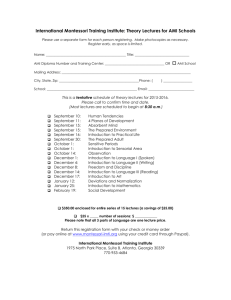

A New Way of Working - Microsoft Center

AP012 Industry Session

Harnessing the

SMB Opportunity

Emma Tomlin

BDM – Cloud Partnerships

Trends Driving IT

Consumerisation of IT

Over eight out of ten Australia Small

Businesses use social media for business purposes, with Facebook being the most popular site used

Source: AMI - Australia Small Business Market Opportunity Assessment 2012

Workforce Evolution

Workforce Evolution

Generation Y

A New Type of Worker

Little Commitment to employer

(a job isn’t for life)

High Turnover

Latest Technology

A New Way of Working

Manage to outcomes not processes

Expect rapid feedback and on the spot rewards

Functional Teams

Open Dialog

Flexible Time

Virtualised Support

Change Brings…..

Australian SMB Overview

A not so small opportunity

Source: AMI - Australia Small Business Market Opportunity Assessment 2012

The ICT Spend by 2015

ICT Spend & Growth in Australia (2011, 2015)

$4

$4

$3

$3

$2

$2

$1

$1

$0

0,0% 2,0%

Bubble Size = 2015 ICT Spend

$4,4

Telecom Svcs

4,0%

Internet

$2,0

Computing

6,0% 8,0%

5-Year CAGR

$4,1

$3,6

Networking

$0,3

IT Services

Software

$1,3

$0,7

Storage

$0,6

$0,3

10,0% 12,0%

Telecom Eqpt

Security

14,0%

Source: AMI - Australia Small Business Market Opportunity Assessment 2012

Size Matters

5-9

16%

10-19

7%

20-49

4%

50-99

1%

1-4

72%

Source: AMI - Australia Small Business Market Opportunity Assessment 2012

Lets get Vertical

AMTUC = Agriculture, Mining, Transportation, Utilities, Construction

FIRE = Finance, Insurance, Real Estate

Source: AMI - Australia Small Business Market Opportunity Assessment 2012

The Average SMB

AMTUC = Agriculture, Mining, Transportation, Utilities, Construction

FIRE = Finance, Insurance, Real Estate

Source: AMI - Australia Small Business Market Opportunity Assessment 2012

The Average Annual Spend on ICT

Source: AMI - Australia Small Business Market Opportunity Assessment 2012

Top Demographics

Source: AMI - Australia Small Business Market Opportunity Assessment 2012

Who makes decisions on IT?

Source: AMI - Australia Small Business Market Opportunity Assessment 2012

Buyer Behaviour

Top Attitudes

ENTERPISE SOLUTIONS

3 out of 4 Small Businesses feel that its strategically important to use enterprise solutions

WORD OF MOUTH

Referral is the number one source of information Australian small

Businesses cite when making technology purchase decisions

SOCIAL MEDIA

30-40% use Internet, Websites and

Social Media as a source for making technology decisions

Buyer Behaviour

Source: AMI - Australia Small Business Market Opportunity Assessment 2012

25%-35% are interested in using services in future,

The Cloud opportunity

Cloud Opportunity use an instant messaging solution today

Source: AMI - Australia Small Business Market Opportunity Assessment 2012 and AMI Cloud Playbook

Australia SMB SaaS Opportunity Breakout

SaaS Value & Growth in Australia (2010, 2015)

$45

$40

$35

$30

$25

$20

$15

$10

$5

$0

10%

SaaS Email SaaS CRM

Note: Bubble size represents market value in 2015

SaaS Payroll

SaaS ERP

SaaS Project Mgt.

SaaS

Accounting

SaaS HR

15% 20% 25%

5-Year CAGR

SaaS BI

Other SaaS

30%

SaaS

Productivity

35% 40%

Source: AMI - Australia Small Business Market Opportunity Assessment 2012 and AMI Cloud Playbook

Hosting and Mobility

Source: AMI - Australia Small Business Market Opportunity Assessment 2012 and AMI Cloud Playbook

Services and Devices

Source: AMI - Australia Small Business Market Opportunity Assessment 2012 and AMI Cloud Playbook

Email Usage

Microsoft Exchange/Outlook

IBM Lotus Notes/Domino

Other On-Premise

Google Gmail

Yahoo Mail

Hotmail/MSN

Hosted Exchange/Exchange Online

Other

0,1%

4%

10%

3%

1%

1%

17%

Source: AMI - Australia Small Business Market Opportunity Assessment 2012 and AMI Cloud Playbook

65%

The Average Annual Spend on SaaS Cloud

Services

Source: AMI - Australia Small Business Market Opportunity Assessment 2012 and AMI Cloud Playbook

Future level of interest - SaaS

Accounting/ financials

Payroll

HR admin & benefits mgt.

CRM

ERP

Project management

Business intelligence/ analytics

9% 20%

15%

16%

23%

17%

20%

17%

Interested Neutral

18%

14%

16%

25%

26%

25%

Source: AMI - Australia Small Business Market Opportunity Assessment 2012 and AMI Cloud Playbook

Current Usage - IaaS

Servers

Virus protection, spam filtering and/or other security solutions

Data storage/ back-up

15%

12%

Source: AMI - Australia Small Business Market Opportunity Assessment 2012 and AMI Cloud Playbook

25%

Future level of interest - Iaas

Servers 13%

Virus protection, spam filtering and/or other security solutions

17%

27%

39%

Data storage/ back-up 25% 26%

Interested Neutral

Source: AMI - Australia Small Business Market Opportunity Assessment 2012 and AMI Cloud Playbook

Mobility Purchase Plans

Total

0.9

Avg #

1-4

0.6

5-9

1.1

10-19 20-49 50-99

1.2

2.6

3.1

Avg # 0.2

0.2

0.3

0.2

0.7

1.0

Avg # 0.7

0.5

0.9

1.0

2.0

2.2

Source: AMI - Australia Small Business Market Opportunity Assessment 2012 and AMI Cloud Playbook

Mobile Brands

Smartphones

Blackberry/RIM

Apple

HTC

Google Nexus

Samsung

Nokia

LG

Sony Ericsson

HP

Motorola

Huawei

5%

5%

5%

2%

2%

0,5%

0,3%

0,2%

0,02%

59%

50%

Tablets

Apple

Acer

Other

HP/Palm

Sony

Samsung

Toshiba

Blackberry/RIM

HTC

LG

Lenovo

Asus

Motorola

Viewsonic

4%

2%

2%

1%

1%

1%

0,5%

0,2%

18%

12%

11%

9%

4%

Source: AMI - Australia Small Business Market Opportunity Assessment 2012 and AMI Cloud Playbook

60%

Bundling, packaging and buying processes

Australia SMB: Highest Potential Revenue-Generating

Productivity/Collaboration Suite Bundles

Productivity/Collaboration Suite Market Impact

Hosted business email

Online storage capacity

Instant messaging and

PC-to-PC calling

Web conferencing

(Document

Collaboration)

ANY Remotely Managed

Service

Purchase

Probability

(% of Firms)

# of SMBs

Likely to

Purchase

(M)

Projected

Bundle

Annual

Revenues

($M)

$534 M $5/$3 per user per month

$5/$3 per user per month

$5/$3 per user per month

$5/$3 per user per month

$38 per device/unit per month

$38 per device/unit per month

$38 per device/unit per month

$38 per device/unit per month

39%

44%

41%

35%

0.22 M

0.03 M

0.01 M

0.001 M

$459 M

$207 M

$55 M

All market segments showing strong purchase probabilities from productivity/collaboration suite plus any remotely managed service bundle.

The largest revenue opportunities exist in the smaller businesses, due to market sizing.

This bundle may be especially attractive to businesses with mobile or remote workers.

Source: AMI - Australia Small Business Market Opportunity Assessment 2012 and AMI Cloud Playbook

Australia SMB: Highest Potential Revenue-

Generating UC Bundles

Unified Communications (UC) Market Impact

Instant

Messaging

Audio conferencing bridges

Video conferencing

Web conferencing

Hosted

VoIP

ANY Remotely

Managed Service

Purchase

Probability

(% of Firms)

# of SMBs

Likely to

Purchase

(M)

Projected Bundle

Annual Revenues

($M)

Included

Included

Included

Included

$12 per seat per month

$12 per seat per month

$12 per seat per month

$12 per seat per month

$38 per device/unit per month

$38 per device/unit per month

$38 per device/unit per month

$38 per device/unit per month

33%

35%

34%

19%

0.19 M

0.02 M

0.004 M

0.0003 M

$512 M

$429 M

$224 M

$47 M

UC bundles including IM, conferencing, hosted VOIP, and any remotely managed service allow SMBs to increase productivity of mobile and remote workers, while decreasing costs on travel, and attract interest across all employee-size segments.

Collectively, firms with less than 50 employees represent nearly $1B of revenue opportunity.

Source: AMI - Australia Small Business Market Opportunity Assessment 2012 and AMI Cloud Playbook

Cloud Profile <10 Employee Firms

Source: AMI - Australia Small Business Market Opportunity Assessment 2012 and AMI Cloud Playbook

Cloud Profile 10-49 Employee Firms

Source: AMI - Australia Small Business Market Opportunity Assessment 2012 and AMI Cloud Playbook

Cloud Profile 50-249 Employee Firms

Source: AMI - Australia Small Business Market Opportunity Assessment 2012 and AMI Cloud Playbook

Summary

• $17BN Opportunity – ICT spend by SMB’s in Australia by 2015

• Scale through breadth – Almost three quarters of SMB’s are sub 5 users

• Get Vertical - Agriculture, Mining, Transportation, Utilities, Construction is the largest vertical within SMB’s – find out their buying needs

• Decision Making – 57% of decisions on IT are made by those who don’t know IT – speak to your audience in a language they understand.

• Leverage you existing customers – Referral is the number one source cited by SMB’s when making technology decisions – turn your customers into your extended sales force.

• $3.2BN Cloud Opportunity – Cloud services for SMB’s in Australia by 2015 – cloud is a real revenue opporutnity

• Cloud is mainstream – 31% of SMB’s use hosted email, 57% use instant messaging services.

• Service aggregation – leverage the channel for hardware, smartphones, connectivity – become THE supplier to your customer

• Profiling and bundling is key – one size doesn’t fit all

*Includes web hosting

CALL TO ACTION – CONTACT AMI

Jackilyn Almazan JAlmazan@ami-partners.com

Tel: +65 6220 5535

In-depth market reports studied for this presentation -

• 2011/12 – Australian Small Business Market Opportunity Assessment

• 2010-11 Australia SMB Cloud and ICT Overview

• 2010-11 Australia SMB Cloud Strategic & Tactical Playbook

Visit the Microsoft Showcase:

See | Learn | Connect

Exhibitors & Sponsors Services & Devices

Infrastructure & Platforms Business Applications Immersion Experiences

To score this session

Your feedback is important to us

Visit aka.ms/connect