Chapter 1: Financial Accounting and Standards

INTERMEDIATE

ACCOUNTING

Sixth Canadian Edition

KIESO, WEYGANDT, WARFIELD, IRVINE, SILVESTER, YOUNG, WIECEK

Prepared by:

Gabriela H. Schneider, CMA; Grant MacEwan College

C H A P T E R

4

Reporting Financial

Performance

Learning Objectives

1. Identify the uses and limitations of an income statement.

2. Prepare a single-step income statement.

3. Prepare a multiple-step income statement.

4. Explain how irregular items are reported.

Learning Objectives

5. Explain intraperiod tax allocation.

6. Explain where earnings per share information is reported.

7. Measure and report gains and losses from discontinued operations.

8. Prepare a retained earnings statement.

Income Statement and Related

Information

Income

Statement

Format of the

Income Statement

Reporting

Irregular Items

Special Reporting

Issues

Usefulness

Limitations

Quality of earnings

Elements

Single-step

Multiple-step

Intermediate components

Condensed income statement

Discontinued operations

Extraordinary items

Unusual gains and losses

Intraperiod tax allocation

Earnings per share

Retained earnings statement

Uses and Limitations of the

Income Statement

Uses:

• Evaluate past performance

• Assist in predicting future performance

• Assess potential risk in achieving future cash flows

Limitations:

• Items are excluded if they cannot be reliably measured

• Amounts reported are affected by accounting methods used

• Use of estimates

Quality of Earnings

• The reliability of the information presented is dependent of the quality of earnings

• Information presented (content) is of high quality (or more reliable) if it demonstrates the following attributes:

– contains less judgement and less bias

– can be correlated with cash flows from operations

– has greater predictive and feedback value (i.e. represent ongoing operations )

– represents economic reality (all significant events have been measured and appropriately reported)

• Recall the discussion from Chapter 2 on the qualitative characteristics of information

Single-Step Income Statement

• Displays only two groupings:

– Revenues

– Expenses

• Income tax expense may be reported as a separate deduction to arrive at net income

• Advantages:

– Ease of preparation

– Elimination of classification problems for various revenue and expense items

• Disadvantages:

– Lack of additional information for users/decision making

– Separation of operating from non-operating activities

Single-Step Income Statement

Revenues

-

Expenses

=

NET INCOME

Earnings per

Share

Revenues

Sales

Other Revenues

Expenses

Cost of Goods Sold

Selling & Admin. Expenses

Interest Expense

Income Tax Expense

Any Gains/Losses from

Discontinued Operations or

Extraordinary Items must be disclosed separately from

Continuing Operations

Multiple-Step Income Statement

• Operating and non-operating activities displayed as separate sections of the income statement

• Expenses classified by function (e.g. cost of goods sold)

• Income tax expense always shown as a separate item for, and within, each section of the statement

• Advantages of this method include:

– provides greater insight into the performance of the enterprise

– provides better opportunity for comparison within the industry

– information provided seen as ‘higher’ quality due to greater predictive and feedback values

Multiple-Step Income Statement

Sections

Continuing Operations

Operating Section

Nonoperating Section

Income Tax

Goodwill

Discontinued Operations

Income/Loss from Operations

Gain/Loss from Disposition

Reported Net of Taxes

Extraordinary Items

Material Gains/Losses

Reported Net of Taxes

Continuing Operations - Detail

Operating Section

Nonoperating Section

Income Tax

Goodwill

Net Sales

Cost of Goods Sold

Selling Expenses

Administrative or General Expenses

Other Revenues and Gains

Other Expenses and Losses

On Income from

Continuing Operations only

Amortization charge (net of taxes)

Condensed Income

Statements

• Expenses are reported on the income statement in group totals

• Details of the various expense groups are reported on separate schedules

• Provides the advantage of a concise income statement

– All information is still available to statement users

– Useful when inclusion of all expense detail on the income statement would make the statement

‘cluttered’

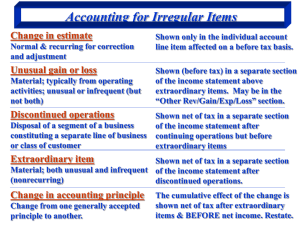

Reporting Irregular Items

• Include the following:

– Discontinued operations

– Extraordinary items

– Unusual gains and losses

• These items are reported on the income statement

• Other items are recorded as adjustments to retained earnings ( CICA Handbook, Section 1506 )

• These ‘other items’ include the following: i. Errors from prior years ii. Retroactively applied changes in accounting policies iii. Foreign exchange gains and losses on self-sustaining foreign subsidiaries

Discontinued Operation

s

• Discontinued operations refer to the disposal of a segment.

• To qualify :

the segment must be a significant and separate line of business

its assets and operations must be distinguishable from other assets and operations

• A distinction is made between:

the segment’s results of operations

the disposal of the segment’s assets

• Each is reported net of tax

Reporting Discontinued

Operations

• There are three important dates when reporting discontinued operations:

- The measurement date

- The year-end date

- The disposal date

• The measurement date is when management commits itself to a plan of segment’s disposal; gains/losses are accrued

• The year-end date is when the discontinued operation financial information is completed for reporting purposes

• The disposal date is the date of sale of the segment

Reporting Discontinued

Operations

• There are three distinct reporting scenarios:

1. No Phase-Out Period:

• Measurement date and disposal date are the same

(and are within the fiscal year)

2. Phase-Out Period:

• Disposal date falls after the measurement date

(but both are within the fiscal year)

3. Extended Phase-Out Period:

• Disposal date falls after the measurement date

( and after the end of the fiscal year)

Jan. 1

No Phase-Out Period

Oct. 1 Dec. 31

Operating Income for the Segment is calculated for this time period

Measurement

Date and

Disposal Date

Fiscal Year

End Date

Gain or Loss on Disposal is

Measured at this Date

No Phase-Out Period –

Statement Presentation

Income from continuing operations (net of tax) $xx,xxx

Discontinued Operations:

Income (Loss) from operations (net of tax) $xx,xxx

Gain (Loss) on disposal (net of tax) xx,xxx xx,xxx

Net Income $xx,xxx

Jan. 1

Phase-Out Period

Oct. 1

Phase Out

Period

Dec. 1 Dec. 31

Operating Income for the Segment is calculated for this time period

Measuremen t Date

Disposal

Date

Gain or Loss on Disposal =

Segment Operating Income during Phase Out Period +

Disposal of Net Assets

Fiscal

Year

End

Phase-Out Period –

Statement Presentation

Income from continuing operations (net of tax) $xx,xxx

Discontinued Operations:

Income (Loss) from operations (net of tax) $xx,xxx

Gain (Loss) on disposal of $x and operating income (loss) of $x both (net of tax) xx,xxx xx,xxx

Net Income $xx,xxx

Extended Phase-Out Period

Jan. 1 Oct. 1 Dec. 31

Extended Phase-Out Period

May. 1

Operating Income for the Segment is calculated for this time period

Measurement

Date

Fiscal

Year

End

Gain or Loss on Disposal

Disposal

Date

If Loss estimated – report at Measurement Date

If Gain estimated – recognize when realized

Extended Phase-Out Period –

Statement Presentation

Expected Loss on Disposal

Income from continuing operations (net of tax) $xx,xxx

Discontinued Operations:

Income (Loss) from operations (net of tax) $xx,xxx

Loss on disposal of $x and operating income (loss) during extended phase-out period of $x both (net of tax) xx,xxx

Net Loss on Disposal xx,xxx

Net Income $xx,xxx

Extended Phase-Out Period –

Statement Presentation

Expected Gain on Disposal – Current Year Income

Statement

Income from continuing operations (net of tax) $xx,xxx

Discontinued Operations:

Income (Loss) from operations (net of tax) $xx,xxx

Operating income during extended phase-out period of $x (net of tax) xx,xxx

Net Gain xx,xxx

Net Income $xx,xxx

Extended Phase-Out Period –

Statement Presentation

Expected Gain on Disposal – Following Year

Income Statement

Income from continuing operations (net of tax)

Discontinued Operations:

Gain on disposal of net assets (net of tax)

Net Income

$xx,xxx xx,xxx

$xx,xxx

Extraordinary Items

• Presented separately on the Income

Statement (net of tax); generally following Discontinued Operations

• Characteristics:

– Material amounts

– Non-recurring events

– Differ significantly from the typical business activities

Extraordinary Items

• Three qualifying criteria:

– Infrequent

– Atypical of normal business activities

– Not primarily dependent on management or owners’ decisions

• All three of these must be met in order to qualify as an Extraordinary Item

Extraordinary Items

• CICA Handbook, Section 3480 lists the following as not qualifying as Extraordinary

Items:

1) Losses, or loss provisions, from bad debts and inventories

2) Foreign exchange gains and losses

3) Contract price adjustments

4) Gains and losses from investment write downs

5) Income tax adjustments

6) Income tax rate or law changes

Unusual Gains and Losses

• Gains and losses that do not qualify as an

Extraordinary Item, but are material in amount

• Disclosed separately on the income statement, immediately above Income

(Loss) before Extraordinary Items

• Alternative presentation is to display a separate section – “Unusual Items”

Intraperiod Tax Allocation

• Refers to the reporting of amounts Net of Tax

• Specifically the allocation of Income Taxes within a fiscal period

• Income Tax expense (or benefit) is calculated separately for each of:

– income from continuing operations

– discontinued operations

– extraordinary items

Earnings per Share

• Earnings per share (EPS) is probably the most important business indicator figure

• Indicates dollars earned per common share; it does not report the dollars paid (or to be paid) per common share

• Earnings per share is required to be disclosed on the income statement for all the major sections

Earnings per Share

•Calculated as:

Net Income less Preferred Dividends

Weighted Average of Common Shares Outstanding

•Preferred dividends are those dividends that have been declared (non-cumulative) or in arrears

(cumulative) for one year only

•Earnings per share is subject to dilution

(reduction) , if issue of additional shares is possible in the future

Retained Earnings Statement

• Retained earnings are increased by net income and decreased by net loss and dividends for the year

• Corrections of errors in prior period financial statements are shown as prior period adjustments to the beginning balance in retained earnings

• Any part of retained earnings, appropriated

(restricted) for a specific purpose, are shown as

Appropriated Retained Earnings

• Earnings may appropriated by contractual obligation, corporate policy, or discretionary

COPYRIGHT

Copyright © 2002 John Wiley & Sons Canada, Ltd.

All rights reserved. Reproduction or translation of this work beyond that permitted by CANCOPY

(Canadian Reprography Collective) is unlawful.

Request for further information should be addressed to the Permissions Department, John

Wiley & Sons Canada, Ltd. The purchaser may make back-up copies for his / her own use only and not for distribution or resale. The author and the publisher assume no responsibility for errors, omissions, or damages, caused by the use of these programs or from the use of the information contained herein.