Interest Rates

advertisement

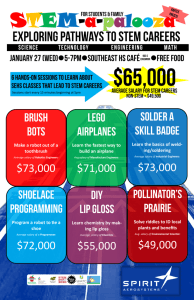

Interest Rates 4C Math Unit B – Credit Cards, etc Cuts and Raises • To compute cuts or raises we multiply our old price or salary by the percentage. Then we add or subtract (add in the case of a raise, subtract in the case of a cut) this number to our old price or salary. • Example B1: If you make $35,000 per year and receive a 5% raise what is your new salary? • 5% of your income is .05 x 35,000 = $1750. • Getting a 5% raise means your new salary is .05 x 35,000 plus your old salary. So your new salary is $35,000 + $1750 = $36,750. • Notice that, just like sales tax, we could have simply multiplied our old salary by 1.05 to get our salary after the raise. Cuts and Raises • However, to compute a pay cut we need to multiply by 1 minus the percent. This is illustrated in the next example. • Example B2: If you make $72,000 per year and receive a 9% pay cut. What is your new salary? • New salary = $72,000 - .09 x $72,000 = $72,000-$6480=$65,520. Or using 1 – 0.09: • New salary = (1-0.09) x $72,000 = .91 x $72,000 = $65,520. Cuts and Raises • Exercise: Suppose your boss tells you that “for bookkeeping purposes” you are going to receive a 20% pay cut followed by a 20% pay raise. Do you end up with the same salary after the raise and cut? What if he gave you a 20% pay raise followed by a 20% pay cut? Are you happy either way? Cuts and Raises • Example C: A clothing store is having a 30% off sale. The sale price of a sweater is $60. What was the pre-sale price? • Caution!! We don’t take 30% of $60 and add that to $60. This is because the discount is 30% of the pre-sale price. • What do we do? Well…if P is the pre-sale price then we have: • $60 = P – 30% of P = P - 0.3 x P. • Then $60 = (1-0.3) x P • and so $60 = 0.7 x P. • To find P we just divide $60 by 0.7. Thus the pre-sale price was P = 60/(1 – 0.3) = $85.71 Cuts and Raises • Example D: Suppose you paid $1100 to insure your car this year and the cost of insurance will go up 10% next year. What will you owe for car insurance next year? Interest • Three ways interest is calculated: a) Simple Interest: A = P + Prt b)Compound Interest: A = P(1+ i)n c) Continuous Interest: A = Pert i = interest rate per compounding period, n = compounding periods in total, P = principal, A = amount, r = yearly interest rate Interest • Example: Suppose we invest $1000 in an account and let it sit. How much is in our account at the end of 2 years if the account has an annual rate of 4% and uses: • (a) simple interest? • (b) interest compounded monthly? • (c) interest compounded daily? Interest • The difference between the 3 types of interest: simple interest is computed once per year, compounded interest is computed every period, while continuously compounded interest is computed continuously (or every instant). • Bank Accounts: The typical savings account computes interest by compounding continuously. • Credit Cards: The typical credit card computes interest by compounding daily. Credit Cards • Example: Suppose your Discover Card has a previous balance of $6000 and APR of 12.74%. • What is the daily periodic rate? • What will the finance charges be this month? • What is your new account balance? Credit Cards • Example: Suppose your Discover Card has a previous balance of $6000 and APR of 12.74%. • Discover Card computes your minimum payment by taking the larger of a) the closest whole number to 2% of your balance and b) $15. How much will this months minimum payment be? Credit Cards • Example: Suppose your Discover Card has a previous balance of $6000 and APR of 12.74%. • If you pay the minimum payment how much of your payment is going towards paying down your original $6000 balance? Credit Cards • Example: Suppose your Discover Card has a previous balance of $6000 and APR of 12.74%. • Discover Card agrees to waive any fees for missing payments. So you decide to not pay anything on your card for a whole year. What is the balance on your card after the year is up? • Credit Cards Exercise: Suppose MasterCard gives you a card with 17% APR and no fees for missing payments. You purchase a new snowboard and gear for $500 on your MasterCard. • What will the first month’s finance charges be? • If you don’t make payments or new purchases for a year what is your new account balance?