Presentation by Reliance Energy - Central Electricity Regulatory

advertisement

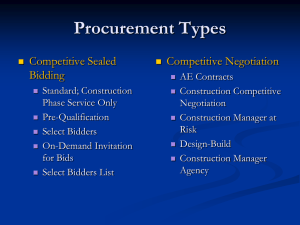

Competitive bidding guidelines for power procurement Presentation to Hon’ble Central Electricity Regulatory Commission and Distinguished Invitees May 7, 2004 1 AGENDA • Context and objectives • Need and importance of competitive bidding for power procurement • Guiding principles • Our suggestions –Scope of guidelines –Bidding process and evaluation of bids –Enablers for speed, transparency, and fairness 2 CONTEXT FOR TODAY’S DISCUSSION Electricity Act, 2003 aspires to create a liberal framework for the development of the power sector – “An Act to consolidate the laws…for taking measures conducive to development of electricity industry, promoting competition therein, protecting interests of consumers and supply of electricity to all areas…” Current situation End goal Largely cost plus tariff systems with limited incentives for improving efficiencies A well functioning power market leading to free competition – rewards more efficient generators and reduce power procurement cost Gradual transition path The power sector needs to introduce competition into the power procurement process as it gradually migrates to competitive markets across electricity value chain 3 INDIAN ELECTRICITY REGULATIONS ENVISAGE A COMPETITIVE MARKET • “Notwithstanding anything contained in section 62, the Appropriate Commission shall adopt the tariff if such tariff has been determined through transparent process of bidding in accordance with the guidelines issued by the Central Government” Section 63 Electricity Act 2003 • “Under the competitive bidding route, the Commission perceives its function of regulating tariffs to primarily be the scrutiny and approval of the process adopted for competitive bidding, with a view to ensure that competitive conditions do prevail” CERC order dated 9th March 2000 on a petition filed by Power Trading Corporation Ltd. • “A significant portion (which could be up to 50% of the new capacity) should be committed to trading or other forms of competitive power markets. This could be attained over a period of time, keeping in view the transition requirements.” Task force report on power sector 2004 , page # 275 • “As far as possible, power procurement should be through a transparent competitive bidding mechanism.” Tariff Policy, Appendix 1 of the Task force report 2004 , page # 275 4 THE TASK FORCE REPORT ALSO SEEKS TO ENHANCE COMPETITION IN THE SECTOR USING COMPETITIVE BIDDING The task force report of 2004 specifies five preferred mechanisms for procurement of electricity through competitive bidding* • Tariff based bid for entire project capacity • Tariff based bids for blocks of capacity Linked to particular generation capacity • Competitive tariff based bidding, without being related to any particular generation source • Tariff based bidding for peaking requirements • Bidding on capital cost of specific project (with overall two part tariff structure) * Page 289 – Report of the Task force on Power Sector Investment and Reforms (Feb 2004 Volume I) 5 OBJECTIVES OF TODAY’S DISCUSSIONS • Share our views on competitive procurement of generation and transmission capacity • To achieve consensus on how to formulate and implement guidelines for competitive bidding process, so that it embodies the spirit of the Electricity Act 2003 • To discuss and arrive at a consensus on the extent of standardization required in the bidding process and documents in order to expedite the process 6 AGENDA • Context and objectives • Need and importance of competitive bidding for power procurement • Guiding principles • Our suggestions –Scope of guidelines –Bidding process and evaluation of bids –Enablers for speed, transparency, and fairness 7 POWER PROCUREMENT COST IS A LARGE PORTION OF THE TOTAL COST OF SUPPLY Paise/Kwh, 2001-02 469 106 357 Other cost 365 98 136 349 119 363 Power procurement cost Power procurement cost as percentage of total cost of power (Per cent) 267 221 230 Maharashtra Delhi Gujarat All India 62 77 73 66 Source: Planning commission report on SEB performance (2001-02) 8 POWER PROCUREMENT IS COMPLEX DUE TO DIFFERENT BASELOAD AND PEAK LOAD REQUIREMENTS Delhi’s ‘unrestricted’ load duration curve (MW) 4000 Peak 3500 3000 Intermediate 2500 2000 Baseload 1500 1000 500 0 0% 20% 40% 60% 80% 100% Hours of the year Source: Delhi operations of REL 9 TODAY, SIGNIFICANT COST DIFFERENCES EXIST AMONG GENERATORS Tariffs of various plants supplying to Delhi Power plant Type • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • Salal Baira Siul Tanakpur Singrauli Chamera Rihand Anta Auraiya Unchachar-I Uri Dadri (Gas) Unchachar-II Dadri (Thermal) Badarpur BTPS RPH IP Station GT Pragati PPCL RAPP(B)-III NJPC RAPP (B)-IV Hydro Hydro Hydro Thermal Hydro MUs bought Rs/Kwh 358 86 58 1,370 132 0.59 0.63 1.04 1.09 1.32 850 375 600 190 286 640 1.47 1.61 1.62 1.88 2.08 2.24 Thermal Thermal Thermal Thermal Thermal 400 5,065 4,600 740 490 2.26 2.27 2.37 2.50 2.50 Thermal (GT) Thermal (GT) Nuclear Hydro Nuclear 1,060 1,706 28 160 276 2.50 2.71 2.98 3.02 3.25 Hydro Thermal (GT) Thermal (GT) Thermal Hydro Gas Source: Delhi Electricity Regulatory Commission order on Delhi Transco ARR for 2002-03 and 2003-04 • While some of these differences can be explained by differences in fuel type, technology, location and vintage, some differences are attributable to differing generation efficiencies • Current cost plus system does not adequately encourage generators to improve operational efficiencies 10 POWER MARKET IS REQUIRED TO EVOLVE TO A NEW STRUCTURE Today’s wholesale power procurement model Desired market structure for power procurement (in the end-state) • Single buyer model - SEB/transco pools • Multiple buyer model (e.g., each distribution utility requirements to procure power • Primarily long duration contracts distribution company procuring for its own requirements) • Suitable mix of long, medium and short term contracts • Cost plus tariff setting • Tariff setting driven by market forces – CPSUs and SEBs: cost plus tariffs based on CERC/SERC orders – IPPs: mix of cost plus and tariff based bidding • Limited incentives to improve efficiency • Market rewards players with lower costs and higher efficiencies 11 TO REACH THE REQUIRED STRUCTURE, IT IS IMPERATIVE TO ACHIEVE COMPETITION IN GENERATION What needs to be achieved as the market transitions to full competition? • Reduce inefficiencies in generation plants to enable low cost power production • Encourage private investment in generation to keep pace with growing demand • Develop a fast, efficient and transparent bidding process that expedites procurement Competitive bidding based power procurement is crucial for the healthy development of this sector • Building a framework for the end state of the power procurement in the envisaged free market pricing system 12 AGENDA • Context and objectives • Need and importance of competitive bidding for power procurement • Guiding principles • Our suggestions –Scope of guidelines –Bidding process and evaluation of bids –Enablers for speed, transparency, and fairness 13 GUIDING PRINCIPLES FOR COMPETITIVE BIDDING Competitive bidding process should ensure • Free fair and effective competition • Transparency • Simplicity and cost effectiveness of process • Minimal burden on regulator and other stakeholders • Flexibility to adapt to varying needs of power procurement according to the structure of the sector The new guidelines should adequately build on CERC and GOI guidelines issued earlier by incorporating new inputs from EA 2003 and the Task Force report 14 AGENDA • Context and objectives • Need and importance of competitive bidding for power procurement • Guiding principles • Our suggestions –Scope of guidelines –Bidding process and evaluation of bids –Enablers for speed, transparency, and fairness 15 GUIDELINES SHOULD COVER PROCUREMENT BY VARIOUS ENTITIES Sellers Buyers Existing generating stations Distribution Licensee Procurement transaction Trading licensee Nominated Buyer (?) New generating stations Trading licensee Distribution Licensee (?) 16 GUIDELINES SHOULD COVER BOTH GENERATION AND NEW TRANSMISSION CAPACITY Procurement category Should guidelines Rationale cover it? • Generation – Capacity – Energy May be baseload/Peak or off peak • Yes • This would form the bulk of the power procurement bids; hence it is imperative that the guidelines cover these • Transmission capacity • Not required – Existing • Firm • Non-firm – Setting up new capacity • Rules for open access on transmission lines already well defined (e.g., transmission service charge bidding) May be entire day/part day • Yes • New capacity addition not based on competitive bidding so far, but lends itself to the process quite naturally • Ancillary services – Spinning reserves – Reactive Power – Harmonics etc. • Not initially • The concept of ancillary services not well developed yet • In future as market matures guidelines may be expanded to include these as well 17 TODAY, DISCOMS/TRANSCOS PROCURE POWER MAINLY THROUGH LONG TERM BILATERAL CONTRACTS Description/Details Long term Medium term Short term • Generally 15-25 year contracts. New capacity may be added if needed • Capacity added in three ways – Self generation (SEB owned generators); capacity cleared by SERC as required – Allocation from central generating stations ; CERC determines tariffs – Independent power producers; Bid/MOU route for projects; CERC/SERC vets the tariff No clear process currently for bridging medium term requirements (i.e. more than one year and less than 15 year duration) • Upto one year duration contracts; (form small part of total power procured) • SEBs propose power purchase from third parties in their ARRs, prior to actual contract • Some SERCs have taken a hands off view on these bids as long as the total annual power purchase cost remains within budget Real time/day to day • No day ahead market • Real time power requirement (in excess or deficit of scheduled drawls) drawn directly from grid without any prior permission from regulator • SEB pays/receives UI charges under ABT regime at the end of accounting cycle Excessive burden on regulator 18 PROPOSED GUIDELINES WOULD COVER POWER PROCUREMENT PHASE Discom forecasts its power requirements for • Long term • Medium term • Short term Regulator approves forecasted power need Covered by competitive bidding guidelines Discom procures power Pricing mechanism Traders Competitive bidding • Competitive bidding Generators Discom power procurement Pricing mechanism With generator MOU based bilateral contracts With traders (e.g., PTC) • Cost plus pricing • Cost plus pricing • Competitive bidding by Trader 19 IN TERMS OF DURATION, GUIDELINES WOULD COVER ALL PROCUREMENT CONTRACTS OUTSIDE THE DAY AHEAD AND REAL-TIME Proposed scope MARKET of guidelines Description of type of contracts • All contracts greater than 10 year duration Long term • Contracts that span 1-10 years duration Medium term • Power requirement for several months duration (upto 1 Short term Day(s) ahead market / Emergency procurement year) • Typically a day to a week ahead demand • Requirement typically driven by forecasting error/ weather changes/unforeseen conditions The lead time (advance notice before start of contract) needs to be decided for each term (long/ medium/ short) to ensure effective competition • Unscheduled spikes/drops in demand that have to be Real time managed • Can continue with current UI/ABT system until the establishment of a fully functioning wholesale and spot market 20 AGENDA • Context and objectives • Need and importance of competitive bidding for power procurement • Guiding principles • Our suggestions –Scope of guidelines –Bidding process and evaluation of bids –Enablers for speed, transparency, and fairness 21 BIDDING PROCESS WOULD START WITH THE REGULATOR APPROVING THE DEMAND FORECAST FOR THE DISTRIBUTION COMPANIES Path 1 Using standard bid documents Demand forecast for short / medium / long term by discom Regulatory approval of forecast Procurement process Path 2 Using non-standard bid documents • Guidelines specify process to be followed in each case • Standard documents supplied for following path 1 • Regulator approves documents if path 2 is followed 22 PROPOSED POWER PROCUREMENT BIDDING PROCESS IF STANDARD DOCUMENTS ARE USED Requirement definition Initiate RFQ Shortlist bidders RFP Bidding Evaluation of bids Award of bid(s) Post bid negotiations Key activities/Salient points • Specification of – Quantum – Timing – Duration of contract • Publish notice • Issue RFQ • Evaluate • Issue RFP responses to RFQs • Shortlist bidders • For short term contracts bidders may be prequalified to selected bidders • Conduct pre-bid conference • Short listed • Technical • RFQ/RFP process may be combined into single bidders invited to submit bids compliance must for any bid to be considered • Determination of winner on bases of price bids • Use of independent observer if necessary step, especially for short term contracts At each stage we may specify minimum number of bids to proceed to next stage Regulator kept informed at all stages of the process 23 PROPOSED POWER PROCUREMENT BIDDING PROCESS IN CASE OF DEVIATIONS FROM STANDARD BIDDING DOCUMENTS Regulatory clearance of forecast Requirement definition Prepare bidding documents Initiate RFQ Shortlist bidders A Iterations on development of bid documents Seek regulatory approval A RFP Bidding Regulatory approval if required Post bid negotiations • Any modifications suggested by bidders, or due to any other reasons to be approved by regulator – possibly over several rounds of iterations Evaluation of bids Regulator’s comments on process and go ahead Awards of bid Even though active regulatory approval needed in only certain stages, but the regulator is always kept informed of all developments 24 IN THE RFQ STAGE, BIDDERS SHOULD BE SCREENED ON THE BASIS OF AN ARRAY OF METRICS For generators Technical metrics Past record Financial metrics To minimise risk of delay/shortfall To prevent frivolous/mischievous bidders To ensure supply contracts, in case of default • For new plants • Should be an organization • To ensure supply • • – Past infrastructure project execution – Resource raising For existing plants – Reliability – Performance in the past Tie ups with transmission companies preferred • For long term contracts For traders • • trader should show the capability/history to source 70-80% of contract amount Tie ups with generators and transmission companies are preferred Source of power has to be specified • of repute No default on previous contracts • Trader of repute • No default on past • • contracts Past litigation record No conflict of interest between other obligations and contract being bid To be suitably relaxed in initial stages for traders, as they would have no history of trading operations • • contracts, in case of default Net worth Credit worthiness Bank/other financial guarantees • Net worth • Credit worthiness • Bank/other financial guarantees Limits to vary by duration of contract and amount of load contracted 25 FOR MEDIUM/LONG TERM CONTRACTS, AT RFP STAGE, BIDS SHOULD BE SCREENED BASED ON NON PRICE EVALUATION PRIOR TO PRICE COMPARISONS Element for evaluation Supplier’s guarantee Details • Financial guarantee covering supply default • Different bidders could be capable of delivering power at Delivery point Delivery dates/period Buyer’s guarantee Force majeure /risk sharing different points in grid • Most reliable/least bottlenecked point most preferable • Relevant for time of day contracts, or for parts of long term • contract Best fit to demand should get preference • Bidder asking for least financial guarantee from buyer would be preferred All these aspects need to be sufficiently detailed in the standard bid documents and processes, to enable bids to be efficiently and transparently evaluated/ rejected on technical merits • Risk sharing mechanism in case of forced outages/unforeseen circumstances 26 BUYER SHOULD SPECIFY THE BID STRUCTURE IN DETAIL Discussed further Element Elements of a bid Illustrative examples What is being bid for? • Energy • Capacity • Percentage of load (varying) Whether part bidding is allowed? • No part bidding • Part bidding allowed • Part bidding allowed in multiples of some pre-specified minimum bid unit (preferred option) What is the tariff structure used? • Single part tariff • Two part tariff with suitable indexation (preferred) 27 BID PRICING STRUCTURE WOULD USUALLY EMPLOY A TWO PART TARIFF Aspect Price setting mechanism Details • Two part tariff structured as follows Tariff bid = Fixed component (X) + Variable component (Y) X = X1 + X2 X1: Inflation linked (e.g., O&M) X2: Non-Inflation linked (e.g., debt servicing) Y = Y1 + Y2 Y1: Variable component not linked to any index Y2: Linked to suitable energy index* • Both X and Y could vary by time frame • Buyer should compare the competing bids based on annualised/NPV type calculations • Bidder should not be disqualified for submitting different price bids in different contracts * Index might be a reference fuel price, or price of a basket of fuels, or some other index Note: Medium term contracts could follow a pricing mechanism similar to long term contracts with simplified indices 28 FOR SHORT TERM CONTRACTS, THREE ASPECTS SHOULD BE MODIFIED TO SPEED UP THE PROCESS Discussed further Aspect Details • Single part tariff Bid pricing Empanelment of bidders – No escalation/inflation – No fuel variation • Bids compete purely on single price (i.e., all bids that fulfill all technical criteria beforehand) • Bidders empanelled once • Panel kept updated on regular basis • For each short term requirement, panel members asked to bid – eliminates the need for bidder qualification step in procurement process Short lead times • Bid process may be started (public notification stage) upto a few weeks before the actual requirement of the contract • Thus mostly traders and existing generators would likely bid for these 29 EMPANELMENT OF BIDDERS - DETAILS • Short term bids need to be executed rapidly since time is of the Rationale essence • Need to avoid unnecessary repetition/ duplication of records Process/details of empanelment Updation of bidders panel • For short term bid, buyer should skip bidder qualification • Buyer should ask the existing panel of bidders to bid • Buyer should regularly update the list of empanelled bidders Buyer should update the list of empanelled bidders to reflect changes over time. These would include – • New entrants – should be allowed to submit details at 3-4 occasions in an year. Once a bidder is empanelled, he stays on the panel until he withdraws, or is disqualified • Regular checks - Empanelled bidders should submit details of credit worthiness and make other financial/ legal disclosures annually. Any discrepancy / shortfall could lead to revoking of pre-qualified status • Disqualification from panel - Bidders will attract disqualification if – They default (or dishonor) on any contract – They have not participated in the last 3-4 bids up for competition 30 INTERNATIONAL PRECEDENTS OFFER SEVERAL USEFUL TIPS FOR FORMULATING THE COMPETITIVE GUIDELINES Aspect Bidding for part of the contract Bidding for partial duration Use of Independent observer Bidding for percentage of load Use of discounting/ NPV calculations for evaluation Pre-qualification of bidders to form a panel Financial guarantees from bidders International examples Reference document Issue date/number • RFP for Central Maine Power Company allows • November 18, 2003; bidders to bid in multiples of 20% of total contract amount • EPSA guidelines mention use of annuity based • calculations while comparing bids for unequal (part) duration and choosing a lower overall bid portfolio Independent observer was used for overseeing the process of RFP’s for Portland General Electric Company • Rather than a fixed load (in MW/ MWh) the bid issued by Maine PUC • EPSA guidebook for design • • EPSA guidebook for design may be asked for the percentage of the utility’s load, so as to offload some risk to the suppliers • Public service commission of Maryland approved implementation and monitoring of competitive power supply solicitations January 20, 2004; Interim report of independent observer • implementation and monitoring of competitive power supply solicitations Order no. 78710 Case no. 8908; Phase II September 2003 use of single discounted average term price (DATP) for evaluation of bids in the phase II settlement proceedings Rules of the Florida Public Service Commission on general purchasing procedures allow the prequalification of bidders to form a panel • Ch.25-25 Sup no.194 • RFP for Central Maine Power Company required • November 18, 2003; • bidders to provide financial guarantees upto US$ 1.21 million/month and 1.50 million/month while bidding for service to 2 classes of consumers issued by Maine PUC 31 INTERNATIONAL BIDDING PROCESS - EXAMPLE US long term PPA bid process Process start Steps Timeline Receiving EOIs 3½ months • Posting of Details • information publicly Request for Expressions of Interest (EoI) Regulatory Validation Bidder selection Receiving proposals Round 1 Revision/ Round 2 15 days 15 days 15 days 2 months 9 months • FERC and • Pre-bid • Source: Allegheny power RFPs and RFQs PJM qualification Credit application and financial information received • conference Eligible bidders qualified and issued certification • Request for detailed proposals from eligible bidders • Price • • proposals received Bids evaluated Award of bids • More • rounds if previous rounds fail to meet objectives Iteration continues till satisfactory solution reached Contract start • Retail prices published 6 months before start of contract 32 AGENDA • Context and objectives • Need and importance of competitive bidding for power procurement • Guiding principles • Our suggestions –Scope of guidelines –Bidding process and evaluation of bids –Enablers for speed, transparency, and fairness 33 SYSTEMS REQUIRED TO ENSURE SPEED, TRANSPARENCY AND FAIRNESS Discussed further Spee d Standardization of contracts • Standard contract documents to cover as many scenarios as possible • All deviations counted as material deviations – requiring regulatory approval Transparency Information dissemination Communications • All details of bid process and method given to all bidders • All factors that will be considered and their relative weights notified in advance • All communications to be made in written form • All records retained for a certain duration after the end of bidding • Optional separate rounds for RFP and RFQs Fairness Independent observer • Not required in usual biddings – as long as standard processes are being followed • Needed if an affiliate of the buyer is also bidding for the contract • This would be more of an oversight role without any involvement in decision making 34 STANDARDIZED BIDDING DOCUMENTS NEEDED FOR EXPIDITING PROCESS • Providing standard documents as templates is important to – Expedite process – Prevent the whole process from getting bogged down in litigation – Reduce burden on regulator and all shareholders • Standardization is easy for short term contracts. It gets increasingly complex as the duration of contracts increases • For new plants standard documents need to capture all possible aspects of – Finance structuring – Risk sharing • Need to provide flexibility for future requirements Need for detailed documents as standard templates; but with sufficient flexibility to ensure responsiveness to new needs 35 IMPORTANT ISSUES FOR DEBATE – NOT EXHAUSTIVE • Can any buyer aggregate power requirements – Across distribution companies? – Across states? – Across regions? In order to avail benefits of scale (e.g., flattened load curve, economic size of the plant) and reduce transaction costs • Even though the Electricity act itself does not prohibit such aggregation, would this lead to a dispute between state and central bodies ? • How do these guidelines change with the development of a power pool? • Should there be a common energy index to link the variable costs of plants? If yes, how should it be developed/monitored/updated? • Should the buyer inform rejected bidders about reasons for rejection? • Should the buyer seek power at one specific delivery point per bid and compare costs accordingly? • For long-term procurement requiring set up of new capacities, should the buyer specify location, fuel, technology (e.g., for BOT basis)? • Evaluation of non-price factors • What is the process for dispute resolution? • Is the duration definition (long-term > 10 years, medium-term between 2 and 10 years, and short-term less than 2 years) rigid or evolving over time? • Should these guidelines cover competitive bidding by a trader as well? 36 Thank you 37