Slide 0 - University of Michigan

advertisement

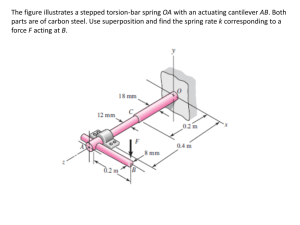

SIAM…Supply Market Dynamics Strategies for Dealing with the New Steel Supply Chain SIAM 3rd Biennial Complexity Symposium University of Michigan--Dearborn Platts Steel Markets Daily Joe Innace, US Managing Editor October 10, 2008 0 Global steel dynamics… Some background: The steel industry has been transformed in recent years and the massive expansion of the Chinese economy has helped drive a huge increase in steel consumption and production, which has pushed prices to record highs. Large segments of the industry were privatized only relatively recently, and the global steel industry is now maturing along the same lines as aluminum and oil. Consolidation has created a new landscape, and a group of high profile, profit-driven steel producers. Steel market is huge: 3rd largest after crude oil and natural gas The Platts mission: Bring clarity and independence to steel price discovery. 1 A more volatile market… • Explosive market growth in an $800 billion industry • Steel is a 1.2 billion tonne market (up 50% since 1999) and 400 million mt traded globally each year • Consumers are searching for ways to manage steel price volatility. • Traditionally HRC hovered around $200-300/mt but peaked at over $1,150 in July 2008 2 • Steel demand and prices move over a business cyclical but many of the uses of steel are seasonal (construction) • Manufacturers of steel goods are suffering from low-priced imports - ‘Made in China Syndrome.’ • No way to manage raw material costs leading to ‘Cost/Price Squeeze’ North American consolidation… N. American sheet market: Estimated annual spot/contract tonnage million short tons Company Estimated spot st/year Estimated contract st/year Total Arcelor Mittal (including Dofasco) 7 13 20 US Steel (including Stelco) 11 9 20 Nucor* 6 6 12 United States 2008 Source: Platts Steel Markets Daily 3 North American consolidation… N. American sheet market: Estimated annual spot/contract tonnage million short tons Estimated spot st/year Estimated contract st/year Total Severstal NA (Rouge) and SeverCorr (including Sparrows Point) 3.5 3.5 7 AK Steel 2.5 3.5 6 Steel Dynamics* 2 1 3 Wheeling-Pittsburgh (Esmark) (Severstal acquiring) 2 0.5 2.5 Company United States 2008 Source: Platts Steel Markets Daily 4 North American consolidation… N. American sheet market: Estimated annual spot/contract tonnage million short tons Company Estimated spot st/year Estimated contract st/year Total Delta 1.7 0 1.7 WCI Steel (being acquired by Severstal) 0.5 1 1.5 Gallatin 1.4 0 1.4 Duferco-Farrell 1 0 1 Beta Steel 1 0 1 39.6 37.5 77.1 1.8 0.2 2 United States Subtotal US Canada Algoma (Essar) North American total Source: Platts Steel Markets Daily 5 79.1 From price stability to volatility… % change in U.S. HRC price month on month 30% 25% 20% 15% 10% 5% 0% -5% -10% -15% 1974 1980 Source: Platts Steel Markets Daily and WSD 6 1986 1992 1998 2004 2008 An exposed supply chain … Mills Exposed Prices are moved by trade flows outside mill control Traders Exposed Contracts are cancelled when prices move unexpectedly Service centers Exposed End-users Exposed Customers increasingly look to imports for better deal Consumers Forced into ‘spot’ market as contracts revised Financial Community Own shares in mills and distributors M&A activity OTC products 7 Benefits of risk management … The value of price transparency • Transparency builds Trust • Consumers know prevailing price levels, allowing both parties to focus attention on strategic issues- job completion, new product development, long term planning, etc. • Transparency sustains Dialogue between buyer and seller • Potential customers are going to shop around anyway •Transparency benefits Price Discovery 8 Benefits of risk management … The value of forward prices and financial contracts • Offset price risks …mitigate risk of price volatility • Protect operating margins • Stabilize long-term financials – Locks in future cash flow – Reduces cost of capital (Improved credit ratings) • The ability to manage short-term/seasonal price fluctuations can make long-term contracts more stable 9 Managing risk …. Automotive A parts stamper is bidding on new business to supply an automotive customer The customer—maybe a carmaker, perhaps a bigger manufacturer—is negotiating with parts stampers to supply it with a vehicle body component. The customer, in effect, is outsourcing its steel supply to the parts stamper. The parts stamper plans on sourcing steel directly from steel mills, but at this point in its bidding process for the business is unable to secure a fixed price quote for steel. This leaves the parts stamper exposed to significant price risk. 10 Managing risk … Automotive Options: This limits the stamper’s options: •Quote a fixed price without a fixed supply agreement from the mill, with high contingency costs for unknowns •Attempt to postpone the bid until a future date •Not bid for the new business Each of these options adds risk for the stamper 11 Managing risks … Automotive Solution: A financial market provides the tools for the stamper to fix the forward price that he cannot find in the physical market, allowing the stamper to “lock-in” an advantageous price, for the duration of the contract. Execution: • Futures Contract: Take a forward position via an Exchange. Contract can be cash settled if held to expiry OR a physical-traded contract can be warehoused until needed • Swaps: Over-the-counter contracts typically involving a broker and a major bank 12 Managing risks … Automotive PHYSICAL Dec ‘08 – Bid allows for 5,000 tons of steel sheet @ $800 * WINS CONTRACT* Feb ‘09 – Negotiates steel supply of 5,000 tons with preferred steel supplier Jun ‘09 – Takes delivery of 5,000 tons of sheet at the market price of $900 in order to make the component. Net Position: $4,000,000 - $4,500,000 = minus $500,000 ($100 / ton) 13 FINANCIAL Dec 08 – Buys financial contract for 5,000 tons of sheet for June ‘09 @ $800 Jun ‘09 – Exercises option to sell financial contract for 5,000 tons at the then market price of $900 Net Position: $ 4,500,000 - $4,000,000 = Plus $500,000 A Steel Price Benchmark Will . . . NOT attempt to capture the price of every grade/size of steel NOT oblige mills to produce only one grade of steel NOT attempt to capture the price of steel in every location NOT remove the need to establish long-term business relationships between buyers and sellers NOT remove price volatility, but will provide both buyers and sellers tools to MANAGE price volatility 14 Progress of Steel ‘Futures’ … DUBAI GOLD AND COMMODITIES EXCHANGE (DGCX) Rebar futures contract started trading in October 2007 to tap a 12 million mt regional market. Volumes began to exceed 500 lots per day within the first two-to-three months, but the contract could not maintain liquidity and has been struggling to attract investors. Zero trades in recent months. The Dubai contract is for both cash settlement and physical delivery in Dubai. 15 Progress of Steel ‘Futures’ … LONDON METAL EXCHANGE (LME) The London Metal Exchange launched a steel billet futures contract in April 2008. Cash trading commenced in July for physical delivery in the Middle East and Asia. Thirty million mt of billet traded annually. LME has traded over 500,000 mt since launch and counts 21 members trading steel billet. Turnover in excess of $500 million. Price peaked at $1,250/mt in June and has declined since and is now below $1,000. 16 Progress of Steel ‘Futures’ … CHICAGO/NEW YORK MERCANTILE EXCHANGE (CME/NYMEX) CME Group will launch HRC futures contract in October 2008, planned for more than two years prior to CME & NYMEX merger. Trading and clearing on CME Globex and ClearPort in the form of futures swaps or physical trade. Each contract will be listed for 18 months. US Midwest contract will be financially settled against a Daily Price Index provided by an independent, third-party. SHANGHAI FUTURES EXCHANGE (SHFE) The Shanghai Futures Exchange has been trying to launch rebar and wire rod futures contract since 2006, but the exchange still awaits support from China's steel industry and the central government. The recent iron ore and steel price shocks in China have given urgency to the issue. The Exchange has not yet given a date for launching its contracts but the industry thinks it might be soon since the scheme has been approved by China’s Securities Regulatory Commission. 17 A glimpse of the future… Risk management tools will help both buyers and sellers, but… …Before the steel industry can enjoy the benefits of risk management tools there is a need for accurate, robust and independent prices. ENTER……………………………. 18 Introducing Platts Steel Markets Daily 19 The Platts difference … Daily steel price assessments: 20 – Refer to specific grades: HRC, CRC, Plate, Rebar (ASTM) – Refer to exact specifications: Chemistry, Weight, Dimensions – Refer to specific locations and INCO terms: CIF Antwerp, EXW Ruhr, FOB Black Sea, CIF Houston, EXW Indiana – Refer to a spot-market order quantity: 1,000-2,000-5,000mt – Capture actual verifiable transactions every day – Transaction prices normalized to Platts assessment guidelines – Rigid compliance regimen updated 2X a year . . . . Methodology Guide 21 Methodology and specs…hot-rolled coil 22 Europe HRC • Ex-works Ruhr • FOB Black Sea • CIF Antwerp North America HRC Specification • EN 10025 • Structural grade Specification - ASTM A 1011 - Commercial Type B/C Dimensions • Thickness 3-15mm • Width 1200-1500 Dimensions • Thickness-.083-0.625 inches • Width 48-60 inches • Ex-works Indiana • CIF Gulf Coast Methodology and specs…rebar 23 Europe • Ex-works NWE • FOB East Mediterranean, basis Turkey North America • Ex-works US Southeast States • CIF Houston Specification • B500B/C Specification • ASTM 615 • A60 Dimensions • 16-20mm diameter • 12m length Dimensions • #7-#11 (22mm-36mm) • 20ft-40ft Panama Canal Authority selects Platts… $3.35 Billion Infrastructure Project Panama Canal Authority selects Platts Steel Markets Daily as reference price for a high-profile RFP. This was a high-visibility breakthrough for Platts involving construction of the Panama Canal's third set of locks. The following is excerpted from the Panama Canal Authority's Particular Conditions addendum: The Employer shall determine reference prices for the aforementioned materials and/or products by averaging the prices quoted over a 180-day continuous period immediately prior to the Base Date, by: (a) Platts Steel Markets Daily, Reinforcing Bar, Ex-Works US SE, Close/Midpoint Price in US $ per short ton for Reinforcing Steel, (b) Platts Steel Markets Daily, Plate, "Ex-Works, US SE, Close/Midpoint Price in US $ per short ton for Lock Gate and Bulkhead Structural Steel Plate Shapes… (d) Platts Latin American Wire, Gulf Diesel (No. 2 Oil), Closing Price, in US $ per US gallon for Diesel Fuel. 24 Existing Panama Canal Locks … 25 New Pacific Locks …South of Miraflores 26 New Atlantic Locks…East of Gatun Lake 27 The Platts difference … Hot-rolled coil composite spot price at about $895/mt $/mt 1150 1050 950 850 Source: Platts Steel Markets Daily average of all daily-assessed regions 750 650 28 10/1/08 9/1/08 8/1/08 7/1/08 6/1/08 5/1/08 4/1/08 3/1/08 2/1/08 1/1/08 12/1/07 11/1/07 10/1/07 9/1/07 8/1/07 7/1/07 6/1/07 5/1/07 4/1/07 3/1/07 2/1/07 1/1/07 550 Thank you . . . Joe Innace US Managing Editor Platts Steel Markets Daily joseph_innace@platts.com 212.904.3484 direct 212.904.2437 fax The McGraw-Hill Companies Two Penn Plaza New York, New York 10121 29