapter 14: Financial Management for Global Operations Export Financing • Export Financing is important because many export projects require a large amount of startup cost. Sources of funds come from the Private Source, and the Governmental Source. Chapter 14: Financial Management for Global Operations Financing: Private Sources • • • • • • • Commercial Banks Export Finance Companies Factoring Houses Forfeit Houses International Leasing Companies In-House Finance Companies Private Insurance Companies Chapter 14: Financial Management for Global Operations Financing: Government Sources • Export-Import Bank Financing (Ex-Im Bank) • Foreign Credit Insurance Chapter 14: Financial Management for Global Operations Financing Global Business Compared to financing international trade, the financing of global production is much more complex. These options include: • Intercompany Financing - where parent and sister subsidiaries competitiveness-finance one another • Equity Financing – Where financing is conducted through issuing stock in home or host country, or cross listing shares on multiple exchanges …/… Chapter 14: Financial Management for Global Operations Financing Global Business Exhibit 14-4: Sources of financing global operations Chapter 14: Financial Management for Global Operations Financing Global Business • Debt Financing – through using Eurocurrency Markets, Eurocredits, or Euronotes. There are also Eurobonds, foreign bonds, Yankee Bonds, Samurai Bonds, and Bulldogs (issued in the United Kingdom) • Local Currency Financing – through bank loans, non-bank sources, discounting, and parallel loans Chapter 14: Financial Management for Global Operations Financing Global Business Exhibit 14-5: Tapping Wall Street: three stages for non-U.S. MNEs to be traded in the United States Chapter 14: Financial Management for Global Operations Managing Foreign Exchange Risk and Exposure • Foreign Exchange Risk – concerns the variance of the domestic currency value of an asset, liability, or operating income that is attributable to unanticipated variances in the exchange rates. • Foreign Exchange Exposure – refers to the sensitivity of changes in the real domesticcurrency value of assets, liabilities, or operating incomes to unanticipated changes in exchange rates. Chapter 14: Financial Management for Global Operations Transaction and Economic Exposure • Transaction Exposure – is concerned wit how changes in exchange rates affect the value of anticipated cash flows in foreign currency and their settlements. • Economic Exposure – also known as operating exposure, measures the change in the present value of the firm resulting from any change in the future operating cash flows caused by an unexpected change in exchange rates and macroeconomic factors. Chapter 14: Financial Management for Global Operations Translation Exposure • Translation Exposure,refers to the potential for accounting derived changes in owner’s equity to occur because of the need to consolidate foreign currency financial statements. Chapter 14: Financial Management for Global Operations Translation Exposure Exhibit 14-6: Framework of managing foreign exchange exposure Chapter 14: Financial Management for Global Operations Managing Transaction Exposure To manage transaction exposure, financial managers hedge with financial instruments. They use the: • Forward Markets, hedging for anticipated exchanges in the future • Futures Markets, hedging via the futures markets • Options Markets, Using calls (buying a number of currency units in the future at some specific price), or puts (selling a number of currency units in the future at a specific price) …/… Chapter 14: Financial Management for Global Operations Managing Transaction Exposure Exhibit 14-7: Forward hedging example Chapter 14: Financial Management for Global Operations Managing Transaction Exposure • Spot Markets, buying and selling currency in current time when there is unpredictable fluctuation • Bartering, buying and selling goods in exchange for other goods Chapter 14: Financial Management for Global Operations Cash Management • Firms need to create a global management system for working capital, cash flow. • HQ must clearly define what aspects of cash management are centralized (like in RTZ) and what should be decentralized. • They should formalize policies that help them manage international accounts receivable. Chapter 14: Financial Management for Global Operations