Unit #8 – Source Documents

advertisement

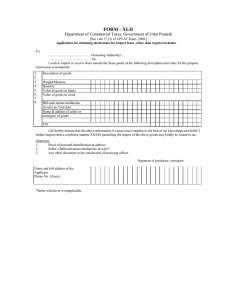

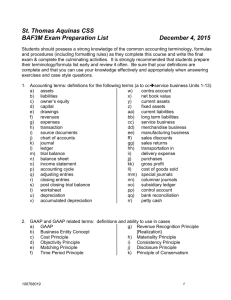

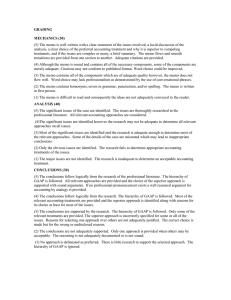

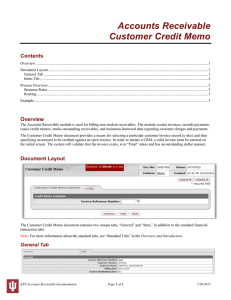

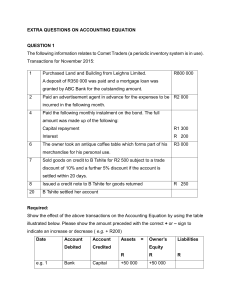

Source Documents Source Documents Companies use Source Documents (as evidence) and enter them into the General Journal to record all of the business’ transactions. Filed for future reference by accountants or the government GAAP REVIEW: The Objectivity Principle Accounting records should be based on the objective evidence provided by source documents to support the values used in recording transactions Source Documents There are 8 source documents that we will discuss Each source document is given for a different reason A hard copy (or digital copy) should always be kept on file GAAP – The Cost Principle The accounting for purchases must be at the cost price of the purchaser This is why we keep receipts – proof Example: Buy an office for $140,000 in 2006. In 2009 it has a value of $210,000. What is recorded in the books? Source Documents What are they? Cash sales slip Sales Invoice Dual purpose sales slip Purchase Invoice Cash Receipt List Cheque Copy Bank Debit Memo Bank Credit Memo Today’s Work Work with a group of 3-4 to fill out the handout you will be provided with For each source document When is it issued? When issued, what account is debited? When issued, what account is credited? Homework Page 147 #16 b,c QUIZ ON TUESDAY!