Module 7

advertisement

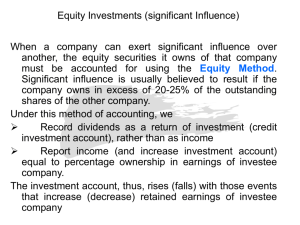

Module 6 Reporting and Analyzing Intercorporate Investments Equity Securities What is an equity investment? Why would a firm invest in the equity of another firm? Accounting for Investments GAAP identifies three levels of influence/control: Passive Significant influence Control Accounting Treatment and Financial Statement Effects Intercorporate Investments Passive Passive. In this case the purchasing company is merely an investor and cannot exert any influence over the investee company. Its goal for the investment is to realize dividend and capital gain income. Generally, passive investor status is presumed if the investor company owns less than 20% of the outstanding voting stock of the investee company. Significant influence Significant influence. In certain circumstances, a company can exert significant influence over, but not control, the activities of the investee company. Generally, significant influence is presumed if the investor company owns 20-50% of the voting stock of the investee company. Control Control. When a company has control over another, it has the ability to elect a majority of the board of directors and, as a result, the ability to affect its strategic direction and hiring of executive management. Control is generally presumed if the investor company owns more than 50% of the outstanding voting stock of the investee company. Some terms Mark-to-market Realized Recognized Ready market Trading security Available for sale security Passive - No ready market Account for at cost No mark-to-market Investment Classifications GAAP allows for two possible classification is equity investments: Available-for-sale. Investments in securities that management intends to hold for capital gains and dividend income; although it may sell them if the price is right. Trading. Investments in securities that management intends to actively trade (buy and sell) for trading profits as market prices fluctuate. Passive - Ready market Trading or Available for sale depending on management’s intentions Both are marked-to-market For trading securities the gain/loss is recognized prior to being realized (on income statement) For available for sale securities recognition is at realization. Until then the holding gain/loss is kept in an the equity section of the balance sheet (not on income statement) Example of Trading and Available for sale 10/1/98 Buy 10 shares @ $15 each • Record at cost 12/21/98 Market value rises to $18 • Mark-to-market 02/20/99 Sell 10 shares @20 each • Gain (loss) = Sales price – Book Value Are Changes in Asset Value Income? Changes in the carrying amount of the investment (asset) has a corresponding effect on equity: Assets = Liabilities + Equity The central issue in the accounting for investments is whether this change in equity is income. The answer depends on the investment classification. American Express Stockholders’ Equity Held To Maturity Investments Equity Method Investments Equity Method accounting is required for investments in which the investor company can exert “significant influence” over the investee. Significant influence is the ability of the investor to affect the financial or operating policies of the investee. Equity Method Investments Ownership levels of 20-50% of the outstanding common stock of the investee company presume significant influence. Significant influence can also exist when ownership is less than 20% if, for example, • the investor company is able to gain a seat on the board of directors of the investee company, or • when the investor controls technical know-how or patents that are used by the investee company, or • when the investor company is able to exert control by virtue of legal contracts between it and the investee company. Accounting for Equity Method Investments Initially record investment at cost. Increase asset to reflect proportionate share of net income. Essentially treats their income as yours. Dividends decrease investment. Treated as a return of investment. They are not considered income. No mark-to-market Income recognized rarely equals either cash flow or actual change in market value. Equity Method Accounting Assume that HP acquires a 30% interest in Mitel Networks. On the date of acquisition, Mitel reports $1,000 of stockholders’ equity, and HP purchases its 30% stake for $300. Assume that Mitel reports net income of $100 and pays dividends of $20 (30% or $6 to HP) Equity Method Accounting Following are the balance sheet and income statement impacts for the preceding transactions: Your turn 1. 2. Initially L purchases 30% of S for $9 when the book value of S = $30 S has income of $20 and pays total dividends of $10 S has a loss of $10 and pays total dividends of $20 Record L’s yearly income from S and investment in S Equity method Why would a firm prefer using the equity method over consolidation? Blue and Yellow = Green example Equity method cautions! Income shown on income statement is not really income. The asset shown is not at market value. Potentially liabilities are “hidden” off balance sheet. Business Combinations (Over 50%) 2 companies brought together as single accounting entity. Results in a combination of both the investor and investment firm’s financial statements. Purchase method must be used for acquisition of another company. Prior to 2002 and outside of U.S., under certain conditions the pooling of interests method was/is used. Investments with Control — Consolidation Accounting Accounting for business combinations (acquisitions) involves one additional step to equity method accounting. Consolidation accounting replaces the investment balance with the assets and liabilities to which it relates, and it replaces the equity income reported by the investor company with the sales and expenses of the investee company to which it relates. Consolidation Accounting Acquired Assets - Tangible Tangible assets and liabilities assumed are valued at their fair market values on the acquisition date. These amounts for assets and liabilities are initially recorded on the consolidated balance sheet. Acquired Assets - Intangible The remaining purchase price is then allocated to acquired identifiable intangible assets, which include the following: Marketing-related assets like trademarks and internet domain names Customer-related assets like customer lists, production backlog, and customer contracts Artistic-related assets like plays, books, and video Contract-based assets like licensing and royalty agreements, lease agreements, franchise agreements, and servicing contracts Technology-based assets like patents, computer software, databases and trade secrets HP’s Allocation of Compaq Purchase Consolidation with Purchase Price Above Book Value Pooling Accounting for Business Combinations The main difference between the pooling and purchase methods is in the amount recorded as the initial investment in the acquired company. Under the purchase method the investment account is recorded at the fair market value of the acquired company on the date of acquisition. Under the pooling method, this account is recorded using the book value amounts from the acquired company. As a result, no goodwill was created. Further, since goodwill amortization was required under previous GAAP, subsequent income was larger under pooling because no amortization arose. Limitations of Consolidated Financial Statements Consolidation income does not imply that cash is received by the parent company Comparisons across companies are often complicated by the mix of subsidiaries included in the financial statements Segment profitability can be affected by intercorporate transfer pricing and allocation of overhead