Accounting-Chapter

advertisement

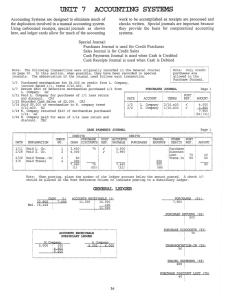

Chapter 9-Purchases & Cash Payments Merchandising Businesses This is a business that buys goods and then resells them Service and merchandising businesses use many of the same accounts Merchandising businesses have additional accounts on their financial records for the purchase and sale of merchandise Forming a Corporation Some businesses need larger amounts of capital that cannot be as easily acquired as a proprietorship Corporation: an organization with the legal rights of a person, which many persons or other corporations own Share of Stock: each unit of ownership in a corporation Stockholder: the owner of one or more shares of stock Subsidiary Ledgers & Controlling Accounts Vendor: a business from which merchandise, supplies or other assets are purchased Subsidiary Ledger: a ledger that summarizes a single general ledger account Accounts Payable Ledger: contains all the vendor accounts The check to make sure that your accounts payable ledger is correct is if all the account balances added together equal the balance you have in the Accounts Payable Account Do working together 9-1, page 248 Accounting for Purchasing of Merchandise We are now going to be using special journals for recording our transactions There are 5 journals we will be using: o Purchases Journal o Cash Payments Journal o Sales Journal o Cash Receipts Journal o General Journal We will focus on Purchases and Cash Payments Journals for this chapter The Purchases Journal will be used to record all transactions where items are purchased It will only record purchases made, nothing else!!! The special amount column in the Purchases Journal puts the amount to 2 different places; Purchases & Accounts Payable Terms of Sale: an agreement between buyer and seller about payment for merchandise Terms of Sale are often abbreviated like this, n/30, meaning that the net (total bill) is due within 30 days of the date printed on the statement Look at the transaction example on page 253 Do working together 9-2, page 254 Posting for Purchases Journal Posting for all the special journals is done the same as the posting we have done in the past When you post the totals for the Purchases Journal you have to make sure you post the total in 2 places; Debit to Purchases & Credit to Accounts Payable Under the total for the Purchases Journal you will put two account numbers; the one for Purchases (5110) and one for Accounts Payable (2110) Do working together 9-3, page 259 Accounting for Cash Payments Cash Payments Journal Used to record only cash payment transactions Trade Discount o Catalogs and Internet sites are set-up to describe the products sold o The list price is the price printed in the catalog or listed on the Internet site and the price you would pay o Often manufacturers will grant a discount to someone buying in bulk o This discount is given so that they don’t have to print two catalogs or maintain two websites o A trade discount will be written as a percentage such as; 30% , 40% etc. o With a trade discount the invoice will only show the discounted price and not the original listed price Cash Discount o This is a discount given to encourage prompt payment by a customer o So the terms of sale written to a customer receiving a cash discount may look something like this: 2/10, n/30 (meaning a 2% discount will be given if the bill is paid in full within the first 10 days, if not the net of the bill is due in 30 days) o Recording of this discount is done in the cash payments journal, using the accounts payable debit column, purchases discount credit column, and cash credit column o Look at example on page 263 o Look at the other examples for transactions on pages 261, 262, 264 and 265 o Do working together 9-4, page 266 Posting for Cash Payments Journal o Posting for cash payments journal is done the same as all the other posting we have done o Once you have all your posting done you will complete a Schedule of Accounts Payable o The schedule lets you know all your posting to accounts payable ledger were correct. o Remember if the total of your Schedule of Accounts Payable = the total amount in your Accounts Payable account in your general ledger Do working together 9-5, page 273 Do application problems 9-1, 9-2, 9-3, 9-4, 9-5 & 9M Once done with application problems test over chapter 9