Lesson 9 - Chapter 9

advertisement

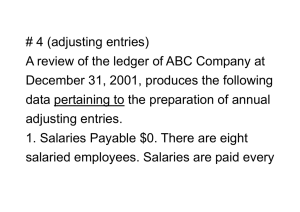

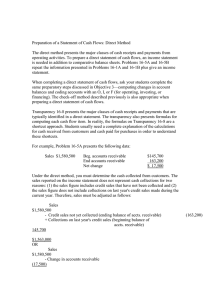

Accounting for a Service Company Record Transactions Prepare a Trial Balance Make Adjusting Entries Prepare an Adjusted Trial Balance Financial Statements & Other Financial Records • Income Statement • Balance Sheet • Statement of Cash Flows • Journal • Ledger Closing Owner Investments Purchases Make Payments Sales Receive Payments Use Record Deposits tool Journal Entry Your Name Checking(Cash) Opening Balance Equity (Capital Account) Use Write Checks tool Journal Entry Supplies Cash Purchases on Account - Credit Purchases Use Enter Bills tool to record purchase Use Pay Bills tool to record payment Journal Entry - Purchase Supplies Accounts Payable Journal Entry - Payment Accounts Payable Cash Use the Record Deposits tool Journal Entry Cash (Your Name Checking) Sales Use the Invoices tool to record sale Use the Receive Payments tool to record customer payments Use the Record Deposits tool to record deposits Journal Entries Accounts Receivable Sales Cash Accounts Receivable Used with frequently recurring transactions Transactions have some static (non-changing) data Saves time entering data Record with Edit>Memorize Bill or Ctrl + M Recall with Lists>Memorized Transactions List or Ctrl + T, then double-click the transaction to use Recorded at the end of the accounting period Brings certain account balances up to date prior to preparing the financial statements Record in QuickBooks using Company>Make General Journal Entries 1. 2. 3. The Trial Balance indicates a balance of $800 in the Supplies account. A physical count of supplies shows that the company has $250 of supplies on hand. Prepare the adjusting entry to update the appropriate accounts. The company purchased an automobile for $20,000 to be used in the business. The automobile is expected to have a useful life of 5 years and a salvage value of $5,000. Prepare the adjusting entry to update the appropriate accounts. The company has a $12,000 note payable. Interest is to be paid when the note matures, but accrues annually at a rate of 6%. Prepare the adjusting entry to update the appropriate accounts. Prepare as of the last day in the fiscal period Income Statement – Shows the results of operations over a period of time (revenue – expenses) Balance Sheet – Shows a company’s financial position as of a particular point in time (assets = liabilities + equity) Statement of Cash Flows – shows how and why the Cash account has changed over a period of time Close accounts in QuickBooks by setting the Closing Date • Company>Set Closing Date Close temporary Accounts • Revenue • Expenses • Income Summary • Drawing/Dividends