The unorganized sector

advertisement

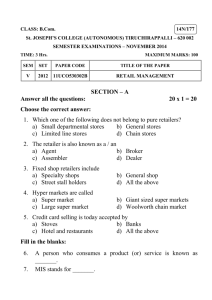

STRATEGIC ISSUES IN RETAILING 1 STRATEGIC ISSUES IN RETAILING At the end of this module, the learning outcomes are • Understand the history of Indian retailing sector • Emerging trends • Understand the strategic drivers of this industry • Understand the challenges the organized retailer faces 2 STRATEGIC ISSUES IN RETAILING Background • Organized retailing • New to India • Excess of 5 million retail outlets • Comprises of both organized and unorganized sector • Organized sector market share is less than 10% 3 STRATEGIC ISSUES IN RETAILING • Large market • Fragmented • Only 7% of the 5 million retail outlets have annual sales in excess of 10 lacs per annum. 4 STRATEGIC ISSUES IN RETAILING Barriers to entry for organized sector • The unorganized sector • Retail margin • Supply chain management • Sourcing economies • Automobile ownership • Infrastructure • Middle class psyche • Large-scale diversity 5 STRATEGIC ISSUES IN RETAILING The unorganized sector • Unorganized retailing • Long history • Many centuries • Local kirana/grocer dominant • Low-cost structure • Saves on real-estate/labor costs • Little or no taxes to pay • Consumer familiarity 6 STRATEGIC ISSUES IN RETAILING Organized sector • • • • • • • • Large overheads Compete with grocer on prices Facilities Airconditioning Power backup Home delivery High inventory costs taxes 7 STRATEGIC ISSUES IN RETAILING Retail margin • • • • 10 to 12% average for grocers in India 25-35% in developed countries Grocer can survive How organized retailer will survive with 1012% margin? • High overheads 8 STRATEGIC ISSUES IN RETAILING Supply chain management • Product availability • Inefficient transportation systems • Makes modern retailing difficult • Absence of economies of scale • Impacts cost 9 STRATEGIC ISSUES IN RETAILING Sourcing economies • Absence of large scale retailers • Diseconomies of scale • Unable to negotiate large discounts with suppliers 10 STRATEGIC ISSUES IN RETAILING Automobile ownership • Limited to 4% of the population • Makes out-of-town shopping difficult • Limits large scale purchases difficult for customers • Large scale shopping is the essence of shopping in organized retail stores. 11 STRATEGIC ISSUES IN RETAILING Infrastructure • Parking limitations • High local government taxes • Frequent power failures • Efficient logistics difficult • Adds to costs 12 STRATEGIC ISSUES IN RETAILING Middle class psyche • Consumer psychology • Larger stores are expensive • Partially a myth • Local grocer still cheaper 13 STRATEGIC ISSUES IN RETAILING Large scale diversity • India, a culture of diversity • Diversity leads to dependence on local suppliers • Match local tastes • Discourages economies of scale • Unfavorable to organized sector 14 STRATEGIC ISSUES IN RETAILING Early entrants in organized sector • Bata • Raymonds • Vimal – Mostly franchisee route – Overcome high real estate costs • Later new breed of players 15 STRATEGIC ISSUES IN RETAILING • • • • • Shoppers Stop Future group Entry of large houses Deeper pockets Success of cooperative chains 16 STRATEGIC ISSUES IN RETAILING The Changing scenario • Changing lifestyles • Increasing disposable incomes • Lesser and lesser time to devote to numerous shopping trips • Lesser trips • Larger size of purchase per trip • Concentration of middle class • Moving away from city to suburbs 17 STRATEGIC ISSUES IN RETAILING • Mall culture setting in • New players • Restrictions on foreign retailers 18 STRATEGIC ISSUES IN RETAILING FUTURE SUCCESS IMPERATIVES Clear value proposition • Big Bazaar • Clear value propositions • ‘Is se sasta koi nahin’ 19 STRATEGIC ISSUES IN RETAILING Plain imitations of western models • Tendency to imitate western models • Will not always work • Different environmental conditions • Failure of Nanz 20 STRATEGIC ISSUES IN RETAILING Strong cost focus • Higher costs for organized sector • Low-margin business • Cost control critical • Longer gestation period 21 STRATEGIC ISSUES IN RETAILING Private labels • Popular in western countries • Why retailers promote • Higher margins than national brands • Threat to national brands • Source of additional revenue to retailers 22 STRATEGIC ISSUES IN RETAILING Building royalty/CRM • Building loyalty • Identifying profitable customers • Use of CRM techniques 23 STRATEGIC ISSUES IN RETAILING Price • As market matures • Price a key differentiating factor • Higher value for money 24 STRATEGIC ISSUES IN RETAILING Value cost leveraging • Create greater customer value at higher costs • Leverage that value proposition to generate volumes • Repeat purchases • Greater volumes means greater contribution • Leads to higher profits 25 STRATEGIC ISSUES IN RETAILING • • • • Local suppliers Diversity of customers More suppliers Local suppliers have advantage over traditional suppliers 26 STRATEGIC ISSUES IN RETAILING Trends • International trends • Food and grocery • Largest segment • More than 40% of the market 27 STRATEGIC ISSUES IN RETAILING FAILURE OF SUPERMARKETS • Why Nanz failed • Poor understanding of consumer behavior • What went wrong • three factors 28 STRATEGIC ISSUES IN RETAILING Three factors • Lack of clear value proposition • Falling prey to sourcing diseconomies • Ignoring the merchandizing mix 29 STRATEGIC ISSUES IN RETAILING Lack of clear value proposition • Nanz a late entrant • Large unorganized retail players • High real estate costs and other overheads • Low efficiency • No clear positioning to customers 30 STRATEGIC ISSUES IN RETAILING Consumer insights • Staples and perishables • Major part of the budget • Decides whether outlet is cheap/expensive • 70% of the consumers do their daily shopping at one place • If staples are not bought, consumers are unlikely to buy other products 31 STRATEGIC ISSUES IN RETAILING Falling prey to sourcing diseconomies • Imitating western models • Centralized warehouse • Use of technology • High overheads • High volume required • Difficult in single stores • Major reason of failure 32 STRATEGIC ISSUES IN RETAILING Ignoring the merchandizing mix • Profitable products • Working on average gross margin • Cannot be same on every product • Sourcing from farmers • Eliminating middleman 33