Audit Inquiries

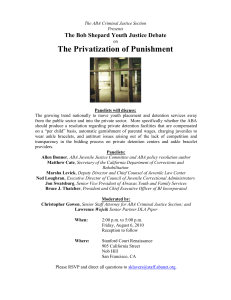

advertisement

Audit Inquiries MCLE Corporate Practice for the Paralegal March 4, 2008 The Role of Audit Inquiries in Preparation of Financial Statements Audited Financial Statements Loss Contingencies: FAS 5 Auditing Standards: SAS 12 Conflict with the lawyer’s duty not to disclose confidential client information without consent The ABA Statement of Policy The Treaty: established uniform standards reconciling the obligations of auditors and attorneys Sarbanes Oxley Act of 2002 Recommended Policy for Responding Adhere to the ABA Statement of Policy State that the response is in conformity with the ABA Policy Require a written request by client Respond only in writing and provide only the types of information contemplated by the ABA Policy Develop model forms and procedures and use them Designate lawyers with expertise as reviewers Procedures Analyze letter from client Companies covered Fiscal period to be covered Materiality threshold, if any Request for confirmation regarding consultation with the client regarding unasserted possible claims Deadline for response Requests regarding outstanding bills, unbilled time and disbursements Procedures (continued) Information requested Overtly threatened or pending litigation Identify pending cases Brief description of nature of litigation Client position Procedural status Avoid judgments as to outcome Procedures (continued) Assembling information Identify client files Identify attorneys and solicit information from them Determine effective date of response. Internal memorandum, 100% response needed Obtain and review descriptions of loss contingencies Gather information on status of client’s account The Audit Response Letter Use master form wherever possible. It’s an opinion letter Paralegal role may include preparation of a draft, including descriptions of loss contingencies provided by attorneys, and then submitting the draft for review by the responsible partner and/or reviewing attorney Updates Client request Same procedures Develop model response for update Some Common Mistakes Failure to include the names of all companies when searching for files Failure to include entire period covered by the audit in determining which attorneys needed to be contacted Omitting lawyers from the distribution list for the internal memorandum Marking up the prior year’s response rather than using the current master form Common Mistakes (continued) Addressing the response letter to an individual rather than the audit firm Failing to clarify what companies are covered by the response letter Omitting either paragraph 5, or if requested in the inquiry letter, paragraph 7 of the K&L Gates Master Form Specifying an “effective date” later than the “as of” date furnished by your Accounting Department Omitting any reference to any materiality threshold included in the inquiry letter. Common Mistakes (continued) Failing to get responses from all attorneys Failure to include all loss contingencies reported by the attorneys Failure to review or edit descriptions of loss contingencies for compliance with the ABA Statement of Policy