Accounting

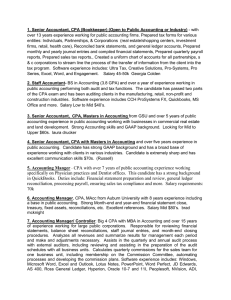

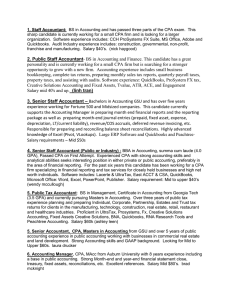

advertisement

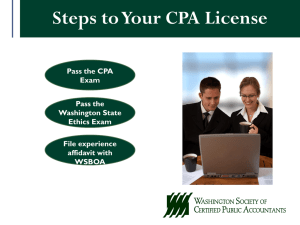

University of Toledo College of Business Administration Department of Accounting George Mutter, Visiting Instructor Accounting Degrees Associate Degree in Accounting Technology – 2 year Degree Bachelor of Business Administration (BBA) in Accounting – 4 year degree Masters of Science in Accountancy (MSA) – 30 semester hour program Beta Alpha Psi • University of Toledo’s Gamma Epsilon Chapter chartered in 1966 •Founded in 1919 at the University of Illinois, Urbana. •Premier professional business and financial information fraternity • Recognizes academic excellence • Provides interaction among students, faculty, and professionals Where Accountants Work Public Practice Business/Industry Government Non-Profit Organizations Colleges/Universities Careers in Accounting Corporate Accounting Audit Assurance Services – (E-Commerce, risk assessment, IS assessment) Environmental Accounting – Environmental compliance issues Forensic Accounting – Searches for evidence of criminal conduct Information Technology Services International Accounting Consulting Services Personal Financial Planning Tax advisory Service Accounting Educators Becoming a CPA Most requirements are determined by the state/jurisdiction in which you hope to practice. In general, this is a summary of the steps to CPA licensure. Education Exam Experience • Accounting degree • 150 semester hours • Apply to sit based on state requirements • Pass all 4 parts with a 75% or higher • 1-2 years in accounting • Under a CPA Becoming a CPA Education requirements – A baccalaureate degree and 150 semester hours • 30 semester hours in accounting • 24 semester hours in business courses other than accounting Exam Requirement – 4 sections (Business, Audit, Regulation and Financial) Experience Requirement – 1-2 years under a CPA Reciprocity between states Accounting is consistently one of the hottest jobs for new graduates, according to the National Association of Colleges and Employers. Figure 1: Top Jobs for the Class of 2009 Job Function Teaching Management Trainee Financial/Treasury Analysis Consulting Sales Accounting (Public) Accounting (Private) Software Design & Development Registered Nursing Project Engineering Source: AICPA Starting Salary Offer $35,496 $41,353 $52,043 $56,472 $41,577 $49,437 $45,859 $63,798 $45,229 $58,570 Positions in Demand By Robert Half International •Tax Accountants •Achieve bottom-line savings •Starting salaries $33,596 - $40,532 •Financial Analyst •Financial plans, forecasts, budgets and identifying ways to improve profitability • Senior and Staff Accountants •Manage ongoing accounting needs • Starting salaries $30,562 - $37,498 • 1-3 years experience $34,897 - $46,601 •Business Analyst •Translate operational and competitive data to improve decision making Recent salary ranges in accounting are: Recent salary ranges in accounting are: Big 4 Firm Overall Typical Experience Entry Level $55,000 $50,000 - 70,000 First year Junior Staff Accountant $46,000 - 63,000 $40,000 - 80,000 1-2 years Senior Staff Accountant $65,000-95,000 $70,000 3-5 years Manager Senior Manager $65-140,000 $72-160,000 $85,000 $115,000 5-7 years 7 years plus Partner $200,000 - 3,000,000 $150,000 10 years plus http://careers-in-accounting.com/acsal.htm Questions?