Monetary Policy

advertisement

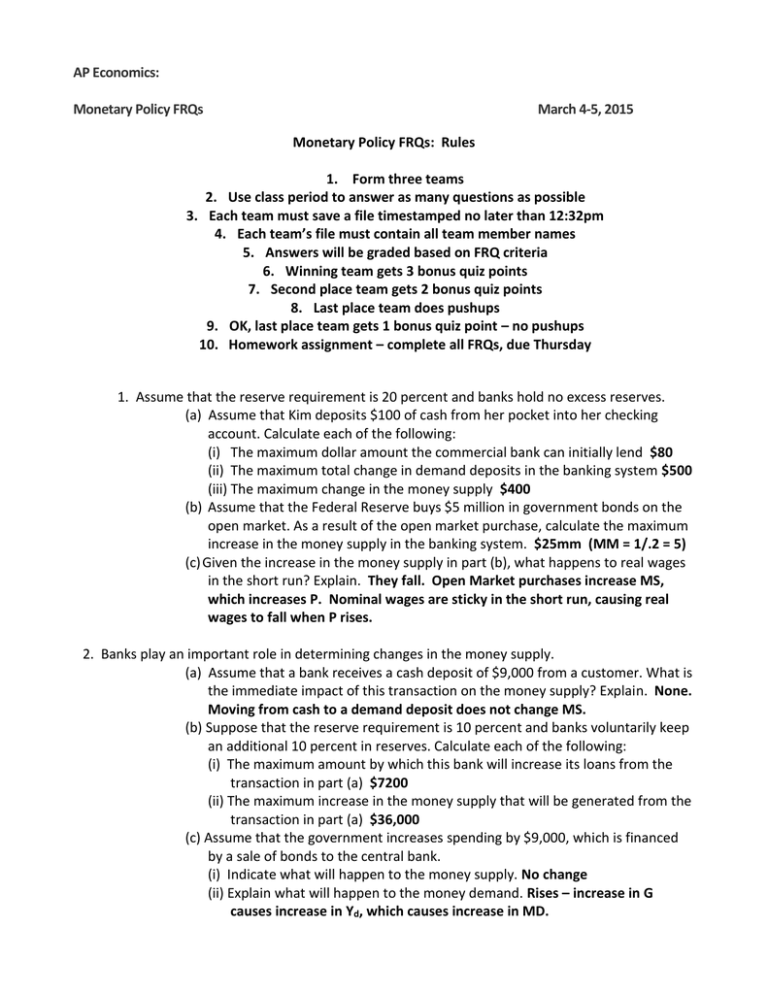

AP Economics: Monetary Policy FRQs March 4-5, 2015 Monetary Policy FRQs: Rules 1. Form three teams 2. Use class period to answer as many questions as possible 3. Each team must save a file timestamped no later than 12:32pm 4. Each team’s file must contain all team member names 5. Answers will be graded based on FRQ criteria 6. Winning team gets 3 bonus quiz points 7. Second place team gets 2 bonus quiz points 8. Last place team does pushups 9. OK, last place team gets 1 bonus quiz point – no pushups 10. Homework assignment – complete all FRQs, due Thursday 1. Assume that the reserve requirement is 20 percent and banks hold no excess reserves. (a) Assume that Kim deposits $100 of cash from her pocket into her checking account. Calculate each of the following: (i) The maximum dollar amount the commercial bank can initially lend $80 (ii) The maximum total change in demand deposits in the banking system $500 (iii) The maximum change in the money supply $400 (b) Assume that the Federal Reserve buys $5 million in government bonds on the open market. As a result of the open market purchase, calculate the maximum increase in the money supply in the banking system. $25mm (MM = 1/.2 = 5) (c) Given the increase in the money supply in part (b), what happens to real wages in the short run? Explain. They fall. Open Market purchases increase MS, which increases P. Nominal wages are sticky in the short run, causing real wages to fall when P rises. 2. Banks play an important role in determining changes in the money supply. (a) Assume that a bank receives a cash deposit of $9,000 from a customer. What is the immediate impact of this transaction on the money supply? Explain. None. Moving from cash to a demand deposit does not change MS. (b) Suppose that the reserve requirement is 10 percent and banks voluntarily keep an additional 10 percent in reserves. Calculate each of the following: (i) The maximum amount by which this bank will increase its loans from the transaction in part (a) $7200 (ii) The maximum increase in the money supply that will be generated from the transaction in part (a) $36,000 (c) Assume that the government increases spending by $9,000, which is financed by a sale of bonds to the central bank. (i) Indicate what will happen to the money supply. No change (ii) Explain what will happen to the money demand. Rises – increase in G causes increase in Yd, which causes increase in MD. 3. In recent years, the Federal Reserve has made targeting the federal funds rate a main focus of its monetary policy. (a) Define the federal funds rate. The interest rate banks charge each other for overnight or short term loans. (b) If the Federal Reserve wants to lower the federal funds rate, what open market operation would be appropriate? Buy securities (c) Assume that the open market operation that you indicated in part (b) is equal to $10 million. If the required reserve ration is 0.2, calculate the maximum change in loans throughout the banking system. $40mm change (d) Indicate the effect of the open market operation that you indicated in part (b) on the nominal interest rate. Buying securities reduces nominal interest rates. (e) Assume the Federal Reserve’s actions results in some inflation. What would be the impact of the open market operation on the real rate of interest? Explain. Real rates fall. Fed buying reduces nominal rates and inflation further reduces real rates. 4. Interest rates are important in explaining economic activity. (a) Using a correctly labeled graph of the money market, show how an increase in the income level will affect the nominal interest rate in the short run. Correctly labeled axes and curves MD curves downward sloping and MS curve vertical MD curve shifts to the right Interest rate increases (b) Using a correctly labeled graph of the loanable funds market, show how a decision by households to increase saving for retirement will affect the real market interest rate in the short run. Correctly labeled axes and curves Downward sloping D S shifts to the right Interest rate falls Q falls (c) Suppose that the nominal interest rate has been 4 percent with no expected inflation. If inflation is now expected to be 2 percent, determine the value of each of the following: (i) The new nominal interest rate 6% (ii) The new real interest rate 4% 5. In Country Z, the required reserve ratio is 20 percent. Assume that the central bank sells $50 million in government securities on the open market. (a) Calculate each of the following. (i) The total change in reserves in the banking system $50mm (ii) The maximum possible change in the money supply $250mm (b) Using a correctly labeled graph of the money market, show the impact of the central bank’s bond sale on the nominal interest rate. Correctly labeled axes and curves Downward sloping D MS shift to left Interest rates rise (c) What is the impact of the central bank’s bond sale on the equilibrium price level? P falls due to reduction in MS. (d) As a result of the price level change in part (c), are people with fixed incomes better off, worse off, or unaffected? Explain. Better off. Fall in P and fixed nominal income means real income rises. (more on following page) 6. Sewell Bank has the simplified balance sheet below. Assets Liabilities Required reserves $2,000 Demand deposits $10,000 Excess reserves $ Owner’s equity $10,000 Customer loans $8,000 0 Government securities (bonds) $7,000 Building and fixtures $3,000 (a) Based on Sewell Bank’s balance sheet, calculate the required reserve ratio. 20% (b) Suppose that the Federal Reserve purchases $5,000 worth of bonds from Sewell Bank. What will be the change in the dollar value of each of the following immediately after the purchase? (i) Excess reserves rises $5000 (ii) Demand deposits unchanged (c) Calculate the maximum amount that the money supply can change as a result of the $5,000 purchase of bonds by the Federal Reserve. $25,000 (d) When the Federal Reserve purchases bonds, what will happen to the price of bonds and interest rates in the open market? Explain. Bonds prices rise. Bond purchases increase MS, causing interest rates to fall. (e) Suppose that instead of the purchase of bonds by the Federal Reserve, an individual deposits $5,000 in cash into her checking (demand deposit) account. What is the immediate effect of the cash deposit on the M1 measure of the money supply? None, both cash and demand deposits are included in M1 so a change from one to the other does not change the total.