Hotlist 1-18-2011 with Names

advertisement

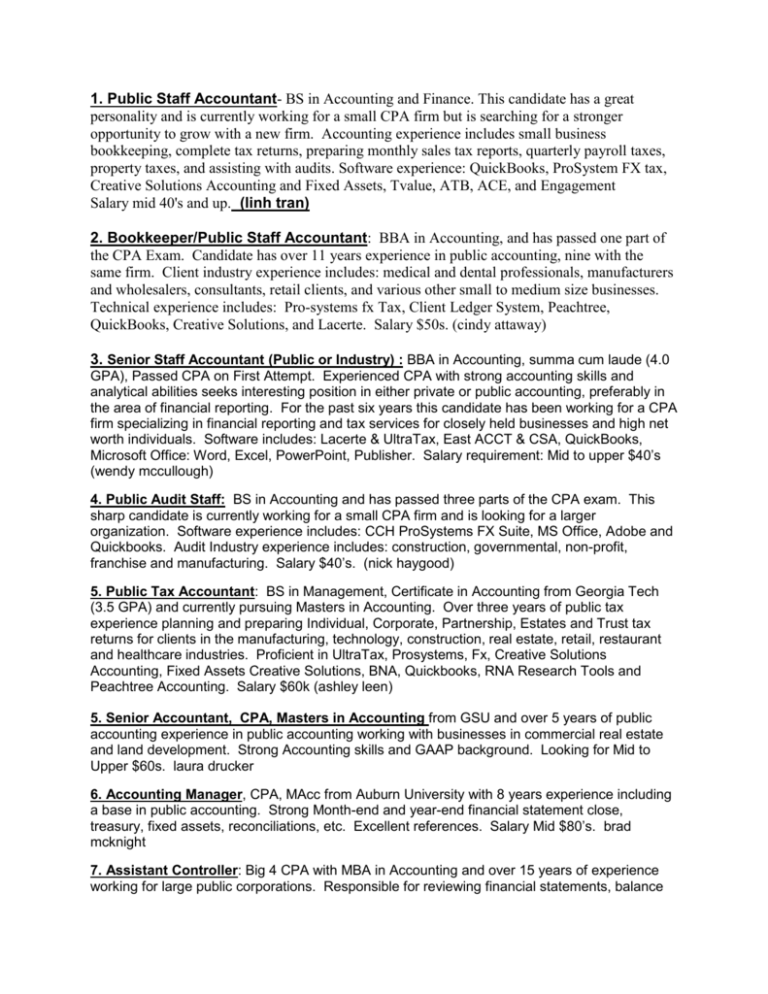

1. Public Staff Accountant- BS in Accounting and Finance. This candidate has a great personality and is currently working for a small CPA firm but is searching for a stronger opportunity to grow with a new firm. Accounting experience includes small business bookkeeping, complete tax returns, preparing monthly sales tax reports, quarterly payroll taxes, property taxes, and assisting with audits. Software experience: QuickBooks, ProSystem FX tax, Creative Solutions Accounting and Fixed Assets, Tvalue, ATB, ACE, and Engagement Salary mid 40's and up. (linh tran) 2. Bookkeeper/Public Staff Accountant: BBA in Accounting, and has passed one part of the CPA Exam. Candidate has over 11 years experience in public accounting, nine with the same firm. Client industry experience includes: medical and dental professionals, manufacturers and wholesalers, consultants, retail clients, and various other small to medium size businesses. Technical experience includes: Pro-systems fx Tax, Client Ledger System, Peachtree, QuickBooks, Creative Solutions, and Lacerte. Salary $50s. (cindy attaway) 3. Senior Staff Accountant (Public or Industry) : BBA in Accounting, summa cum laude (4.0 GPA), Passed CPA on First Attempt. Experienced CPA with strong accounting skills and analytical abilities seeks interesting position in either private or public accounting, preferably in the area of financial reporting. For the past six years this candidate has been working for a CPA firm specializing in financial reporting and tax services for closely held businesses and high net worth individuals. Software includes: Lacerte & UltraTax, East ACCT & CSA, QuickBooks, Microsoft Office: Word, Excel, PowerPoint, Publisher. Salary requirement: Mid to upper $40’s (wendy mccullough) 4. Public Audit Staff: BS in Accounting and has passed three parts of the CPA exam. This sharp candidate is currently working for a small CPA firm and is looking for a larger organization. Software experience includes: CCH ProSystems FX Suite, MS Office, Adobe and Quickbooks. Audit Industry experience includes: construction, governmental, non-profit, franchise and manufacturing. Salary $40’s. (nick haygood) 5. Public Tax Accountant: BS in Management, Certificate in Accounting from Georgia Tech (3.5 GPA) and currently pursuing Masters in Accounting. Over three years of public tax experience planning and preparing Individual, Corporate, Partnership, Estates and Trust tax returns for clients in the manufacturing, technology, construction, real estate, retail, restaurant and healthcare industries. Proficient in UltraTax, Prosystems, Fx, Creative Solutions Accounting, Fixed Assets Creative Solutions, BNA, Quickbooks, RNA Research Tools and Peachtree Accounting. Salary $60k (ashley leen) 5. Senior Accountant, CPA, Masters in Accounting from GSU and over 5 years of public accounting experience in public accounting working with businesses in commercial real estate and land development. Strong Accounting skills and GAAP background. Looking for Mid to Upper $60s. laura drucker 6. Accounting Manager, CPA, MAcc from Auburn University with 8 years experience including a base in public accounting. Strong Month-end and year-end financial statement close, treasury, fixed assets, reconciliations, etc. Excellent references. Salary Mid $80’s. brad mcknight 7. Assistant Controller: Big 4 CPA with MBA in Accounting and over 15 years of experience working for large public corporations. Responsible for reviewing financial statements, balance sheet reconciliations, staff journal entries, and month-end closing procedures. Analyzes all revenues and summarize results for management each period and make and adjustments necessary. Assists in the quarterly and annual audit process with external auditors, including reviewing and assisting in the preparation of the audit schedules with all business units. Calculates quarterly commissions for the sales team for one business unit, including membership on the Commission Committee, automating processes and developing the commission plans. Software experience includes: Windows, Microsoft Word, Excel and Outlook, Lotus Notes, PowerPoint, Word Perfect, JD Edwards, AS 400, Ross General Ledger, Hyperion, Oracle 10-7 and 11I, Peoplesoft, NVision, ADI, FRX, FSG Financial Reporting, Citrix. Salary requirement: $90K +/- (Carole Barnett) 8.Senior Corporate Accountant: Big 4 CPA with Large Public Company Accounting experience. Candidate has over 8 years of very strong experience in the field of accounting and finance which includes 2 years of public accounting experience with a Big 4 Firm. Candidate has strong hands on experience with Revenue Recognition (SOP 97-2) and month end close and general ledger maintenance and has done a lot of process improvements in her current and previous roles which has resulted in significant positive revenue impact and also resulted in significant reduction in time required to compete the tasks on a monthly basis. Software: MS Office applications including: Word, Excel, Access and PowerPoint in a Windows Operating environment and have very good working knowledge of SAP, PeopleSoft and Hyperion Essbase. Salary $80’s. 9. Financial System Analyst: Responsible for the development and maintenance of the management reporting application as well as serving as a technical subject matter expert in assisting management in the evaluation, launch and support of new reporting and dashboard applications. Understand and assisting in influencing the Essbase databse and Hyperion (Financial Reporting Mgmt) structure to meet the reporting needs of customers in the most optimal way. Software experience includes: JD Edwards, Oracle, SAP, SYSPRO, Hyperion, Lotus notes, MS Office and more. Leadership training achievement - Six Sigma – Best Training. Salary: upper $80s. (sonya perry – af) 10. Senior Internal Auditor: Executive MBA, Multi-lingual (Spanish, Portuguese, conversational Italian) and over seven years of progressive audit experience working for Large Multi-billion dollar organizations (Manufacturing & Telecom). Candidate has fraud detection experience and strong international audit experience including Asia, Europe, Latin America and North America. Strong Financial, operational, Sox and compliance audit experience. Candidate is a road warrior and willing to travel up to 75%. Software experience includes: JD Edwards One World, lotus notes, MS Office and more. Green Belt certified - Six Sigma. Salary: upper $80s. 11. Internal Audit Manager (Financial & Operational Audit experience): CPA/MBA with Fortune 500 Audit, Big 4 and Regional Public Accounting Experience and over six years experience. Currently Plans, executes, operational, financial, and strategic audits for in accordance with GAAS. Big 4 Audit Experience includes: Completed 10K & 10Q audits of public companies in accordance with GAAS Mentored audit staff and performed detail review in accordance with GAAP Performed SOX 404 process narrative and test of controls procedures Experienced industries include: Telecom, Manufacturing, Banking, Financial Services 12. Audit Manager, CPA with over 14 years of experience including a base in public accounting. Candidate currently managers the internal audit and compliance function for a publicly held company. Works closely with external auditors during the annual audit, and performs reviews and audits of Forms 10K and 10Q prior to filing, and Identified internal and external risks and created audit procedures to address those risks and ensure compliance. Currently manages a team of 10-15 professionals. Salary requirement: Mid $90s (brent davis) 13. Audit Manager, CPA: (Big 4 & Fortune 500 Audit Experience): with a Masters in Accounting with 7+ years’ experience building and directing best in class auditing divisions. Successfully combines solid strategic planning, analytical thinking, and creative problem solving skills with outstanding finance qualifications. Strong Consumer Products and Retail audit background. Software experience MS Office Suite, Enterprise Reporting Tool, AS/2 Software, CERTUS, Hyperion Essbase. (Alicia Wilson) 14. Tax Manager, CPA – BS in Accounting from UGA with over seven years of progressive public accounting experience. Duties include: Review C-corporation, S-corporation, partnership, high net worth individuals and gift tax returns. Responsible for calculating quarterly estimated tax payments and preparing various tax payment vouchers for corporations and individuals. Research various tax issues and prepare memoranda. Review payroll, sales & use, and property tax returns. Assist clients with and prepare responses to various Internal Revenue Service and state tax notices. Software experience includes: Quickbooks, Word, Excel, PowerPoint, GoSystem Tax, RIA Checkpoint, CCH Research Tools, Peachtree Accounting Software, BNA Income Tax Planner. (Leslie Holley) 15. SEC Reporting Manager, Big 4 CPA with Masters in Accounting: Responsible for all internal and external consolidated financial reporting. Coordinates with external consultants and regional finance teams on the planning and execution of global Sarbanes-Oxley compliance projects. Ensures compliance with audit documentation standards. Drafts filings for SEC Form 10Q's and 10K’s including footnote and MD&A preparation. Prepares ad hoc reporting and analysis for senior management. Implements policies and procedures around FAS 123R analysis and disclosure. (dan pham)