Chapter 13 PowerPoint Presentation

advertisement

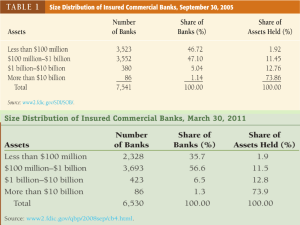

Banking Industry • Number of banks ~7,000 decreasing (result of consolidation, deregulation and failures) • Number of branches ~90,000 (result of relaxed geographical restrictions) • About 4,000 are small banks (< $100 million in assets) • The large banks in our economy have mostly gotten there by means of mergers and acquisitions. 1 Banks vs. Branches (1920-2010) 2 Balance Sheet for a Commercial Bank Uses of Funds (Assets) Sources of Funds (Liabilities + Capital) Cash Assets (8%) Deposit Liabilities (69%) FF sold/Rev repos (4%) Borrowed Funds (16%) Investments (19%) Other Liabilities (3%) Loans & Leases (55%) Subordinated Notes & Deben (1%) Premises (1%) Capital Accounts (11%) Other (13%) (See pp. 411 & 417) 3 First Three Items on Left Cash Assets (8%): • Vault cash (physical currency and coin) • Reserves at the Fed Fed Funds Sold/Rev repos (4%): • Fed Funds sold • Reverse Repurchase Agreements Investments (19%): cushion in case need more liquidity • U.S. Treasury securities • Agency securities • Municipal bonds 4 Fourth Item on Left Loans and Leases (55%) Loans commercial and industrial real estate agricultural consumer Leases fast-growing line of business for the big banks fleet assets (aircraft, ships,..), rolling stock (railroad cars, trucks,..), equipment (cranes, generators,..) 5 First Two Items on Right Deposit Liabilities (69%): • Transaction Deposits • Savings Deposits • Time Deposits (retail and negotiable CDs) Borrowed Funds (16%): • Fed Funds purchased • Repurchase Agreements • Eurodollars (dollars borrowed abroad) • Discount Window loans 6 Last Two Items on Right Subordinated Notes and Debentures (1%) • Subordinated to claims of depositors Capital Accounts (11%) • Paid-in capital (from sale of stock) • Retained earnings 7 Capital Adequacy • Capital adequacy ratio: Core Equity Capital a percentage like 6-10% Risk-weighted Assets • Numerator is subordinated notes & bonds + capital stock + retained earnings • Denominator is a weighted average of assets • Riskfree, weight of 0.0 • Very risky assets like CDOs, weight of 1.0 • Everything else, weight in between 8 Five ‘C’s of Credit • Five “C”s of Credit: Character (willingness to pay) Capacity (cash flow) Capital (wealth or net worth) Collateral (security for the loan) Conditions (economic conditions) 9 Base Rate Pricing • Markups to base rate include adjustments for default risk, term-to-maturity, and competitive factors. rL = BR + DR + TM + CF • In this way, business loans can vary from customer to customer. • BR could be prime rate, Libor, or a T-bill rate. • Loan pricing is one of most important managerial decisions is banking. 10 Fixed Income Securities (a) Fixed income securities – pay a return according to a fixed formula. Although payment amounts can vary, formula is known in advance. Issued by governments and corporations that are designed to pay contractually a specified income over a specified time horizon. Fixed income securities generally carry lower returns because of their guaranteed income characteristics. 11 Different Balance Sheet Treatments Generally used by people for income purposes rather than for capital appreciation (as in stock market). Assets Liabilities Capital on issuer’s books in here 12 Things for Final Last third of course. 5 Cs 3 base rate adjustments What TIPS stands for 6 types of MM instruments Names of 3 ratings agencies Latest National Debt and Social Security Trust fund figures 2.7 trillion 13 + 5 trillion = 18 trillion Other numbers: 3.7 trillion 550 billion (approx) Know meaning of the word “notional” – principal or face value amount Know about Commodity Futures Modernization Act Questions end Dec 9 midnight. 13