Kidwell, Peterson, Blackwell & Whidbee

advertisement

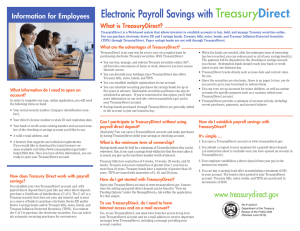

Money Market (MM) • MM is where organizations go to adjust their liquidity. • Market is a collection of dealers that specialize in one or more MM instruments. • Liquidity is stored in the MM by investing in MM securities (lending). Liquidity is purchased in the MM by selling MM securities (borrowing). • Ideal place for temporary investments. 1 Properties of a Good MM Instrument • low default risk. • short maturity (to have low price risk). • high marketability (typically facilitated by standardized features). Sold in large denominations ($1 million is a tiny trade), per-dollar transaction costs thus kept low. 2 Typical MM Instruments typical maturities U.S. Treasury Bills Repurchase agreements 13 and 26 weeks 1 to 14 days Commercial paper 30 to 180 days Negotiable CDs 12 to 180 days Fed Funds Banker’s acceptances 1 to 7 days 30 to 180 days 3 Auctioning New T-Bills • Weekly auction by U.S. Treasury of 13-week, and 26week bills. Other bills (e.g., 1-day, 4-week, 52-week) sold on an as announced basis. • Sold at a discount basis. • Sold in multiples of $100. • $100 million is not a large institutional purchase. • All winning bidders pay same price which is the price of the lowest successful bid. Thursday/Monday/Thursday schedule. 4 For Instance, This Past Week’s Schedule • Thursday (Oct 29), Treasury Department announced sale of $26 billion of 26-week T-bills, that were auctioned off on Monday (Nov 2). • On auction dates, noncompetitive tenders due by 11:00 am, competitive tenders due by 11:30 am. • Results of auction announced minutes later. • Bills issued and payments made on Thursday (Nov 5). 5 http://www.treasurydirect.gov/instit/annceresult/press/preanre/2015/A_20151029_1.pdf 6 http://www.treasurydirect.gov/instit/annceresult/annceresult.htm 7 http://www.treasurydirect.gov/instit/annceresult/press/preanre/2015 Bid-to-Cover Ratio = 9.74/26.0 = 3.75 8 CUSIP Number Committee on Uniform Security Identification Procedures A 9-digit alphanumeric identifier, such as 00817Y 10 8 Uniquely identifies each U.S. and Canadian security. CUSIP system, operated by Standard & Poor’s, but owned by American Bankers Association, is designed to facilitate bookkeeping and the settlement of trades. First 6-characters identify “issuer” Next two identify the “issue” Last is a “check digit” 9 Competitive Bids • Competitive bidders (dealers and large banks) specify • quantity • discount rate willing to accept (in multiples of .005%) • Treasury Dept. ranks bids according to bank discount rate, then allocates down the list. • Bid-to-Cover Ratio signals how easy it is for US Gov’t to borrow money. • No more than 35% of an issue can be sold to any competitive bidder to ensure a competitive secondary market. 10 Noncompetitive Bids Small part of offering, all noncompetitive bids accepted. Noncompetitive bidders (individuals and small banks) specify only quantity • $5 million max per noncompetitive bidder. • receive the “High Rate” of accepted competitive bid tenders • Can buy online. Set up TreasuryDirect account (with bank routing number & bank account number). Treasury electronically debits your bank account at beginning & credits it at end. • Interest on US Treasuries taxed as ordinary income at the federal level, but not taxed at the state level. 11 Example 1: Overview offering competitive ($49.5 B total) $15.9 B accepted $18 B Tenders with lowest discount rate bids accepted noncompetitive $2.1 B $33.6 B rejected 12 Example 1: Auction Process Offering Amount $18.0 billion Competitive tenders $2.5 billion 3.880% Noncompetitive tenders $2.1 billion $5.0 billion 3.895 $6.0 billion 3.910 Competitive tenders $49.5 billion $2.0 billion 3.930 High Rate (highest accepted rate) 3.945% $4.5 billion 3.945 $9.0 billion 4.290 $11.0 billion 4.305 $9.5 billion 4.315 Bid-to-Cover Ratio (49.5 + 2.1)/18 = 2.87 Competitive tenders Allocated at High rate .4/4.5 = 8.89% Median Rate (of accepted competitive tenders) 3.910% Low Rate 3.880% 13 Secondary Market for T-Bills discount rates investment rate • Bid & Asked are bank discount rates. Bid applies when customer sells, Asked applies when customer buys. • Asked Yield is bond equivalent rate. 14 Discount Rate • The (bank) discount rate yd is given by: Pf P0 360 yd Pf n where Pf is face value P0 is discounted price (today’s price) n is calendar days to maturity • Solving for P0 we have P0 Pf Pf n yd 360 15 Bond Equivalent Rate • Bond equivalent rate ybe is given by ybe Pf P0 365 P0 n (note 365 annualizer and discounted price is in denominator) • Solving for P0 we have Pf P0 ybe n 1 365 • Bond equivalent yields are reported to facilitate comparison against other debt instruments. 16 Example 2: Using Bank Discount Rate Consider a $1,000 T-bill that matures in 133 days whose Bid and Asked quotes are 4.96 and 4.92, respectively. If selling, would get P0 Pf Pf n yd 360 1000(133)(.0496) 1000 360 $981.67566 If buying, would cost P0 Pf Pf n yd 360 1000(133)(.0492) 1000 360 $981.82333 17 Example 3: Using Bond Equivalent Rate Bond Equivalent Rate is same as Investment Rate as on slides 7 & 17. Suppose you are contemplating a $1,000 T-bill that matures in 67 days whose Asked Yield is 5.23. How much would it cost? Pf P0 ybe n 1 365 1000 .0523(67) 1 365 $990.49101 18 Fed Funds • Unsecured loans between banks. • Overnight interest rate called the fed funds rate. • Term “fed funds” is misleading. • Typically done in units of $1 million. • Yields on fed funds assume 360-day year. Conversion to bond equivalent yield is as follows. 365 ybe y ff 360 19 Commercial Paper • Review slides 14-17 of Module 2.3. • Compete head-to-head against T-bills. Consequently, sold at discount, and quoted using bank discount rate Pf P0 360 ycp Pf n • There is a secondary market. • Virtually impossible to sell without backup line of credit and a P-1 or A-1 rating. 20 Federal Agencies (GSEs) Agencies created by Congress for public policy reasons to assure availability of capital in areas of the economy where credit might otherwise be insufficient or too costly. Mostly in • Home mortgages • Agriculture GSEs often provide loan guarantees and conduct securitizations. Obtain the money they need by issuing agency securities. Such agency securities qualify as legal instruments to be held by banks, insurance companies, and pension funds. 21 Government Sponsored Enterprises • Agency (i.e, GSE) debt perceived to have only slightly greater default risk than US Treasuries. • Marketability very good. • (Fannie Mae) Federal National Mortgage Association (Freddie Mac) Federal Home Loan Mortgage Association • (Ginnie Mae) Government National Mortgage Association • See list of GSEs on p. 214. 22 Retail Certificates of Deposit • Issued by banks to finance their business activities. • Not negotiable – no secondary market, can only be sold back to issuing bank early, with penalty. • Issued at face value with interest as an “add on”. • Interest based on a 365 day year. • Can be in any denomination. • FDIC insured up to standard amounts. • Banks typically use standard maturities such as 0.5, 1.0, 1.5, 2.0 and 5.0 years. 23 Negotiable Certificates of Deposit • Large-denomination CDs issued by well-known banks are negotiable (exists a secondary market for them). • Issued at face value with interest as an “add on”. • Stated interest computed on a 360-day year (like Fed Funds). • Interest rates on negotiable CDs are higher than on T-Bills because of higher credit risk and lower marketability. • Purchased mainly by corporate businesses. 24