Chapter 1: Finance and the Firm

advertisement

Finance and

the Firm

1

Learning Objectives

The field of finance

The duties of financial managers

The basic goal of a business firm

Legal and ethical challenges for

financial managers

Forms of business organization

2

The Field of Finance

Financial Management

– Analyze and forecast a firm’s

performance

– Evaluate investment opportunities

Financial Markets and Institutions

– The flow of funds through institutions

– Markets in which financial assets are sold

– Impact of interest rates on that flow of

funds

Investments

– Locate, select, and manage money

producing assets.

3

Financial Statements

Balance Sheet

Assets

Liabilities

Equity

Liabilities and equity represent sources of

funds.

Assets represent uses of funds.

Liabilities represent a debt claim.

Equity represents an ownership claim.

4

Financial Management

Capital Budgeting

Capital Structure Policy

Working Capital Management

5

Financial Management

ST Assets

ST Liabilities

LT Assets

LT Liabilities

Equity

Capital Budgeting

Deals with the firm’s investment

in long-term real assets

e.g., in what projects should the

firm invest?

6

Financial Management

ST Assets

ST Liabilities

LT Assets

LT Liabilities

Equity

Capital Structure Policy

Deals with long-term financing of

the firm’s activities

e.g., what mix of long term debt

and equity will the firm use?

7

Financial Management

ST Assets

ST Liabilities

LT Assets

LT Liabilities

Equity

Working Capital Management

Deals with management of short-term

(current) assets.

e.g., will the firm purchase supplies on

credit or pay cash?

8

Investments

Looks at financial analysis from

perspective of investor

Stockholders are owners of the firm

Bondholders are creditors of the firm

From investor’s perspective, what

matters is the rate of return on a security

Risk-return tradeoff: Investors prefer high

returns to low returns and low risk to high risk.

From the firm’s perspective this rate of return

represents a cost of funds.

9

Financial Markets and Institutions

Financial markets and institutions facilitate the

flow of funds in the economy

This makes society more productive, thus

increasing social welfare

Topics include:

How interest rate levels are determined

How the Fed controls the money supply

Relationships between macroeconomic

variables such as inflation, interest rates,

money supply and GDP.

10

Duties of Financial Managers

Measure a firm’s performance

Forecast financial consequences

Recommend new investment

Locate external financing

Recommend best financing mix

Determine financial expectations of

owners

11

Basic Goal of the Business Firm

The primary financial goal of the

business firm is to maximize the

wealth of the firm’s owners (or the

value of the firm).

This is not necessarily the same as

“maximizing profits”.

12

Maximizing the "value” of a

firm?

The value of a firm is determined by

the discounted value of all future

expected cash flows derived from

the firms business activities.

The financial manager should make

decisions that cause this value to be

maximized.

Value depends on future prospects

and risk.

13

Factors that affect the value of a

firm’s stock price:

Cash flows

– Necessary to pay the bills

– Not the same as sales or profits

Timing of cash flows

– Cash received sooner is better than cash

received later

Risk

– Definite cash inflows are generally

preferred to uncertain cash inflows

14

Legal and Ethical Challenges

Agency issues

Managers are agents for the firm’s

owners but they may have interests

that conflict with those owners.

These agency conflicts impose costs

(such as the cost of accounting audits).

Interests of non-owner stakeholders

Workers, creditors, suppliers,

customers, and others are not owners,

but may have a stake in the business.

15

Legal and Ethical Challenges

The interests of society as a whole may

not coincide with the interests of owners

of a firm.

Costs of disposing of toxic waste reduce

owners’ profits.

There may be goodwill generated by

voluntary actions that benefit society.

Sometimes the right thing must be done in

spite of the cost to the company

Government often imposes rules that

force companies to respond to the best

interests of society.

16

Forms of Business Organization

Sole Proprietorship

Advantages

• Easily Established

• Minimal Organizational Costs

• Keep all Generated Profits

Disadvantages

• Unlimited Liability

• Losses absorbed by owner

• Limited Capital

• Limited Life

17

Forms of Business Organization

General Partnership

Advantages

• Minimal Organizational Requirements

• Negligible Government Regulations

Disadvantages

• Unlimited Liability

• Must be Dissolved or Reorganized if a

Partner Leaves or Dies

18

Forms of Business Organization

Limited Partnership (LP)

Two classes of partners

• General Partners

• Limited Partners

Every partnership must have at

least one general partner

19

Forms of Business Organization

Limited Partnership (LP)

General Partners

Advantages

•Participate actively in management

•More favorable allocation of

ownership/profit/losses

Disadvantages

•Unlimited Liability

20

Forms of Business Organization

Limited Partnership (LP)

Limited Partners

Advantages

•Limited liability

Disadvantages

•not active in management

•less favorable allocation of

ownership/profit/losses

21

Forms of Business Organization

Limited Liability Partnership (LLP)

Similar to General Partnership

•operates like a corporation

•limited liability

•partnership not taxed

•income passed through to

partners and partners are taxed

22

Forms of Business Organization

Corporation

A legal “person” separate and distinct

from its owners

•

•

Advantages

– Limited Liability

– Permanency

– Transferability of Ownership

– Better Access to Capital

Disadvantages

– Double Taxation

– Time and Cost of Incorporation

23

Forms of Business Organization

Limited Liability Company (LLC)

A form of business organization that is a

state-approved, unincorporated association.

•

Advantages

– Limited Liability

– No Double Taxation

•

Disadvantages

– Relatively New - Some Legal

Issues Not Yet Defined

24

Homework Questions

1. What is the fiduciary responsibility of an agent?

2. What is meant by double taxation?

3. Explain which type of business organization form affords the most

control to the owner?

4. Why would someone choose a limited partnership share over a

sole proprietorship?

5. How do agency problems arise? What are some examples of

agency problems? What can corporations do to monitor these costs?

25

Financial Markets

and Interest Rates

26

Learning Objectives

•

•

•

•

•

Operation of U.S. financial system.

Financial securities.

Function of financial intermediaries.

Financial markets.

Securities traded in the money and capital

markets.

27

The Financial System

The purpose of the financial system is to

bring together individuals, businesses,

and government entities (economic units)

that generate and spend funds.

Surplus economic units have funds left over

after spending all they wish to spend.

Deficit economic units need to acquire

additional funds to sustain their operations.

28

The Financial System

• To enable funds to move through the financial

system, funds are exchanged for securities.

• Securities are documents that represent the

right to receive funds in the future.

• Financial intermediaries discussed in Chapter 3

often help to facilitate this process.

29

Financial Markets

• Classified according to the characteristics

of participants and securities involved.

• The primary market is where deficit

economic units sell new securities to raise

needed funds.

30

Financial Markets

The Circular Flow of Income

Funds

Primary

Market

Securities

Primary Market handles IPO’s (new public offerings)

31

Financial Markets

• Classified according to the characteristics

of participants and securities involved.

• The primary market is where deficit

economic units sell new securities.

• The secondary market is where investors

trade previously issued securities with each

other.

32

Financial Markets

Funds

Secondary

Market

Securities

The Circular Flow of Income

33

Financial Markets

• Money Market vs. Capital

Market

34

Financial Markets

• Money Market

– Trade short term (1 year or less) debt instruments (e.g.

T-Bills, Commercial Paper)

– Major money centers in Tokyo, London and New York

• Capital Market

– Trades long term securities (Bonds, Stocks)

– NYSE, ASE, over-the-counter (Nasdaq and other OTC)

35

Financial Markets

Intermediaries such as commercial banks and

insurance companies help to facilitate the

flow of funds in the financial marketplace.

$$

Securities

Securities

$$

36

Market Efficiency

• Market efficiency refers to the ease, speed, and

cost of trading securities.

– The market for the securities of large companies is

generally efficient: Trades can be executed in a

matter of seconds and commissions are very low.

– The real estate market is not generally efficient: It

can take months to sell a house and the commission is

6-7% of the price.

37

Market Efficiency

Why is market efficiency important?

– The more efficient the market, the easier it

is to transfer idle funds to those parties that

need the funds.

– If funds remain idle, this results in lower

growth for the economy and higher

unemployment.

– Investors can adjust their portfolios easily

and at low cost as their needs and preferences

change.

38

Securities in the Financial Market

• Money Market Securities

– Highly liquid, low risk

– Treasury Bills (T-Bills)

– Certificates of Deposit (CDs)

– Commercial Paper

– Eurodollars

– Banker’s Acceptances

39

Securities in the Financial Market

• Money Market Securities

– Highly liquid, low risk

– Treasury Bills (T-Bills)

– Certificates

of Deposit

(CDs)issued by the

• T-Bills:

are short-term

securities

Federal

government.

– Commercial

Paper

• After initial

sale, they have an active secondary

– Eurodollars

market.

– Banker’s Acceptances

• They are bought at a discount and at maturity

the investor receives the full face value.

40

Securities in the Financial Market

• Money Market Securities

– Highly liquid, low risk

– Treasury Bills (T-Bills)

– Certificates of Deposit (CDs)

• Negotiable

CDs: are

interest-bearing securities

– Commercial

Paper

issued

by financial institutions.

– Eurodollar

• They have maturities of one year or less.

– Banker’s Acceptances

41

Securities in the Financial Market

• Money Market Securities

– Highly liquid, low risk

– Treasury Bills (T-Bills)

– Certificates of Deposit (CDs)

– Commercial Paper

• Commercial

paper: is unsecured debt issued

– Eurodollars

by corporations

with good credit ratings.

– Banker’s Acceptances

• Most buyers are large institutions.

42

Securities in the Financial Market

• Money Market Securities

– Highly liquid, low risk

– Treasury Bills (T-Bills)

– Certificates of Deposit (CDs)

– Commercial Paper

– Eurodollars

• Eurodollars:

areAcceptances

dollar denominated, deposits,

– Banker’s

located in non-US banks.

• Buyers and sellers are large institutions.

43

Securities in the Financial Market

• Money Market Securities

– Highly liquid, low risk

– Treasury Bills (T-Bills)

– Certificates of Deposit (CDs)

– Commercial Paper

– Eurodollars

– Banker’s Acceptances

•Banker’s Acceptances: are debt securities that

have been guaranteed by a bank. They are used

44

to facilitate international transactions.

Securities in the Financial Market

• Money Market Securities

– Highly liquid, low risk

– Treasury Bills (T-Bills)

– Certificates of Deposit (CDs)

– Commercial Paper

– Eurodollars

– Banker’s Acceptances

45

Securities in the Financial Market

• Capital Market Securities

– Bonds

•Bonds:

are “IOUs” issued by the borrower and

sold to investors.

• The issuer promises to repay the

face amount on the maturity date and to pay

interest each year in the amount of the coupon

rate times the face value.

46

Securities in the Financial Market

Capital Market Securities

– Bonds

Treasury

Bonds

• Treasury

Bonds:

are issued by the federal

Municipal Bonds

government.

Corporate

Bonds

• Municipal

Bonds:

are issued by state and local

governments.

• Corporate Bonds: are issued by corporations.

47

Securities in the Financial Market

Capital Market Securities

– Stock

• Companies can also raise funds by selling

shares of stock

48

Securities in the Financial Market

Capital Market Securities

– Stock

Common

Stock

• Common

stockholders:

own a portion of the

company and can vote on major decisions.

• They receive a return on their investment in

the form of dividends and capital gains.

49

Securities in the Financial Market

Capital Market Securities

– Stock

Common Stock

Preferred Stock

• Preferred stockholders do not generally have

voting rights, but have priority in receiving

dividends and are paid dividends at a pre-set

rate.

50

Interest Rates

Interest Rates Determined by

– Real Rate of Interest

– Expected Inflation

– Default Risk

– Maturity Risk

– Illiquidity Risk

51

Interest Rates

Real

Rate of Interest

– Compensates for the lender’s lost

opportunity to consume.

52

Interest Rates

Default Risk

– For most securities, there is some risk that the

borrower will not repay the interest and/or

principal on time, or at all.

– The greater the chance of default, the greater

the interest rate the investor demands and the

issuer must pay.

53

Interest Rates

• Expected Inflation

Inflation erodes the purchasing power of

money.

Example: If you loan someone $1,000 and

they pay it back one year later with 10%

interest, you will have $1,100. But if prices

have increased by 5%, then something

that would have cost $1,000 at the outset

of the loan will now cost $1,000(1.05) =

$1,050.

54

Interest Rates

• Maturity Risk

If interest rates rise, lenders may

find that their loans are earning

rates that are lower than what they

could get on new loans.

The risk of this occurring is higher

for longer maturity loans.

55

Interest Rates

• Maturity Risk

Lenders will adjust the premium they

charge for this risk depending on

whether they believe rates will go up or

down.

56

Interest Rates

• Illiquidity

Investments that are easy to sell

without losing value are more liquid.

Illiquid securities have a higher

interest rate to compensate the

lender for the inconvenience of

being “stuck.”

57

Determination of Rates

k = k* + IRP + DRP + MP + ILP

k

k*

IRP

DRP

MP

IlP

= the nominal, or observed rate

on security

= real rate of interest

= Inflation Risk Premium

= Default Risk Premium

= Maturity Premium

= Illiquidity Premium

58

Interest Rates

• Term Structure

Relationship between long and

short

term interest rates

Yield curve

59

Treasury Yield Curve

8.00%

7.50%

3 month

T-Bill

7.00%

6.50%

6.00%

5.50%

5.00%

Jan 10, 2006

4.50%

4.00%

3.50%

3

6

mos

.

1

yr.

2

3

5

7

10

20

maturities

60

Treasury Yield Curve

8.00%

7.50%

7.00%

6 month

T-Bill

6.50%

6.00%

5.50%

5.00%

Jan 10, 2006

4.50%

4.00%

3.50%

3

6

mos

.

1

yr.

2

3

5

7

10

20

maturities

61

Treasury Yield Curve

8.00%

7.50%

1 year

T-Bill

7.00%

6.50%

6.00%

5.50%

5.00%

Jan 10, 2006

4.50%

4.00%

3.50%

3

6

mos

.

1

yr.

2

3

5

7

10

20

maturities

62

Treasury Yield Curve

8.00%

7.50%

2 year

T-Note

7.00%

6.50%

6.00%

5.50%

5.00%

Jan 10, 2006

4.50%

4.00%

3.50%

3

6

mos

.

1

yr.

2

3

5

7

10

20

maturities

63

Treasury Yield Curve

8.00%

7.50%

7.00%

6.50%

6.00%

3 year

T-Note

5.50%

5.00%

Jan 10, 2006

4.50%

4.00%

3.50%

3

6

mos

.

1

yr.

2

3

5

7

10

20

maturities

64

Treasury Yield Curve

8.00%

7.50%

7.00%

6.50%

5 year

T-Bond

6.00%

5.50%

5.00%

Jan 10, 2006

4.50%

4.00%

3.50%

3

6

mos

.

1

yr.

2

3

5

7

10

20

maturities

65

Treasury Yield Curve

8.00%

7.50%

7.00%

6.50%

6.00%

5.50%

5.00%

Jan 10, 2006

4.50%

4.00%

3.50%

3

6

mos

.

1

yr.

2

3

5

7

10

20

maturities

66

Treasury Yield Curve

8.00%

7.50%

7.00%

6.50%

6.00%

5.50%

5.00%

Jan 10, 2006

March 22,1995

August 1, 2008

4.50%

4.00%

3.50%

3

6

mos

.

1

yr.

2

3

5

7

10

20

maturities

67

Homework Questions

1. Would the default premium on an investment grade corporate bond

be higher or lower than that on a junk bond? Explain.

2. Explain the difference between a dealer and a broker.

3. The more liquid the financial instrument, the wider the spread

between the bid and ask price. Explain why you agree or disagree

with this statement.

4. The economy is suffering from a recession, explain what will

happen to the yield spread between a Treasury bond and a BBB rated

corporate bond.

5. Explain how you earn a return on a Treasury bill. How is this

different from the manner in which you earn a return on a Treasury

note or bond?

68

Financial

Institutions

69

Learning Objectives

• The role of financial intermediaries.

• Commercial banks and the impact of reserve

requirements.

• Federal Reserve regulation of financial

institutions.

• The difference between savings and loans and

commercial banks.

• Operation of credit unions.

• Distinguish among finance companies, insurance

companies, and pension funds.

70

The Role of Financial Institutions

as Intermediaries (“Middle Persons”)

• A household with surplus funds can “purchase”

a savings account at a financial institution. The

bank, S&L, or credit union channels those

surplus funds to a firm, government entity, or a

household that needs them.

• In this way, small surplus units can be packaged

together to meet the needs of large deficit

economic units.

71

Services offered by

Financial Institutions

•

Denomination matching

72

Services offered by

Financial Institutions

• Denomination matching

– Households generally have small amounts of

surplus funds to invest. They can put small

amounts into savings at a time.

73

Services offered by

Financial Institutions

• Denomination matching

– Households generally have small amounts of

surplus funds to invest. They can put small

amounts into savings at a time.

– Those who need loans usually require larger

amounts of funds. They can borrow for

business purposes, or to buy a home or

automobile.

74

Services offered by

Financial Institutions

• Maturity Matching

– Household and business savers generally want

to lend for only a short time. Savings and

checking accounts are usually available for

immediate withdrawal.

75

Services offered by

Financial Institutions

• Maturity Matching

– Household and business savers generally

want to lend for only a short time. Savings

and checking accounts are usually available

for immediate withdrawal.

– Borrowers often want long-term financing.

Institutions can give 30 year mortgages and

long-term loans to businesses and

government entities.

76

Services offered by

Financial Institutions

• Absorbing Credit Risk

– Individual lenders cannot easily evaluate the

credit risk of borrowers. They also cannot

generally afford to take the risk of losing

their limited savings.

77

Services offered by

Financial Institutions

• Absorbing Credit Risk

– Individual lenders cannot easily evaluate the

credit risk of borrowers. They also cannot

generally afford to take the risk of losing their

limited savings.

– Institutions have the necessary expertise and

also are in a better position to absorb an

occasional loss.

78

The Role of Financial Institutions

Intermediaries help to facilitate the

flow of funds in the financial marketplace.

$$

Securities

Securities

$$

79

Financial Intermediation

Example 1

$$

Businesses

Commercial

loans

Checking

accounts

Commercial

Bank

Households

$$

80

Financial Intermediation

Example 2

Insurance

policies

$$

Insurance

Company

Businesses

Stocks,

Bonds

Households

$$

81

Types of Financial

Institutions

• Commercial Banks

82

Types of Financial Institutions

• Commercial Banks

The primary purpose of commercial banks

is to take in business deposits and to lend

funds to businesses.

83

Types of Financial Institutions

• Commercial Banks

• Savings and Loans

84

Types of Financial Institutions

• Commercial Banks

• Savings and Loans

Savings and loans’ primary purpose is to

take in deposits from households and to

lend funds for home mortgages.

85

Types of Financial Institutions

• Commercial Banks

• Savings and Loans

• Credit Unions

86

Types of Financial Institutions

• Commercial Banks

• Savings and Loans

• Credit Unions

Credit Unions are owned by depositors

(actually share owners) who are individuals,

not businesses. Credit Unions take in

funds and primarily make personal loans.

87

Types of Financial Institutions

• Commercial Banks

• Savings and Loans

• Credit Unions

}

Depository

Institutions

88

Types of Financial Institutions

• Commercial Banks

• Savings and Loans

• Credit Unions

}

Depository

Institutions

•Take in deposits

•Make loans

89

Types of Financial Institutions

• Finance Companies

90

Types of Financial Institutions

• Finance Companies

Non-bank firms that borrow funds to

make short and medium term loans to

higher risk borrowers.

91

Types of Financial

Institutions

• Finance Companies

• Insurance Companies

92

Types of Financial Institutions

• Finance Companies

• Insurance Companies

Receive premiums for insurance policies.

This pool of funds is used to reimburse policyholders

who incur losses that are covered under the policy .

Life Insurers: Insure against financial

hardship caused by death.

Property and Casualty: Insure against

damage to person and property (health, autos,

homes, theft, earthquake, etc.)

93

Types of Financial Institutions

Finance Companies

Insurance Companies

Pension Funds

94

Types of Financial Institutions

• Finance Companies

• Insurance Companies

• Pension Funds

Workers and/or employers

contribute funds. Defined Benefit

Plans (DBP) versus Defined

Contribution Plans (DCP).

95

Types of Financial Institutions

• Finance Companies

• Insurance Companies

• Pension Funds

}

NonDepository

Institutions

96

Types of Financial Institutions

• Finance Companies

• Insurance Companies

• Pension Funds

}

NonDepository

Institutions

•Funds come from borrowing,

selling insurance policies, and

other claims.

•Funds used to buy securities

and make loans.

97

Reserve Requirement of Depository

Institutions

• A specified percentage of deposits must be

held as non-earning reserves.

• Required by the Fed.

• Insures that institutions have some liquidity

to meet demand for withdrawals and helps

to control the money supply.

98

Simplified Balance Sheet of

Commercial Bank

Reserves

Deposits

Investments

Borrowed Funds

Loans

Bank Capital (Equity)

Fixed Assets

99

The Federal Reserve System

• The Fed is the central bank of the United

States

• Created in 1913

100

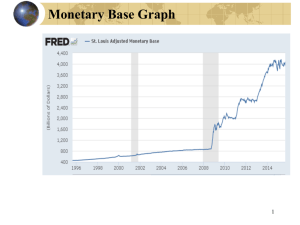

Purpose of the Fed

Monetary authority

i.e., control the money supply

101

Purpose of the Fed

Monetary authority

i.e., control the money supply

Lender of last resort

Fed makes “discount loans” to depository

institutions

102

Purpose of the Fed

Monetary authority

i.e., control the money supply

Lender of last resort

Fed makes “discount loans” to depository

institutions

Check clearing

103

Purpose of the Fed

Monetary authority

i.e., control the money supply

Lender of last resort

Fed makes “discount loans” to

depository institutions

Check clearing

Bank Supervision

104

Structure of the Fed

• Board of Governors

– Seven members

– Located in Washington, DC

• Federal Open Market Committee (FOMC)

– Board of Governors plus five district Federal

Reserve Bank presidents

– Located in Washington, DC

• Twelve Federal Reserve Banks

– Corresponding to twelve districts

• Member Banks

105

How the Fed Influences Interest Rates

• Open Market Operations

• Discount Rate Policy

• Reserve Requirements

106

Open Market Operations

• The Fed buys and sells government securities

in the open market.

• Buying securities increases the money supply

which tends to decrease interest rates.

• Selling securities decreases the money supply

which tends to increase interest rates.

107

T-bills

The Fed

$

The public

When the Fed buys T-Bills

108

When the Fed buys T-Bills

T-bills

The Fed

$

The public

Reserves are

injected into

the economy

109

When the Fed buys

T-bills

Bank reserves increase.

110

When the Fed buys T-bills

Bank reserves increase.

This makes banks more willing to

lend, increasing the supply of

loanable funds.

111

When the Fed buys T-bills

Bank reserves increase.

This makes banks more willing to

lend, increasing the supply of

loanable funds.

{Supply of LF }

{i }

112

When the Fed buys T-bills

• Bank reserves increase.

• This makes banks more willing to lend,

increasing the supply of loanable funds.

• {Supply of LF }

{i }

• Fed decreases rates when it wants to

stimulate the economy.

113

T-bills

The Fed

$

The public

When the Fed sells T-Bills

114

When the Fed sells T-Bills

T-bills

The Fed

$

The public

Reserves are

extracted from

the economy

115

When the Fed sells

T-bills

Bank reserves decrease

116

When the Fed sells T-bills

Bank reserves decrease

This makes banks less willing to

lend, decreasing the supply of

loanable funds.

117

When the Fed sells T-bills

Bank reserves decrease

This makes banks less willing to

lend, decreasing the supply of

loanable funds.

{Supply of LF }

{i }

118

When the Fed sells T-bills

• Bank reserves decrease

• This makes banks less willing to lend,

decreasing the supply of loanable funds.

• Fed raises rates when it wants to slow the

economy down.

{Supply of LF

}

{i

}

119

Discount Rate Policy

When the Fed increases the

discount rate

This increases the cost of funds to

borrowing depository institutions,

causing them to increase the rates they

charge.

120

Discount Rate Policy

• When the Fed increases the discount rate

– This increases the cost of funds to borrowing

depository institutions, causing them to

increase the rates they charge.

• When the Fed decreases the discount rate

– This decreases the cost of funds to

borrowing depository institutions, causing

them to decrease the rates they charge.

121

Reserve Requirements

When the Fed increases reserve

requirements

– This decreases the amount of funds

available for lending

122

Reserve Requirements

When the Fed increases reserve

requirements

– This decreases the amount of funds

available for lending

– {Supply of LF

}

{i

}

123

Reserve Requirements

When the Fed increases reserve

requirements

– This decreases the amount of funds

available for lending

– {Supply of LF

}

{i }

When the Fed decreases reserve

requirements

– This increases the amount of funds

available for lending

124

Reserve Requirements

• When the Fed increases reserve requirements

– This decreases the amount of funds

available for lending

– {Supply of LF }

{ i}

• When the Fed decreases reserve requirements

– This increases the amount of funds available

for lending

– {Supply of LF }

{ i}

125

The Federal Reserve

• As the central bank of the United States,

“The Fed” regulates the financial system,

the nation’s money supply, and makes

loans to financial institutions.

• The Fed consists of twelve district banks,

the Federal Open Market Committee,

and the Board of Governors. The latter

two are located in Washington DC.

126

The Fed Influences Interest Rates by:

• Buying and selling federal securities (“open market

operations”).

– Selling (buying) securities reduces (increases) the money supply

which tends to increase (decrease) interest rates.

• Discount rate

– Increasing the cost of funds to financial institutions tends to

increase the rates they charge.

• Reserve Requirements

– Increasing (decreasing) the amount of non-earning reserves that

must be held makes funds less (more) available and generally

more (less) costly.

127

Homework Questions

1. Explain how the Fed lowers and raises the federal funds

rate.

2. What is the discount window?

3. The Federal Reserve is concerned about a continuing

recession; what will they most likely do and how will they

accomplish this?

4. What would happen to the standard of living if financial

institutions did not exist? Why?

5. Interest rates are about to rise in the near future.

Explain how this would impact a negative interest-rate

spread of a financial institution.

128