ICC Model International Sale Contract for Manufactured Products

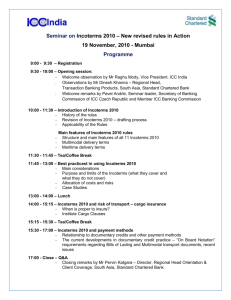

advertisement

ICC Romania one day Seminar on: ICC Model International Sale Contract for Manufactured Products ICC’s series of Model contracts is a unique set of trade tools, invaluable for experts, lawyers and students alike. Succinct and practical, they are fair and balanced for all parties by clearly presenting comprehensive sets of rights and obligations. The ICC Model International Sale Contract is the latest time-saving tool for traders, business people and lawyers involved in important import/export- and sales transactions. It applies mainly to the sale of manufactured goods but can serve as an example to work on for other types of products as well. Schedule Considerations for choosing the "right" Incoterms 2010 rule. What is the purpose of model contracts? How was this model drafted? What does the model say? How does the model work? This Seminar is a must for: Exporters and importers involved in trade with manufactured goods (intended for resale); bankers working in various fields of international trade finance such as in export/import finance, documentary credits, bank guarantees and standby letters of credit; specialists in trade finance; front office bank specialists, relationship managers; lawyers, advocates, academics. If you are involved in negotiations and sale transactions, this seminar is a must for you to attend. The ICC Model International Sale Contract is a time-saving tool for traders, business men, lawyers and all parties involved in important import/export- and cross-border sales transactions. It applies mainly to the sale of manufactured goods but can serve as an example to work on for other types of products as well. This concise model is fair and balanced for all parties involved by clearly presenting a comprehensive set of rights and obligations. Providing clear directions to sellers and buyers, its introduction takes the parties step-by-step through the process – from A to Z covering: - general characteristics of the contract - scope of application - termination of the contract - dispute resolution and more. This updated version takes into account recent developments in international business and trade finance. It incorporates the latest trade rules, ICC’s Incoterms® 2010, as well as the new Bank Payment Obligation (BPO) rules developed jointly by the ICC Banking Commission and SWIFT. Dates: 14 october 2014 Venue: Headquarters of the Chamber of Commerce and Industry of Romania Time: 09:00 – 16:30 Topic: Contract of Sale: ICC Model Sales Contract Practical seminar on contract of sale from practical point of view. Workshop will focus on practical usage of the ICC Model form with focus on main aspects of the contract such as payment terms, delivery terms, documentary evidence of the performance etc.. Topics: General aspects of the International Contract of Sale: o Main legal issues; o Main parts of the contract; o Main seller´s obligations; o Main buyer´s obligations; Scope of the ICC Model Sales Contract: o Scope of the application; o General terms and conditions; o Specific terms and conditions; o Delivery obligations; o Payment terms; ICC Model Sales Contract: o Termination of the contract; o Damages; o Dispute Resolution, Court litigation v. Arbitration o Questions and answers Material relevant to the course will be distributed and a certificate of attendance will be delivered to all those who completed the course. Lunch and coffee brakes will be provided during the Seminar. Seminar Language - English About the Trainer Mr. Pavel Andrle Mr. Andrle is a Secretary to the Banking Commission of ICC Czech Republic which he regularly represents at the ICC Banking Commission meetings abroad. He chaired the working groups of ICC CR which revised translations of UCP 500, UCP 600, eUCP, ISP98, URDG 758 and other Banking Commission documents as well as Incoterms 2010 into Czech language. He has been deeply involved in the revision of UCP as a member of UCP 600 Consulting group being formed by over forty experts from all over the world. He has been also closely involved in revision of URDG 758. He chaired the working group of ICC Czech Republic which translated the URDG 758 rules into Czech language. Nowadays he is a member of ICC Task Force on Guarantees, also a member of the new ICC Banking Commission Task Force for Forfaiting (regarding the new ICC rules for Forfaiting), and a member of the new ICC Banking Commission Consulting group for Rules on BPO. In the year 2011 he also served as a member of the ICC Banking Commission Group of Experts which drafted the official ICC Banking Commission Opinions on ICC Rules. Mr. Andrle worked closely with Mr. Miroslav Subert, a member of the Incoterms 2010 Drafting Group and Secretary of International Trade, Transport and Insurance commission of Czech Republic as his Assistant during the revision of Incoterms and cooperated in the official translation of Incoterms 2010 into Czech language. He has delivered numerous seminars on the Incoterms 2000 and Incoterms 2010, both in Czech Republic and abroad. Mr. Pavel Andrle is an international trade finance consultant and lecturer. He has worked for a number of leading local and international banks in various positions (for instance as trade finance specialist, head of trade finance, trade finance risk manager, in-house trainer). Frequent Lecturer in Documentary Credits, Bank Guarantees & Trade Finance for Bankovni Instititut Vysoka, Institute of Foreign Trade Transport & Forwarding, ICC CR and Economic Chamber of Commerce of Czech Republic. Regular facilitator in seminars abroad in English for ICC National Committees world-wide. Mr. Andrle has lead many seminars held in Bangladesh, Cambodia, Vietnam, India, Sri Lanka, Philippines, Singapore, Sierra Leone, Zambia, Uganda, South Africa, Nigeria, Poland, Albania, Slovakia, Ireland, Lithuania, Latvia, Bulgaria, Georgia, Greece, Turkey, Russia, Mongolia, Uzbekistan, Azerbaijan, China, Malta, Trinidad and Tobago, Dominica, etc. He is author of the publication „Documentary Credits – a Practical Guide“ published by Grada Publishing, a.s. He has written „Commentary to UCP500 in the light of ISBP and other ICC Banking Commission documents“, „Commentary to UCP600” (Czech language) and “Examination of Documents under Documentary Credits” (in English), all published by ICC CR. He is and appointed ICC CR expert to reply to enquiries related to Documentary Credits and Trade and Structured Finance – development of technical assistance consultancy services of ICC CR to banks, carrier, insurance companies and traders. It includes advisory services and in-house technical assistance in banks and companies. DOCDEX Expert of ICC Centre for Expertise with ICC International Arbitration Court, ICC Paris, arbitrator with Vilnius Arbitration Court, Lithuania. He is active trainer under Global Trade Finance programme of IFC (International Finance Corporation – a member of World Bank Group) as a consultant for the global training firm in international trade and finance GTI. Mr. Andrle is the lead tutor in the Finance of International Trade with the electronic Business School International. Currently, he is also studing LLM distance course on “International Trade Law” in Northumbria University in Newcastle, UK. Mr. Pavel Andrle can be contacted at pa@cmail.cz or andrle@icc-cr.cz