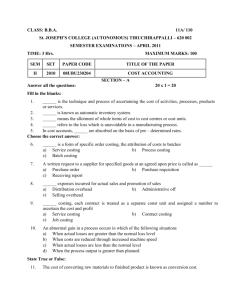

cost & mgt accounting - E

advertisement