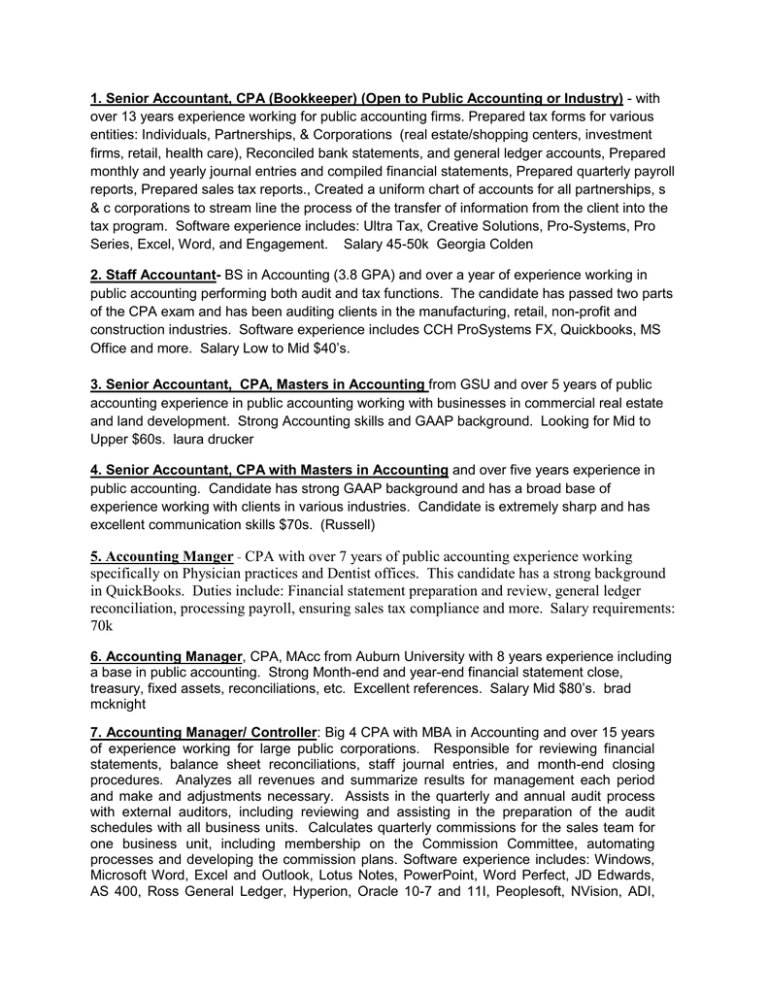

Hotlist 1-5-2011 with Names

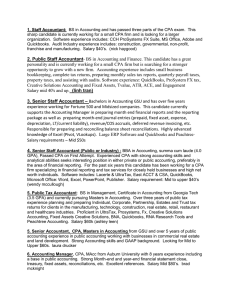

advertisement

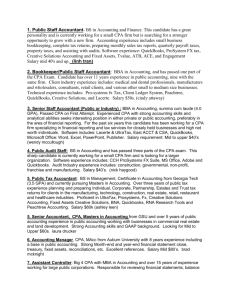

1. Senior Accountant, CPA (Bookkeeper) (Open to Public Accounting or Industry) - with over 13 years experience working for public accounting firms. Prepared tax forms for various entities: Individuals, Partnerships, & Corporations (real estate/shopping centers, investment firms, retail, health care), Reconciled bank statements, and general ledger accounts, Prepared monthly and yearly journal entries and compiled financial statements, Prepared quarterly payroll reports, Prepared sales tax reports., Created a uniform chart of accounts for all partnerships, s & c corporations to stream line the process of the transfer of information from the client into the tax program. Software experience includes: Ultra Tax, Creative Solutions, Pro-Systems, Pro Series, Excel, Word, and Engagement. Salary 45-50k Georgia Colden 2. Staff Accountant- BS in Accounting (3.8 GPA) and over a year of experience working in public accounting performing both audit and tax functions. The candidate has passed two parts of the CPA exam and has been auditing clients in the manufacturing, retail, non-profit and construction industries. Software experience includes CCH ProSystems FX, Quickbooks, MS Office and more. Salary Low to Mid $40’s. 3. Senior Accountant, CPA, Masters in Accounting from GSU and over 5 years of public accounting experience in public accounting working with businesses in commercial real estate and land development. Strong Accounting skills and GAAP background. Looking for Mid to Upper $60s. laura drucker 4. Senior Accountant, CPA with Masters in Accounting and over five years experience in public accounting. Candidate has strong GAAP background and has a broad base of experience working with clients in various industries. Candidate is extremely sharp and has excellent communication skills $70s. (Russell) 5. Accounting Manger - CPA with over 7 years of public accounting experience working specifically on Physician practices and Dentist offices. This candidate has a strong background in QuickBooks. Duties include: Financial statement preparation and review, general ledger reconciliation, processing payroll, ensuring sales tax compliance and more. Salary requirements: 70k 6. Accounting Manager, CPA, MAcc from Auburn University with 8 years experience including a base in public accounting. Strong Month-end and year-end financial statement close, treasury, fixed assets, reconciliations, etc. Excellent references. Salary Mid $80’s. brad mcknight 7. Accounting Manager/ Controller: Big 4 CPA with MBA in Accounting and over 15 years of experience working for large public corporations. Responsible for reviewing financial statements, balance sheet reconciliations, staff journal entries, and month-end closing procedures. Analyzes all revenues and summarize results for management each period and make and adjustments necessary. Assists in the quarterly and annual audit process with external auditors, including reviewing and assisting in the preparation of the audit schedules with all business units. Calculates quarterly commissions for the sales team for one business unit, including membership on the Commission Committee, automating processes and developing the commission plans. Software experience includes: Windows, Microsoft Word, Excel and Outlook, Lotus Notes, PowerPoint, Word Perfect, JD Edwards, AS 400, Ross General Ledger, Hyperion, Oracle 10-7 and 11I, Peoplesoft, NVision, ADI, FRX, FSG Financial Reporting, Citrix. Salary requirement: $90K +/- (Carole Barnett) 8. Senior Internal Auditor: Executive MBA, Multi-lingual (Spanish, Portuguese, conversational Italian) and over seven years of progressive audit experience working for Large Multi-billion dollar organizations (Manufacturing & Telecom). Candidate has fraud detection experience and strong international audit experience including Asia, Europe, Latin America and North America. Strong Financial, operational, Sox and compliance audit experience. Candidate is a road warrior and willing to travel up to 75%. Software experience includes: JD Edwards One World, lotus notes, MS Office and more. Green Belt certified – Six Sigma. Salary upper $80s. Sandra Garotti 9. Senior Tax Accountant: BS in Management, Certificate in Accounting from Georgia Tech (3.5 GPA) and currently pursuing Masters in Accounting. Over three years of public tax experience planning and preparing Individual, Corporate, Partnership, Estates and Trust tax returns for clients in the manufacturing, technology, construction, real estate, retail, restaurant and healthcare industries. Proficient in UltraTax, Prosystems, Fx, Creative Solutions Accounting, Fixed Assets Creative Solutions, BNA, Quickbooks, RNA Research Tools and Peachtree Accounting. Salary $60k (ashley leen) 10. Senior Tax Accountant – Big 4, CPA, FAS 109 (industry only): BS in Accounting, and over four years experience working for a Big 4 firm. Currently preparing and reviewing both consolidated and separate company, federal and multi-state, partnership and corporate tax returns. Experience preparing FAS 109 tax provisions and FIN 48 analysis for audited financial statements of private and publicly traded corporations. Identifying and analyzing the tax effects of specific company transactions, such as the tax establishment and purchase of subsidiaries, in order to ensure positive business decisions. Salary – Upper $70s. (sasan) 11. Tax Manager Big 4, CPA: BS in Accounting and MTx from GSU and over 20 years of experience with multi-national, multi-state corporate tax and public accounting environments. Strong background in FAS 109 & FIN 48, Corporate Income Tax, Tax Audits and Consolidated Federal/Multi-State/Unitary. Salary $115K. 12. SEC Reporting Manager, Big 4 CPA with Masters in Accounting: Responsible for all internal and external consolidated financial reporting. Coordinates with external consultants and regional finance teams on the planning and execution of global Sarbanes-Oxley compliance projects. Ensures compliance with audit documentation standards. Drafts filings for SEC Form 10Q's and 10K’s including footnote and MD&A preparation. Prepares ad hoc reporting and analysis for senior management. Implements policies and procedures around FAS 123R analysis and disclosure. (dan pham) 13. Audit Manager, CPA with over 14 years of experience including a base in public accounting. Candidate currently managers the internal audit and compliance function for a publicly held company. Works closely with external auditors during the annual audit, and performs reviews and audits of Forms 10K and 10Q prior to filing, and Identified internal and external risks and created audit procedures to address those risks and ensure compliance. Currently manages a team of 10-15 professionals. Salary requirement: Mid $90s. 14. Cost Accounting Manager/Plant Controller - CPA: Financial Controller with extensive Global Financial Management, Corporate Shared Service, Startup/ Acquisition, and ERP Project Management Experience. Demonstrated ability for driving operational improvement, maximizing working capital and leading cross-functional teams. Tremendous business acumen, process improvement and business integration abilities. BS in Accounting and MBA from University of Illinois Over 15 Years experience working for Domestic and International manufacturers Developed percentage of completion process and maintained bank relations. Implemented cash control processes. Wrote and implemented policies and procedures to ensure adequate system of internal controls for SOX compliance. Selected financial and labor collection systems. Developed and implemented IT strategies for both entities. Developed financial reporting system for parent company in the Netherlands Salary: $100,000/Year ( RUSSELL)