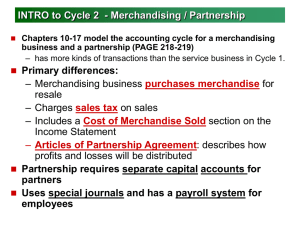

Special Journals: Purchases and Cash Payments

advertisement

Special Journals: Purchases and Cash Payments Chapter 17 Using the Purchases Journal • Purchases journal is for recording purchases on account. (Not just merchandise but anything on account) • Enter date the invoice was received not the date it was prepared Pg 482 Purchases of Merchandise On account Purchases of Non Merchandise On account Pgs 483-484 Posting Merchandise Posting Non-Merchandise Pgs 485-486 Proving and Ruling Special Amount Columns Posting Column Totals Pgs 486-487 Using the Cash Payments Journal • The cash payments journal is used to record all transactions in which cash is paid out or decreased. Pg 489 Cash Payment for Prepaid Insurance Cash Payment for Purchases Cash Payment on Account Payable Pgs 490-491 Cash Payment for Transportation In Cash Paid for Salaries Cash Payment of Miscellaneous Expenses such as Bank service charges Pgs 492-493 Cash Payment of Bank Card Fees Pg 494 Posting Payment to an Accounts Payable Posting Transactions From the General Column Accounts payable payments and payments to accounts journalized in the general column are posted individually on a daily basis. Pgs 495, 497 Proving and Ruling the Cash Payments Journal Pg 498 Posting Column Totals of the Cash Payments Journal Prove and rule the journal Once debits and credits equal General Column Totals Don’t get posted. Totals are posted once A month Pg 499 Schedule of Accounts Payable • Used to make sure that the amount in the controlling account, Accounts Payable, it the same as the account totals in the Subsidiary Ledger. Pg 500 Proving Cash • Proving Cash is the process of verifying that cash recorded in the accounting records (cash ledger) agrees with the amount in the checkbook (check stub). Pg 501